For a minority stake in Mobile Money (MoMo), MTN and Mastercard signed a memorandum of understanding. MoMo was valued at over US$ 5.2 billion, or roughly R99 billion, or nearly 40% of MTN’s market value. The agreement will assist Mastercard in expanding its foothold in digital payments across Africa. MoMo, MTN’s mobile money platform, as well as e-commerce, insurance, and airtime financing, are just a few of the 16 mobile money businesses that make up the fintech division of the company. The partnerships with MTN, according to Mastercard, will “add to the continued development of technology and infrastructure to drive financial inclusion across the African continent.” The MTN Group Fintech business delivered on the company’s rapid expansion plans. The volume of transactions increased by 37% to 8.3 billion in the first half of the year. Sixty-one million active MoMo customers executed these.

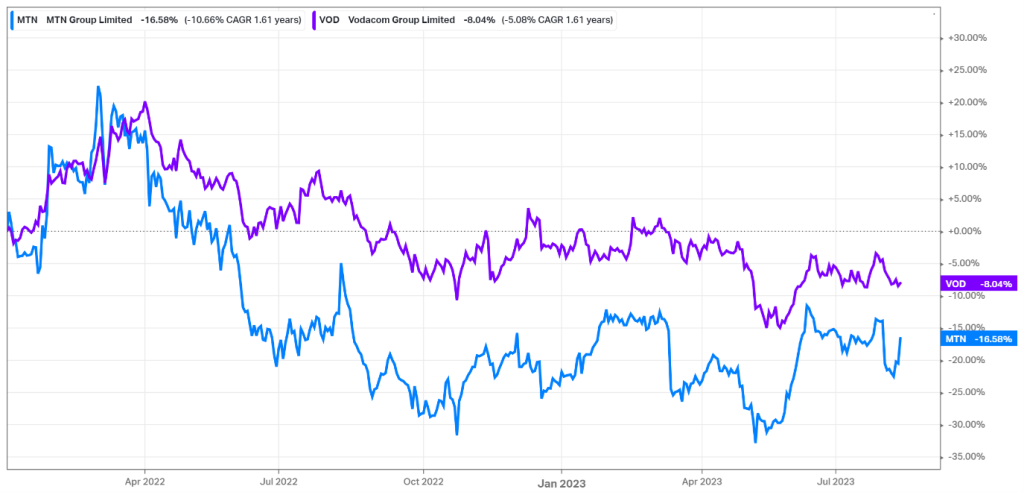

The graph below shows the price action for the two largest telecommunications companies in the country from the beginning of 2022. Besides a bit of rise in the share price in the first few months of 2022, the two share prices have dropped, with MTN taking the most significant knock over the period and currently down by 16.58%.

Technical analysis

After the share price dropped from recent highs of ZAR 208 in March of 2022, the share price has been trading sideways in the range of ZAR 120 and ZAR 145. The price action has been stuck in the range ever since, with a few instances that the share price tested the two levels and broke out to the top side in August 2022 and on the downside in May this year.

When we further analyse the chart, we note that the share price took an enormous dive after the financial results were released in March this year. In June, the share price had a strong performance in terms of the share price. The Relative Strength Index isn’t showing much conviction in whether the stock is currently overbought or oversold. Lastly, the exponential moving averages are now on top of one another.

Fundamental analysis

In constant currency terms, the service income for MTN Group increased by 15% to over R108 billion. The main drivers were revenue growth of 24% from data services and 22% from fintech services. The quarter saw a 6% growth in phone service revenue. Due to continued investment in networks and platforms, data traffic and fintech transaction volumes increased by 18.5% and 37.3%, respectively. The Group spent R17.2 billion on capital expenditures in the first half, for a 15.2% capex intensity. The Group spent R17.2 billion on capital expenditures in the first half, for a capex intensity of 15.2%, falling within the medium-term goal range of 15-18%. The Group delivered service revenue growth of 15.1%, up slightly from a year ago and in line with medium-term guidance.

Due to persistently high inflation and currency depreciation, Ebitda climbed by 13.5%, with an Ebitda margin of 44% (first half of 2022: 44.5%). The company specifically dealt with the effects of Nigerian changes, which added to the immediate burden on consumers and enterprises. Due to decreased data rates and easier access to broadband services, the corporation had 292 million users at the end of June 2023, an increase of 4% from the previous year.

The corporation claimed a 19% growth in total data traffic and more than a 7% increase in active data users, who now number close to 140 million. The balance sheet of the Group remained solid, with all essential measures being well within the parameters of our loan covenants. Adjusted headline earnings per share (HEPS) climbed by 25% to 749 cents, and adjusted return on equity (ROE) increased by 1% to 24.4%, driven by solid sales growth and better efficiencies. These complied with our medium-term recommendations. Looking ahead, MTN will keep working to create shared value across its markets. “We are focused on the continued execution of our Ambition 2025, which remains relevant in the current macroeconomic volatility and presents attractive scope for growth,” said Mupita.

MTN has stated that it intends to raise R25 billion by selling assets. The company recently sold and leased back some of its South African cell towers and plans to sell some of its West African holdings. Additionally, it has a stake in the New York-listed tower owner IHS Holding Ltd. that it might sell down, although any sale in the near future has been put on hold due to low trading prices and a conflict with the company’s management. MTN SA and IHS Group have a deal to sell MTN SA’s power assets, which include roughly 5 700 tower sites and its tower infrastructure. The deal went into effect on May 30, 2022.

Comparative valuation analysis

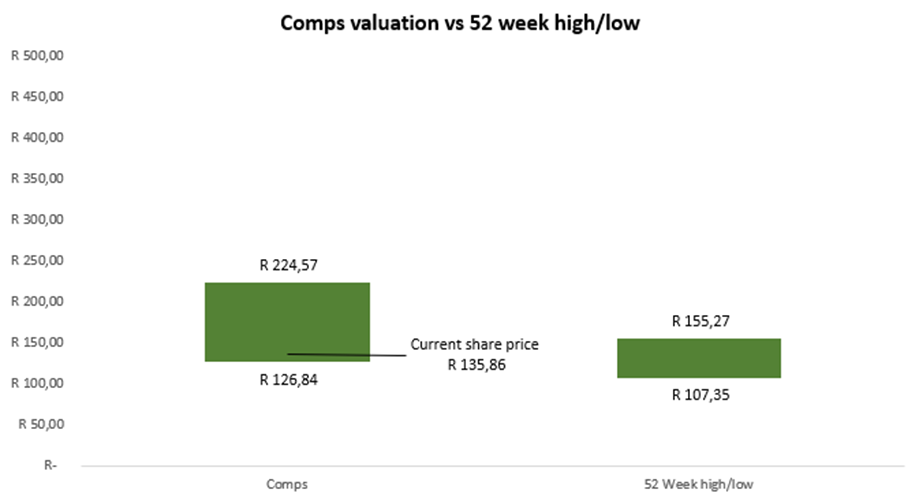

The comparative valuation for MTN indicates much upside for the share price, with EV/Revenue and EV/EBIT above the current share price at R174.81 and R224.57, respectively. Whereas the valuation done using the P/E ratio has the share at R126.84.

Summary

MTN’s financial results were stellar for the first half of their 2023 financial showing double-digit growth in revenue. Additionally, the deal to sell off the business towers and the selling of their stake in MoMo has generated interest from investors.

Sources: MTN; Tech Central; Reuters; News24; Trading View; KoyFin and MoneyWeb

Author: Odwa Magwentshu

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.