Update 9 October

FirstRand Ltd (JSE: FSR) announced changes to its executives

Mary Vilakazi, currently serving as the Chief Operating Officer (COO) of FirstRand, has been named the new CEO of the group, effective April 1, 2024. This appointment marks a historic moment as she becomes the first black female CEO of Africa’s largest lender by market value. Vilakazi brings a wealth of experience and expertise to her new role, with an impressive track record in the financial services sector spanning over 25 years. She has held key leadership positions at prominent financial institutions, including Absa and Nedbank. Her reputation is built on her strategic acumen, ability to navigate complex projects successfully, and unwavering dedication to delivering exceptional customer service. Beyond her professional accomplishments, Vilakazi is a staunch advocate for workplace diversity and inclusion.

As the CEO of FirstRand, Vilakazi assumes the responsibility of steering the group through a transformative period. The financial services industry is evolving, with emerging technologies and evolving customer expectations shaping its trajectory. Vilakazi has expressed her unwavering commitment to guiding FirstRand towards a future where it maintains its prominent position in the African financial services landscape. She has also underscored her deep-seated dedication to driving positive societal impact and intends to leverage her CEO role to further promote diversity and inclusion within the organization. Vilakazi’s appointment as CEO represents a momentous milestone for both FirstRand and South Africa, placing a highly qualified and seasoned leader at the helm to chart the organization’s course into the future.

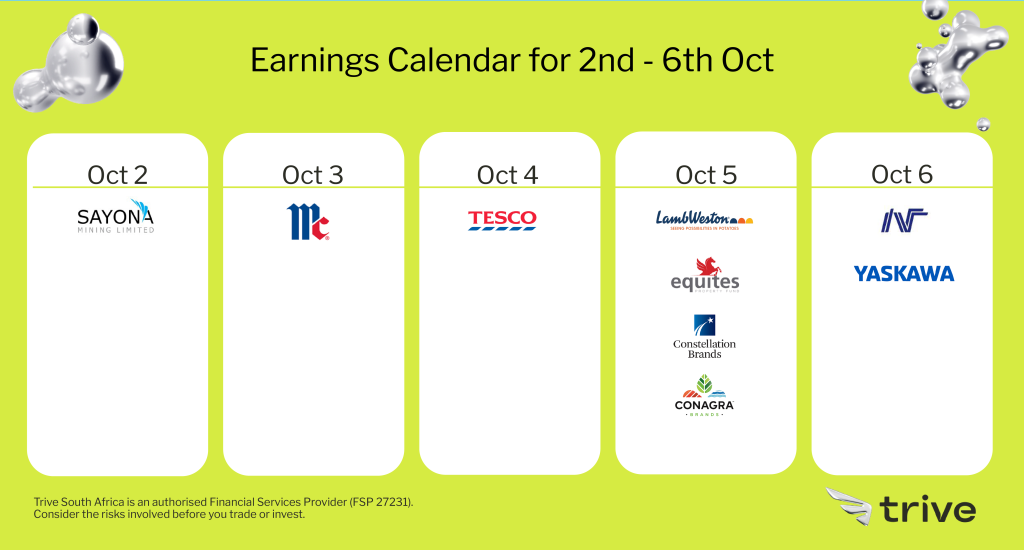

Lamb Weston Holdings Inc. (NYSE: LW)

Lamb Weston Holdings Inc. (LW), a leading global supplier of frozen potato products, reported strong earnings results for its fiscal first quarter of 2024. The company’s net sales increased 47% to $1.695 billion, and its adjusted net income increased 90% to $178 million. The strong earnings results were driven by a number of factors, including:

- Higher sales volumes: Lamb Weston’s sales increased 12% in the quarter, driven by strong demand from food service and retail customers.

- Higher prices: Lamb Weston’s prices also increased in the quarter, reflecting higher input costs and strong demand.

- Acquisitions: Lamb Weston acquired the remaining interests in its European joint venture Lamb-Weston/Meijer in the quarter. This acquisition contributed $381 million to the company’s net sales in the quarter.

Lamb Weston’s CEO, Tom Werner, commented on the company’s strong earnings results: “We are pleased to report strong earnings results for our fiscal first quarter. Our results were driven by higher sales volumes, higher prices, and the acquisition of the remaining interests in our European joint venture. We are seeing strong demand for our products from both food service and retail customers, and we are well-positioned to meet this demand.”

Looking ahead, Lamb Weston expects to continue to perform well in fiscal 2024. The company expects its net sales to increase 10% to 12% in fiscal 2024 and its adjusted net income to increase 15% to 20% in fiscal 2024.

Constellation Brands Inc (NYSE: STZ)

Constellation Brands, Inc. (STZ) reported earnings results for the second quarter of fiscal 2024 on October 5, 2023, beating analysts’ expectations on earnings and revenue. The company’s adjusted earnings per share (EPS) came in at $3.70, versus the consensus expectation of $3.36. Revenue for the quarter was $2.84 billion, versus the consensus expectation of $2.82 billion.

Constellation Brands’ beer business was the main driver of growth in the quarter, with double-digit sales growth. The company’s Mexican beer brands, including Corona Extra and Modelo Especial, continue to be very popular in the United States. However, sales of wine and spirits lagged in the quarter. The company attributed this to a number of factors, including supply chain disruptions and inflation.

Despite the weakness in wine and spirits, Constellation Brands raised its fiscal 2024 earnings per share outlook to a range of $9.60 to $9.80, up from a prior range of $9.35 to $9.65

Sources: Moneyweb; FirstRand; Bloomberg; MarketWatch

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.