The word “Recession” has been synonymous with negativity since the dawn of time, and when you hear the “R” word, the first words that usually come to mind are “Oh no!”. But relax; it’s not all doom and gloom, and here is why:

What is a Recession?

According to the National Bureau of Economic Research, a recession is when economic activity declines for over two consecutive quarters. When the Gross Domestic Product (GDP) declines, real income, consumer spending, industrial production, and employment fluctuate.

Causes and Effects of a Recession

Recessions are caused by economic shocks, speculative asset bubbles bursting, or rising debt, among other factors. The more recent and notable recessions occurred in 2008 and 2001.

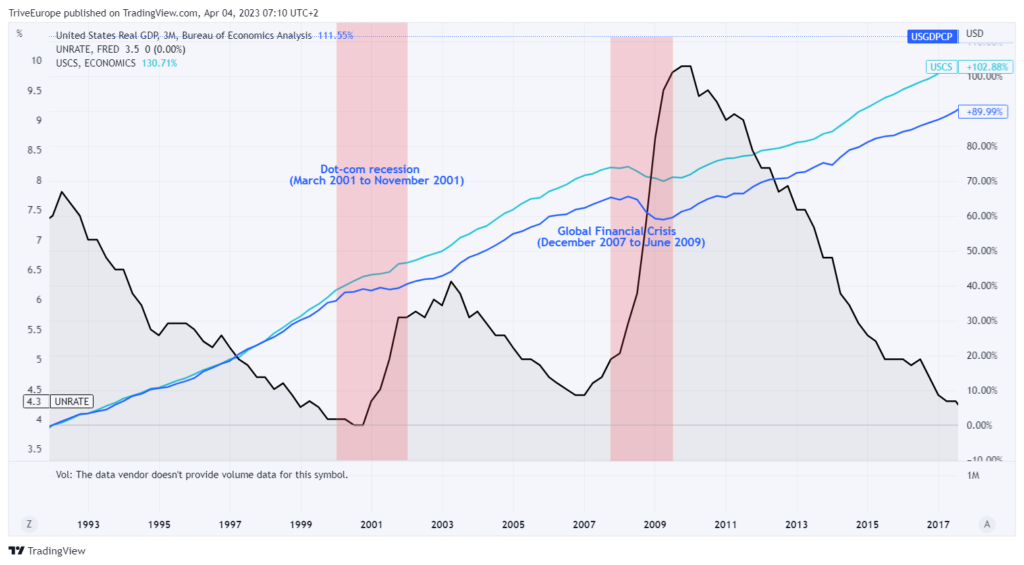

The 2008 Global Financial Crisis was caused by a housing market bubble catalysed by low-interest rates and bad credit. When the bubble finally burst, a recession was in full swing lasting 18 months. GDP fell 4.3%, and unemployment rose to 10%, while the U.S. Government injected $700B as a bailout package for the failing banks of the time.

The DOT-COM Recession of 2001 had similar traits to the Global Financial Crisis but was caused by an over-inflated Nasdaq Index, which declined 75% and totalled tech investor’s capital. Due to the recession being somewhat contained to the effects of losses in the stock market, it lasted only eight months, with GDP contracting 0.6% and unemployment reaching 5.5%.

In the above illustration above, U.S. Real GDP (USGDPCP) is tracked against Consumer Spending (USCS) and the Unemployment Rate (UNRATE). The 2008 Global Financial Crisis saw a huge surge in unemployment while consumer spending dipped.

Why Recessions are Not the End of the World

Understandably, no one wants a recession; however, there are ways to safeguard your investments, leaving you with a recession-proof approach or an umbrella during the storm.

During a recession, equities take a knock. This is due to the decline in real incomes and consumer spending, which leaves public companies competing for less. Businesses are subsequently forced to reduce prices in some instances to attract customers, thereby further exacerbating their revenue loss.

However, not all sectors are prone to lose out. Some sectors perform better than others in a recession, and we will explore some of them.

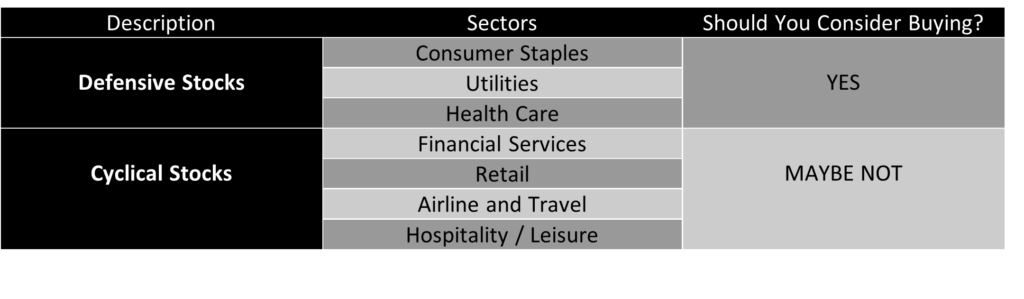

During an economic recession, defensive stocks tend to perform between stable to positive and usually outperform other sectors. Defensive stocks sell necessities or essentials, such as food, drugs, medical supplies or energy. Households typically allocate a budget to these even when their real income is declining.

Cyclical stocks tend to align with the economy as they grow in demand when the economy expands and vice versa. For example, recessions usually come with low-interest rates to stimulate economic growth with cheaper borrowing costs. Financial services companies that rely heavily on interest income could suffer declining revenues and earnings, making them less attractive investments. In addition, with lower disposable income across households, airline, travel, and hospitality sectors suffer losses as households generally cut back on non-essential spending, making stocks in this sector less attractive.

