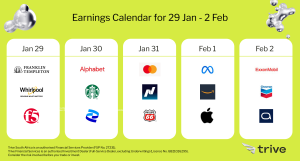

Another jam-packed week filled with earnings and economic data could set the tone for the rest of the year if positive across the board. Apple and Amazon will drive the earnings focus offshore while the local Royal Bafokeng Platinum, Sappi Ltd and AB InBev grab our attention.

Update 7 August

During the past week, earnings season in the US maintained momentum as the second half of releases commenced. Notably, giant tech names such as Apple and Amazon, along with Pfizer Inc., PayPal, and Starbucks, headlined the earnings releases in the US.

PayPal Holdings Inc (NSDQ: PYPL)

PayPal, the leading digital payments company, reported its second-quarter earnings on Wednesday after the market close, delivering impressive results that showcased its continued growth and success in the digital payments landscape.

During the second quarter ending on 30th of June, PayPal’s earnings per share (EPS) reached $1.16, representing a significant 24% increase compared to last year. This remarkable growth in EPS indicates the company’s ability to leverage its platform and capitalize on the increasing demand for digital payment solutions. In addition to impressive earnings, PayPal’s revenue also witnessed a notable climb, rising by 7% to reach $7.3 billion during the quarter. This rise in revenue reflects the company’s sustained momentum and the effectiveness of its business strategies in capturing a larger share of the digital payments market.

One of the key drivers of PayPal’s success is the substantial growth in total payment volume processed by its merchant customers. In the second quarter, the total payment volume surged by 11% to reach an impressive $376.5 billion. These figures comfortably surpassed analysts’ expectations, who had projected a lower total payment volume of $368.9 billion. This surge in payment volume indicates PayPal’s continued popularity and preference among merchants and consumers alike.

However, there was a slight dip in the number of PayPal users during the second quarter. The company reported a decrease of 2.5 million users, bringing the total user base to 431 million. Despite this dip, the numbers remained close to market estimates of 432 million users. Although this slight decline may be noteworthy, it is crucial to take into account the broader context of PayPal’s overall growth and market positioning.

Fitch Ratings Downgrades US Sovereign Credit Rating, Raising Concerns Over Fiscal Deficit and Governance

Fitch Ratings Inc. recently cut the US top-tier sovereign credit rating, citing concerns over the country’s rising fiscal deficit and an “erosion of governance” related to debt ceiling standoffs. The credit rating was downgraded by one notch from AAA to AA+, bringing it to the same level as that of S&P Global Ratings. Fitch clarified that the downgrade was not solely triggered by the latest debt ceiling standoff but reflected a gradual decline in governance standards over the past two decades, particularly concerning fiscal and debt matters.

Analysts assert that the potential financial impact on everyday people will likely be long-term rather than immediate. The downgrade poses an economic threat, as it may lead to higher loan interest rates. The nation and its borrowers could be deemed less trustworthy in the eyes of global investors, causing borrowing costs to rise across various aspects of daily life, such as credit cards, mortgages, and car loans.

Johannesburg Stock Exchange (JSE: JSE)

The JSE (JSE) released results for the six months ended June 30, 2023. One of the key highlights of the announcement was the remarkable increase in group profit, which surged by an impressive 10.4% year on year, reaching an impressive R492.8 million. Total revenue also showed a positive trend, rising by 5% to R1.45 billion during the same period. This growth was primarily supported by double-digit increases in both Information Services and JSE Investor Services (JIS) revenue.

However, the results were not without challenges. The JSE’s largest division, equity trading, experienced a decline of 5% year on year. This decrease was attributed to lower trading activity amid macroeconomic uncertainty, negatively impacting the division’s performance. Nevertheless, the exchange managed to offset these losses with robust gains in fixed income and interest rate trading, which soared by an impressive 27%. Additionally, more robust derivatives trading further contributed to mitigating the impact of the equity trading downturn.

The prevailing high-interest rate environment played a favorable role in bolstering the exchange’s financial income during the period.

Sources: CNN Business, iOL, MarketWatch. YahooFinance, Reuters

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.