As Apple Inc. (NASDAQ: AAPL) stock took a nosedive of nearly 2% after their newest iPhone debut, it seems their soaring journey hit a turbulence zone. Slipping from their recent heights, Apple‘s been grappling with a barrage of obstacles lately—China bans and fierce competition in the high-end smartphone arena—making it a wild tech world out there. Hopes were high for the ‘Wonderlust’ event to revive their ailing hardware division, but alas, it left investors with less optimism than a snooze button. So, can the tech behemoth return to its former glory?

Apple’s struggles began when it reported its latest quarterly earnings report, missing analyst forecasts as the global smartphone slump took a toll on its top line. Net sales fell from $82.96Bn to $81.79Bn despite record revenue in its services division. However, due to the company’s competitive positioning in the industry, it managed to produce a net income of $19.88Bn, pushing basic earnings per share (EPS) up from $1.20 to $1.27. Going forward, investors were looking toward the release of the new iPhone 15 to gauge whether the company’s latest innovations and developments could catalyse the top-line growth it has seen for so many years as it made its journey to the top of the industry.

Technical

On the 1D chart, the quarterly earnings triggered a high volume breakdown from the ascending channel, whereafter, the news of the Chinese ban resulted in a second leg down, also on high volume. With the 25-SMA (green line) falling below the 50-SMA (blue line), the shorter-term momentum falls to the bearish side, opening up the potential for further downside in the upcoming sessions.

If the support at $176.30 fails to contain the downside pressure, the share price could continue its descent toward $172.02. From there, the 38.2% Fibonacci retracement at $169.06 could be within reach, with neckline resistance close to $167.97.

However, these downside moves could open up potential opportunities for investors, with the estimated fair value sitting at $203.65. If the share price can clear resistance at $189.91 and $196.51, the share price could converge with the estimated fair value, presenting a 15.5% potential upside from Tuesday’s close.

Fundamental

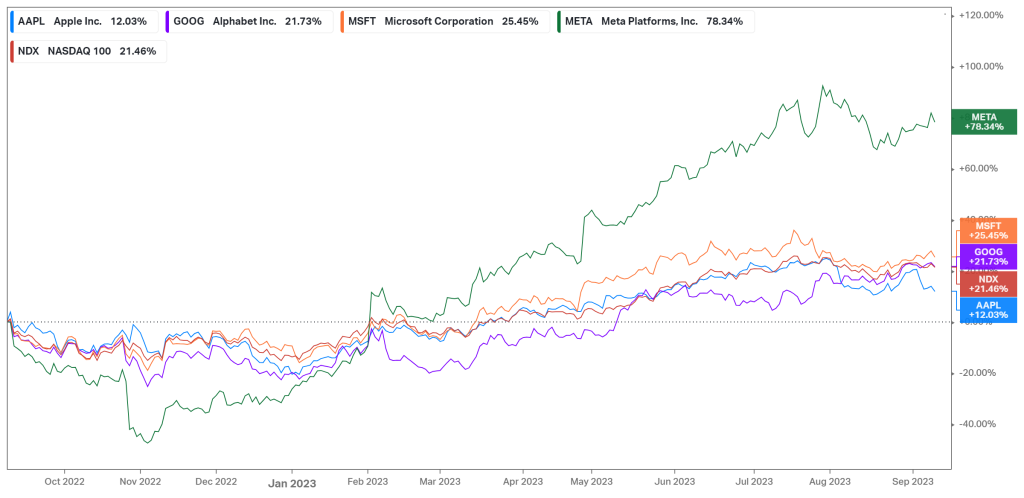

Over the last year, Apple has had its ups and downs, reaching an all-time high toward the end of July as the technology rally stimulated the demand for the iconic smartphone maker. However, with its higher dependence on hardware sales compared to cloud computing and service offerings, its earnings felt the heat of a challenging economic backdrop a bit more than its industry peers as consumer spending tightened. As a result, its 12.03% return over the last twelve months lags the 78.34% of Meta and 25.45% that Microsoft returned over the same period. After the news of the China ban and its latest iPhone reveal, the share price has been under further scrutiny, falling behind the broader Nasdaq 100, which has appreciated 21.46%. However, the question is whether this correction from the high is due to a prior overreaction in its uptrend or a cyclical shift, which now more accurately reflects its true value.