SPDR S&P Bank ETF (KBE) and Invesco Defensive Equity ETF (DEF) are two ETFs which track cyclical and defensive stocks, respectively. The illustration below shows that defensive stocks outperform cyclical stocks during a recession.

What About Other Asset Classes?

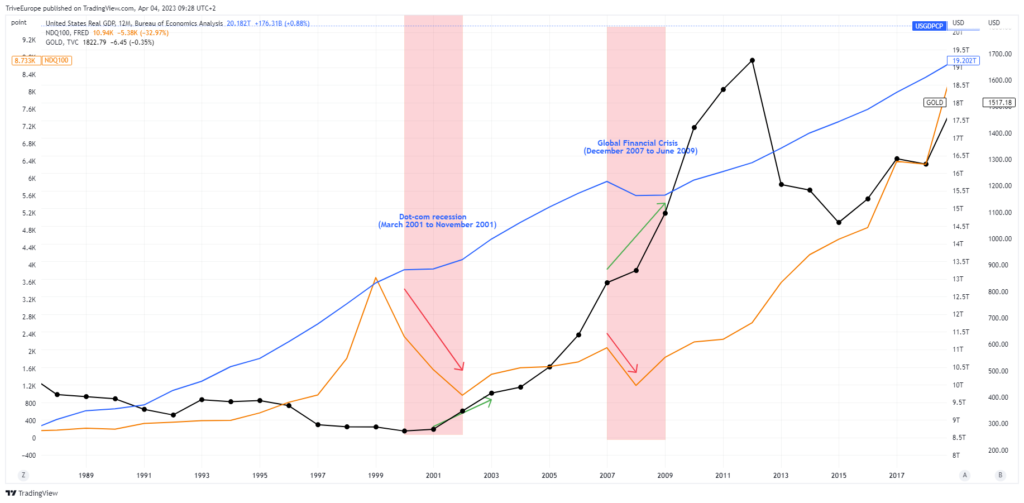

Gold, which is generally considered a safe-haven investment, tends to outperform during times of economic downturn. Due to the value of other assets declining, Gold is viewed as a store of value, and its demand generally peaks during recessions. The illustration below shows that Gold picks up steam as a recession unfolds. Gold shot up almost 18% during the 2008 Global Financial crisis, while the Nasdaq100 dipped 9.36%.

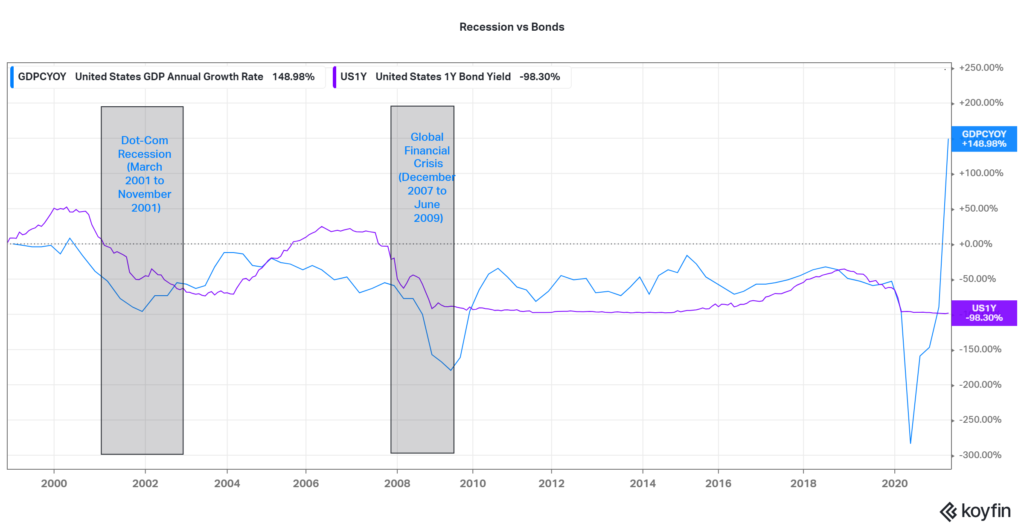

Bonds prices often move higher as demand for them increases. The central bank normally encourages low-interest rates to stimulate growth during a recession. Older bonds which offered higher yields and were issued before the recession are sought after due to their more lucrative income-generating capability over newer issued bonds with low-interest rates. The graph below illustrates the reaction of Bond Yields (US1Y) to an economic contraction. Bond yields, which are inversely related to their price, tend to take a dip in a recession while bond prices surge.

How to Take Advantage of a Recession

It’s not rocket science! Financial derivative instruments might be a good way to maximise opportunities and mitigate risk during a recession. Derivative instruments allow the investor to go long (buy) or short (sell) various asset classes like Futures, Options and even using some sector ETFs.

Drumroll!!!!!!!!!

And the winner is Gold, Defensive Stocks and Bonds! These offer the most lucrative opportunities to buy into a rally during a recession. On the losing end of the cycle is Cyclical Stocks! Cyclical stocks remain under pressure when a recession unfolds until the macroeconomic picture changes. Cyclical stocks are best to short during a recession as their value generally declines.

Sources: National Bureau of Economic Research, Bureau of Economics Analysis, World Bank, CNBC, Bloomberg, TradingView, Koyfin

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.