2022 will be remembered as a highly volatile year for the US markets, especially as the year growth stocks lost their shine.

How did the Major US Indices do in 2022?

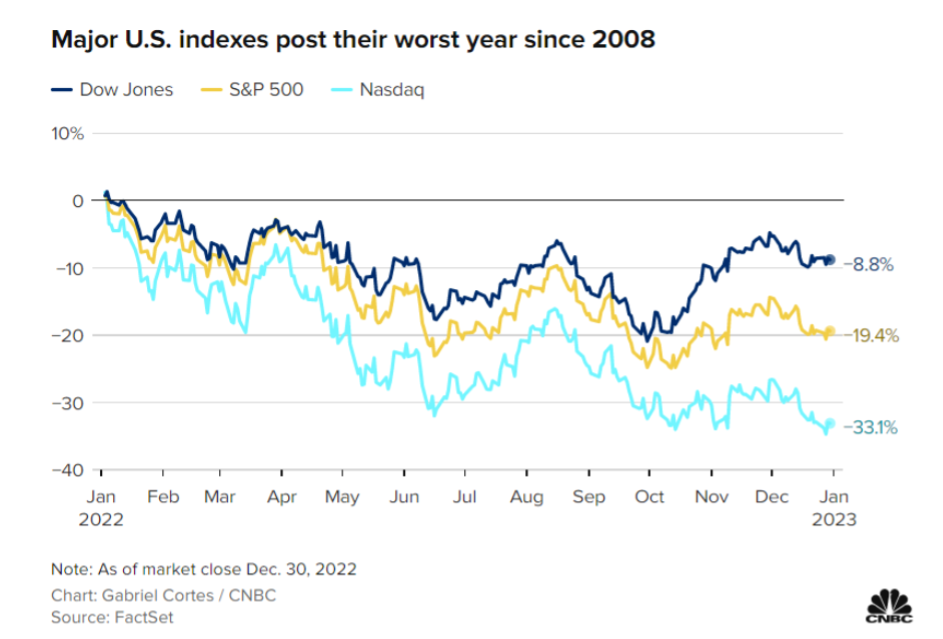

All three major Indecis had their worst year since the financial crises in 2008 and snapped a three-year win streak. Sticky inflation and overly aggressive rate hikes from the US Federal Reserve Bank (Fed) halted growth for tech stocks and weighed heavily on investor sentiment throughout the year. Not to mention the Geopolitical concerns and volatile economic data, which also kept markets on edge. Some investors think the sell-off is far from over and expect the bear market to persist until a recession has come to fruition in 2023. Some investors also project that US stocks will move lower and hit new lows before rebounding in the second half of 2023. Despite the annual losses, the Dow and S&P 500 broke three-quarter losing streaks in the year’s final three months. The Nasdaq, dominated by the likes of Apple, Tesla and Microsoft, stumbled through the fourth consecutive negative quarter for the first time since 2001.

Biggest sector winners and losers across the US market:

Biggest Winners

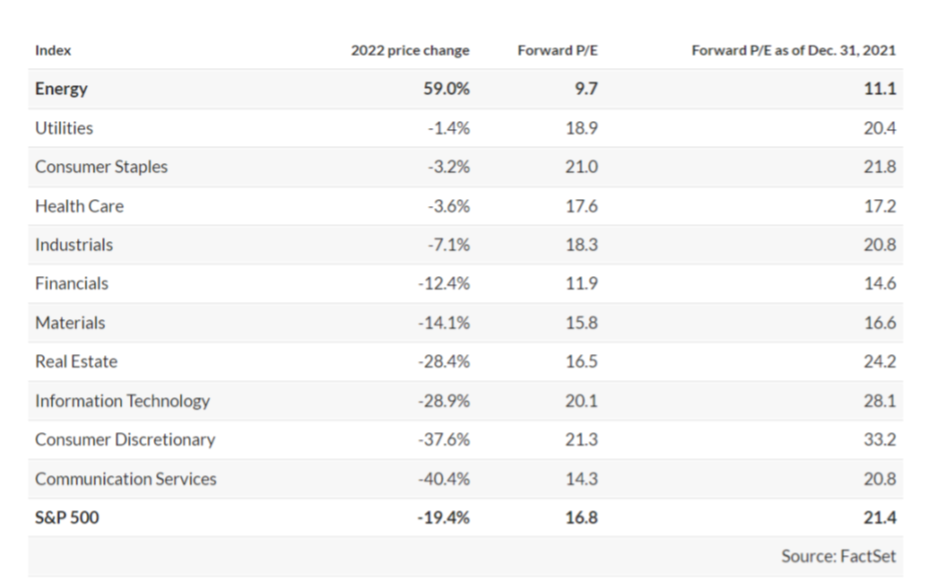

Despite a year in which the S&P 500 index declined 19%, with 72% of its stocks in the red, there were plenty of winners.

