Like a wild stallion galloping through unchartered terrain, the once-superior South African Rand has charged towards the elusive R20-mark against the mighty U.S. dollar, leaving investors and economists spellbound. In the wake of a rapid decline triggered by a fierce sell-off, the Rand has encountered its fair share of obstacles, forcing market participants to navigate treacherous waters.

With foreign investors abandoning South African Rand-denominated bonds favouring safer harbours such as gold, a staggering net worth of more than R11 billion has already been swept away from the country’s economic shores. In a swift and staggering sell-off, the Rand is teetering on the edge of uncertainty, with the currency breaching the psychological mark of R19 against the dollar. A dire energy crisis amidst rolling blackouts, the recent greylisting, and rumours of South Africa supplying arms to Russia has seen the Rand slump to its weakest-ever level against the greenback currency, coming in at ZAR19.4069 to the dollar at 9:45 a.m. South African Standard Time.

In a complex geopolitical dance, the relationship between South Africa and the United States, a key trade partner ranking second only to China, has hit turbulent tides. Tensions have escalated as Pretoria remains resolute in maintaining a non-aligned position regarding Russia’s involvement in the Ukrainian conflict. This steadfast stance has strained ties between the two nations, with Reuben Brigety, United States Ambassador to South Africa, expressing grave apprehension over rumours that South Africa is supplying arms to Russia. While the country’s debilitating power crisis has stagnated economic growth, suppressing investor confidence, whispers of South Africa’s involvement in providing arms to Russia have ignited a blazing discourse, intensifying the current risks surrounding the nation’s outlook. As this shadow looms over the broader financial landscape, industry experts expect the Rand to bear the weight of this newfound uncertainty and the currency “should reflect that risk premium.”

Exploring ZAR/USD Amidst Emerging Market Rivals

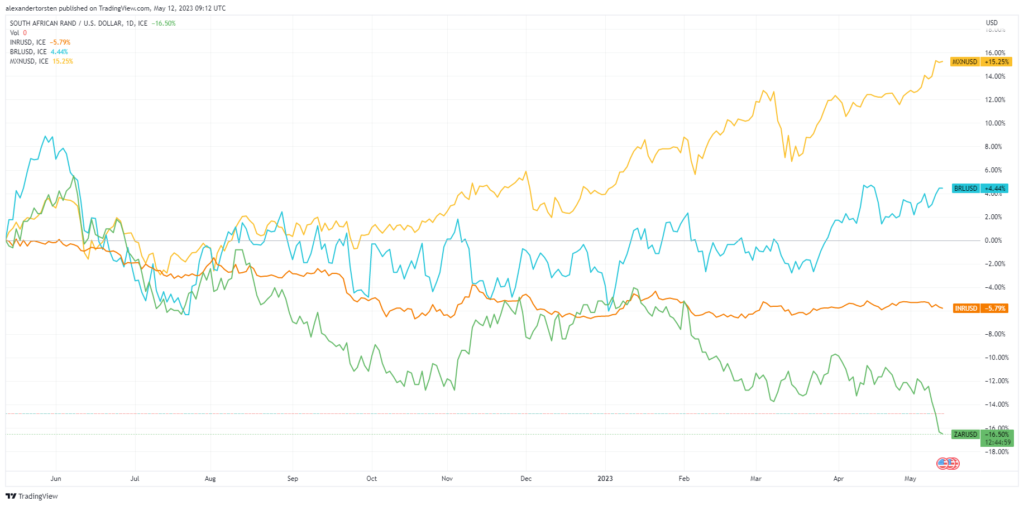

The term “loadshedding” has become all too familiar to South Africans, but its debilitating impact on the broader economic outlook cannot be overemphasised. Amidst a dire energy crisis and ongoing power outages, South Africa’s gross domestic product (GDP) retracted by a staggering 1.3% in the fourth quarter of 2022, a quarter which was predominantly characterised by day-to-day power disruptions. Over the last year, while the dire energy crisis has inevitably demoralised investor sentiment and stunted growth prospects, the Rand has weakened by an eye-watering 16.50% relative to the dollar. Over the last twelve-month period, it is clear that the Rand has lost significantly more ground to the dollar compared to other emerging market currencies, such as the Mexican Peso (yellow line), the Brazilian Real (blue line), and the Indian Rupee (orange line), as can be seen in the chart below.