Apple’s reliance on its hardware offerings is shown below, as services, while expanding at a healthy rate, only account for 26% of the company’s top line, coming in at $21.21Bn in the latest quarter. Due to sluggish demand, the sale of iPhones and other Apple products has slowed. In the latest quarter, iPhone sales contracted from $40.67Bn to $39.67Bn, while its Mac sales declined from $7.38Bn to $6.84Bn. Similarly, its iPad sales fell from $7.22Bn to $5.79Bn, making the Wearables, Home and Accessories segment the only hardware section that realised growth, expanding from $8.08Bn to $8.28Bn.

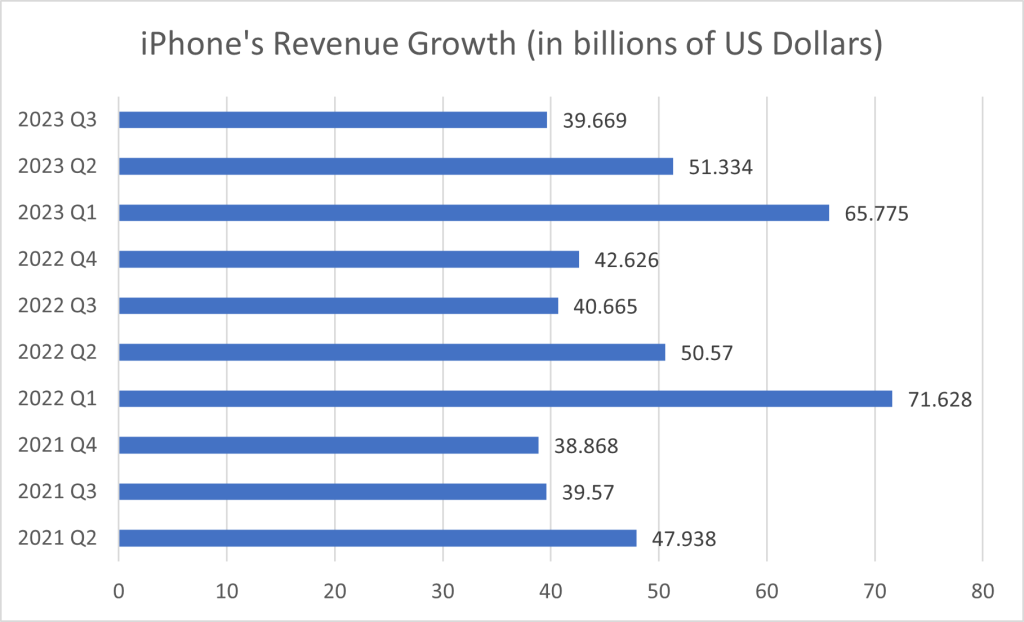

However, the iPhone headwinds come as no surprise, as the graph below depicts the cyclicality of these sales over the past few years. While the company reached the highs of $65.78Bn in its first quarter of 2023, iPhone sales have fallen back to the levels reached in 2021. It is evident that Q1 is the strongest quarter of the year. Still, the concern lies in the fact that its strongest quarters are reaching lower peaks in the cycle, showing a fundamental shift in consumer demands, as individuals are perhaps trading down to more affordable options. This could be one of the reasons behind the recent decisions made in the launch of the iPhone 15. The base model iPhone 15 is set to cost $799, while the iPhone 15+ will go for $899. These prices show no increase from last year’s iPhone 14 base models. While investors hoped to see higher prices to capture more margin, the company’s ability to continuously raise these prices is somewhat limited. One positive, however, was the increase in the minimum price for the iPhone 15 Pro Max, which will cost $1,199 and has 256GB of storage. While this is the same price as the iPhone 14 with the same amount of storage, Apple has removed the lower price 128GB model in an attempt to entice consumers to purchase the higher-end model.