One of the reasons market participants are still confident in the energy sector is that oil producers have remained cautious when it comes to spending. Oil producers don’t want to increase oil supply enough to cause prices to crash, as they did in the run-up to 2014, when prices fell steadily through early 2016, causing bankruptcies and consolidation in the industry.

As Occidental Petroleum Corp.’s chief executive explained in a recent interview in US media, the oil companies are now focusing on maintaining supply, raising dividends, and buying back shares.

Biggest Losers

The growth sector felt the brunt of the sell-off in 2022, especially fast-growing companies like Meta, Amazon and streaming sensation Netflix as future earnings expectations became less rosy.

Looking at the worst-performing sectors, the consumer discretionary sector includes Tesla and Amazon, which have fallen nearly 50% this year. The communications sector includes Meta Platforms along with Match Group, which is down 69% for 2022, and Netflix, which is down 51% this year.

There were many reasons easy to cite for Big Tech’s decline, such as a questionable change in strategy for Facebook’s holding company, Meta, as CEO Mark Zuckerberg has put so much of the company’s resources into developing a new world that most people don’t wish to enter, at least yet. Meta’s shares were down 64% for 2022.

Here’s how the S&P 500’s 11 sectors performed for the year:

6 Key Factors that Moved the Stock Market in 2022.

1. Omicron wave

The number of infections peaked in January 2022, after which the wave receded. Since then, many variants of Omicron have emerged, and at the end of the year, a new variant resurfaced, named BF.7. This new variant was behind the sudden rise in infections in China and some other parts of the world. Experts are now in wait-and-watch mode.

2. Russia-Ukraine war

As the concerns around coronavirus infections receded, Russia announced a ‘special military operation’ in Ukraine. The international community condemned the attack on Ukraine by Russian forces, with many countries imposing sanctions on Russian trade.

3. Global Inflation

Global central banks have kept monetary policy loose and a dovish stance for two long years since the breakout of coronavirus in 2020 to support economic growth. Before the world could come to grips with the impact of the pandemic, Russia attacked Ukraine. As a result, commodity prices started to rise at a record pace, leading to higher crude prices. This cascaded effect on food prices and other products and services

in the US and globally.

Countries around the globe faced an inflation outbreak as food and energy prices surged out of control.

US inflation rose to as high as 9%, and if inflation does not start to slow down, we are looking at an uglier scenario. Fortunately, there are clear signs that inflationary pressures are moderating and will continue to do so in 2023, said JP Morgan Asset Management in a recent report.

4. Fed rate hike

In an effort o curb high inflation, central banks globally started to lift key benchmark rates throughout 2022. In light of high inflation and a steep increase in interest rates around the globe, the US Dollar began to gain significant strength. Some of the main factors to mention in the inflation story were supply chain shortages, the energy crisis due to the COVID-19 pandemic and Russia’s invasion of Ukraine. In November, US Fed indicated it would reduce the number of interest hikes but warned of sticky inflation, saying that rate hikes might be lower for longer.

5. Europe’s energy crisis

European countries imposed sanctions on Russia and reduced the trade of fuel supplies such as oil and gas from the government. European nations scrambled to find alternative energy supplies when Moscow switched the Nord Stream 1 pipeline off to retaliate against sanctions.

6. Slowing growth and possible recession.

Concerns of a hard landing emerged after the central banks tightened the monetary policy. Experts predict a modest slowdown or a slight recession in the US

around the second half of 2023.

The International Monetary Fund (IMF) recently cut global growth forecasts, warning that downside risks from high inflation and the Ukraine war were materializing and could push the world economy to the brink of recession if left unchecked.

Overall review of Wall Street’s most loved Stocks

Amazon.com, Apple, Alphabet, Microsoft, Tesla, and Meta Platforms collectively lost $632 billion to $908 billion in market value. These losses accounted for roughly half the $9.1 trillion decline in the S&P 500 Index.

Apple, the world’s largest company by market capitalization, saw its stock price quash by over 25%. Tesla and Meta were lower by almost 65% from the January

highs, while stockholders in Warner Bros. and PayPal also suffered losses. Between 15 and 50 per cent was lost by leading US stock market companies, including Netflix, NVIDIA, Amazon, Intel, Walt Disney, and others.

On the positive side, some companies, like Merck, Caterpillar, and Coca-Cola, were able to produce positive returns that outperformed the index. The Chevron Corporation saw the most significant increase on the Dow Jones 30 Index list of companies that generated above 50% in 2022

.Some of the top losers of the Dow 30 Index were Salesforce, Walt Disney, 3M Company, NIKE, Microsoft Corporation, and Verizon Communications. The Dow’s most significant loss, Intel Corporation, saw a nearly 50% decline in 2022.

Sources: Trive New York LLC, FactSet, Refinitiv, Reuters, Livemint, Marketwatch, NBCNews.

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.