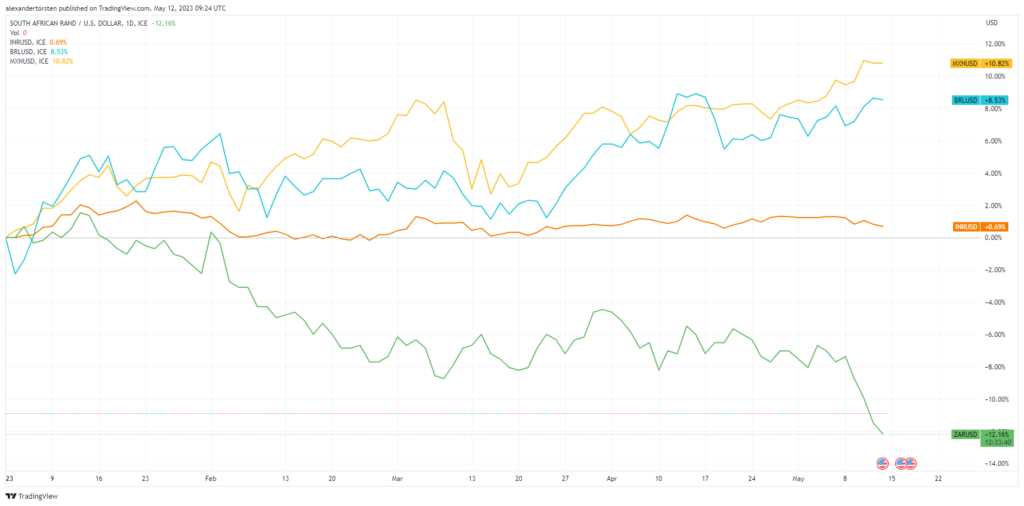

Year-to-date, it is worrying that the Rand has weakened by more than 12% relative to the dollar (green line). At the same time, the Mexican Peso, the Brazilian Real, and the Indian Rupee have all strengthened relative to the dollar, as seen in the chart below.

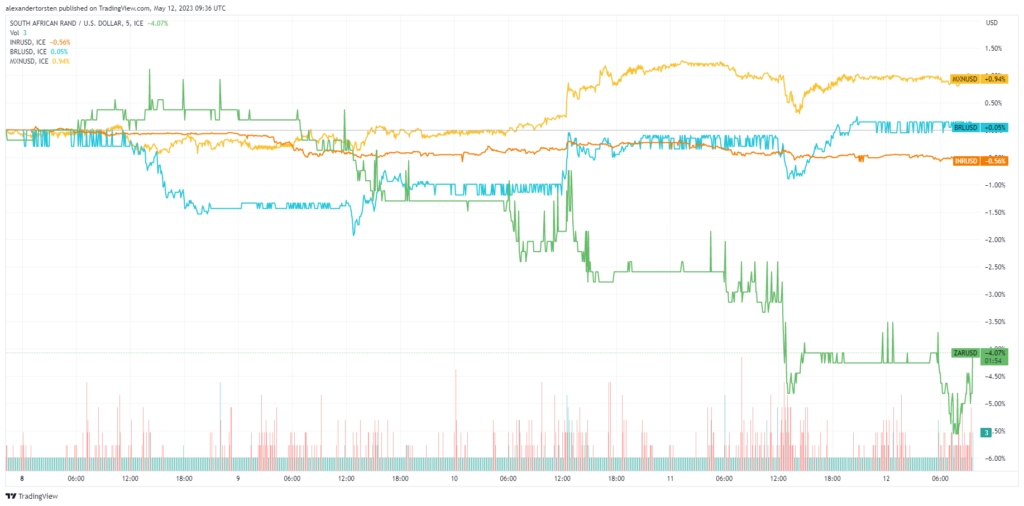

While the above two charts indicate the combined effects of loadshedding and the greylisting on the relative strength of the Rand, the recent speculation about South Africa supplying Russia with arms has sent the Rand into a downward spiral, weakening by more than 4% to the dollar over the last five days, a number that will send shivers down the spines of local market participants. The below chart displays how the Rand has weakened tremendously against the dollar over the past week.

Technical Outlook for the Rand

Looking at the daily time frame on the USD/ZAR, we can see that the South African Rand has recently broken through the psychological barrier of ZAR19.00 relative to the dollar, recently climbing to its weakest level in history.

For the bear case, should the current negative sentiment persist around South Africa, market participants could see the Rand continue to slip against the dollar, possibly weakening to ZAR20.00 to the dollar (red line). Bullish investors will keep an eye on the ZAR19.00 and ZAR18.60 levels, which could potentially come into play should some positive sentiment filter through.

Sources: Bloomberg, BBC News, IOL, The Washington Times, Trading View

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.