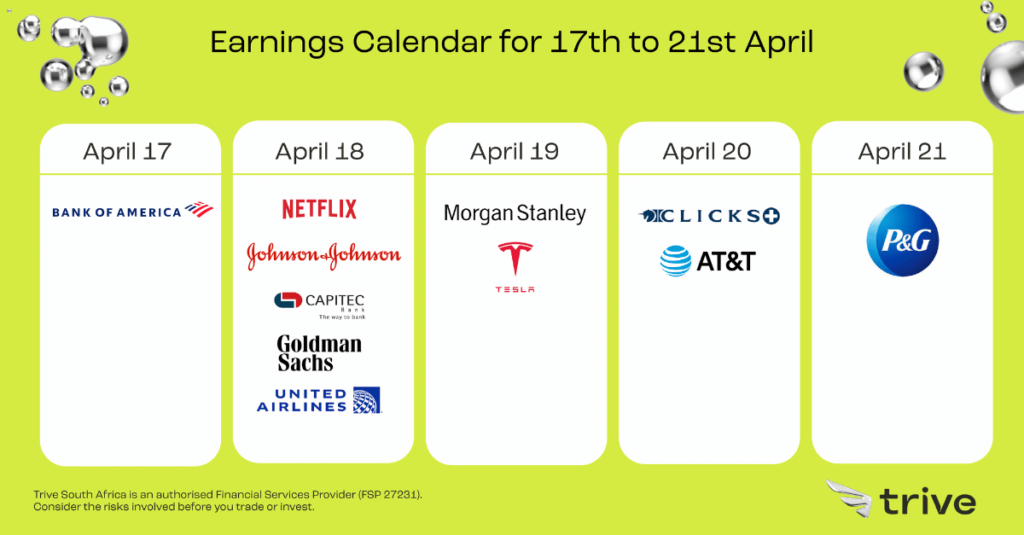

It’s time for earnings season again, and the company report cards are expected to be a bit lackluster this time after an extremely busy US data-driven week behind us, which could see another rate hike soon. But it’s all about banking this week with local juggernaut Capitec Bank reporting, and major US investment banks like Morgan Stanley, Goldman Sachs, and Bank of America are releasing earnings this week.

Update 24 April 2023

SA CPI: March 2023

In March, consumer inflation increased slightly to 7.1% year-on-year, with a monthly increase of 1.0%, the most significant monthly rise since July 2022. The Consumer Price Index (CPI) increase was due to price increases in various categories, including food and non-alcoholic beverages, housing and utilities, transport, and miscellaneous goods and services. Food inflation hit a 14-year high of 14.4% in March, up from 14% in February. The prices of bread and cereals experienced a surge of 20.3%, placing a significant burden on low-income and working-class households that heavily rely on maize meal as a staple food source.

The core inflation rate rose from 4.9% in January to 5.2%. Core inflation represents inflation excluding food and non-alcoholic beverages, fuel, and energy. This uptick in core inflation suggests that the interest rate hikes by the South African Reserve Bank may not be effectively curbing inflation, and additional rate hikes may be necessary.

Capitec Bank Holdings LTD (JSE: CPI)

Capitec (JSE: CPI) released their financial results for the year ended on 28 February 2023, showing bottom-line growth at the upper end of management’s forecast.

The company’s headline earnings for the period increased by 15% to R9.7 billion compared to R8.4 billion in the previous year. The income from operations also showed growth of 12%, amounting to R30.3 billion. However, the net income only increased marginally by 2%, reaching R24 billion. The rise in credit impairments was the main factor contributing to this reduction in income, with an increase of 80% to R6.3 billion. Despite the challenging economic environment that continues to exert significant financial pressure on consumers and businesses, Capitec now serves one-third of the population.

The business banking segment continued to gain momentum, resulting in robust profit growth. However, credit impairments increased significantly, leading to a deteriorating credit loss ratio. The higher interest rate environment benefited interest income on lending and investments, while the insurance business saw improvement in its post-pandemic claims experience. Capitec’s focus on transitioning clients to digital banking solutions was detrimental to transaction income, which grew by 9.5% year-on-year, and particularly fee margins, which dropped by 300 basis points year-on-year. To give context, transaction income increased by 21% in FY22. Load-shedding also had a negative impact on the availability of cash devices. The share price fell by 5.9% on the day.

TESLA INC (NYSE: T)

Tesla (NSDQ: TSLA) the electric car manufacturer, recently released their 1Q23 results, with adjusted earnings per share falling by 21% year-on-year to $0.85. This decline was expected by the market due to management’s decision to reduce vehicle selling prices to drive higher volumes and boost deliveries, resulting in solid top-line growth of 24% but with lower margins. Higher costs along the supply chain also contributed to the decrease in profitability. While the Energy Generation & Storage vertical performed well, the impact on the bottom line was minimal. Despite management’s positive outlook for growing vehicle deliveries at a fast pace, the business needs to consider structural factors such as increasing demand for its products at a higher price-point, possibly through the launch of new models. Tesla’s stock price multiples remain lower than its historic average but still trade at a significant premium to its auto peers. The outlook for Tesla’s growth remains positive, with support for battery electric vehicle demand, although pricing pressure and market share losses could potentially hinder the company in the near term.

Sources: CNBC, Financial Times, News 24, Statistics South Africa

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.