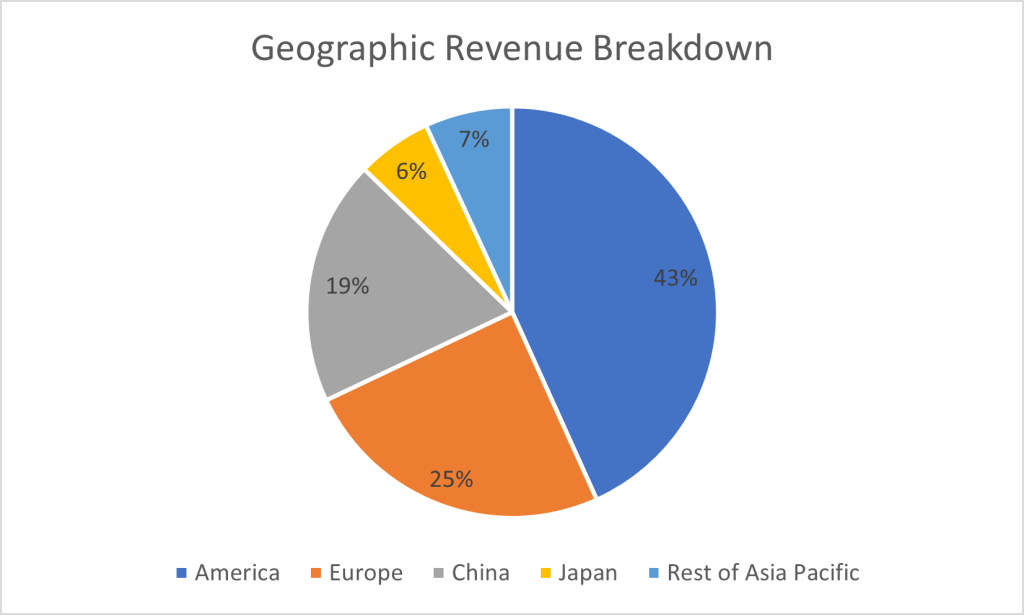

The other headwind Apple has to navigate is the recent ban by Chinese regulators that prohibits government employees and state-owned enterprise workers from using Apple’s products. This could be significant, considering that 19% of Apple’s revenue comes from China. This geography is the third biggest sector in Apple’s global operations, and a large-scale demand reduction could be detrimental to its already stagnating top line. However, on Wednesday, Chinese spokeswoman Mao Ning claimed that China has not released official regulations to stop using foreign smartphones, essentially denying the rumoured reports. This development is certainly one worth monitoring as it could have significant implications for the company’s revenue.

While its China geography is vulnerable, Apple has recently ventured into India, a market it identified as a high-growth opportunity, and the company is actively working toward expanding its offerings in India. Analysts estimate India could account for 15% of Apple’s revenue growth over the next five years, highlighting the lucrative opportunity in that geography. However, competition is also intensifying in the industry. In recent years, the sanctions imposed by the US on Chinese access to critical strategic technology have reduced companies like Huawei’s ability to compete in the higher-end market. In the early months of 2020, Huawei held a large share of the premium smartphone market in China, rivalling Apple to a much larger extent than it has been able to do in recent years. In 2023, iPhones contributed 65% of that market, with Huawei falling to an 18% share. However, Huawei last week released a phone with the speed and capability necessary to compete in the higher-end market, suggesting it has found a way around the Western restrictions and can now re-enter the premium market segment to rival Apple once more.

Summary

It has been tough going for Apple in recent weeks, as the headwinds kept piling up ahead of its iPhone 15 release. The ‘Wonderlust’ event did little to convince investors of its growth as we advance, and some shorter-term downside may persist. However, the company and its management have proved over a long period of time the resilience and strength in the company’s business model, and one can expect the company to bounce back strong once the cyclical headwinds start fading. The estimated fair value of $203.65 presents a 15.5% potential upside from Tuesday’s close.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, The Wall Street Journal, CNBC, Apple Inc.

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.