Update 18 March

Mixed Fortunes for South African Banks: Absa Stumbles, Standard Bank Surges

South African banks painted a contrasting picture with their recent financial reports. While Standard Bank, the continent’s largest lender, celebrated a strong 27% profit increase, Absa Group Ltd. encountered a rough patch, experiencing its first profit decline in three years.

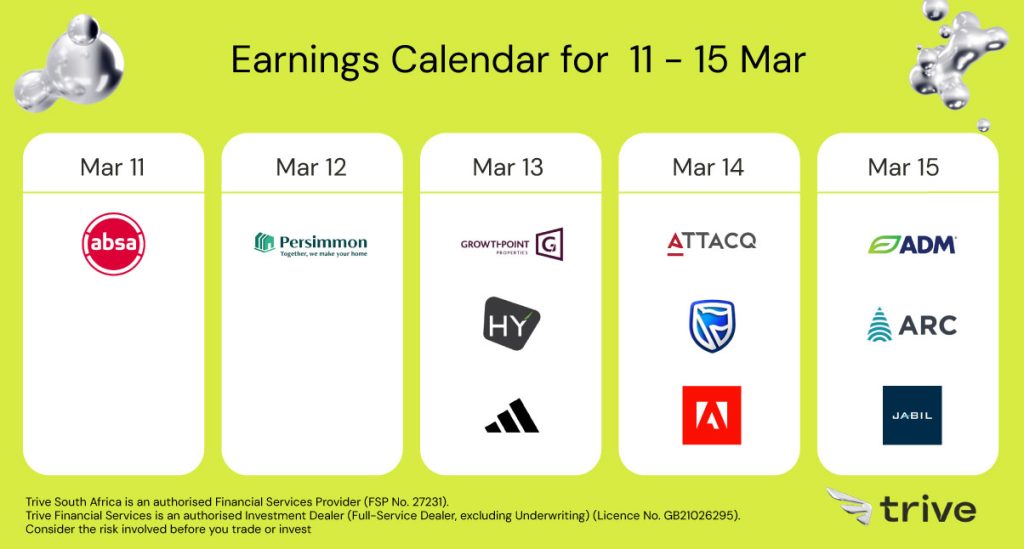

ABSA Group Ltd (JSE: ABG)

Absa Group Ltd. hit a rough patch, reporting a disappointing 1.8% decline in its annual profit for the year ending December 31, 2023. This marks the first profit dip for the South African lender in three years, and investors took notice with Absa’s share price falling as much as 3.6%.

The primary culprit behind the profit slide? A significant increase in bad loans. Impairments, the money Absa sets aside to cover potential loan defaults, jumped by 13%. This surge is linked to two key factors:

- Tepid Economic Recovery: South Africa’s sluggish economic growth is leading to lower consumer confidence. People are hesitant to spend, making it harder to repay loans.

- High Borrowing Costs: Interest rates in South Africa are currently at their highest level since 2009. This makes borrowing more expensive and repayments more challenging for borrowers.

Absa’s credit-loss ratio, a key measure of bad loans as a percentage of total loans, climbed to 1.18%. This is concerning as it falls outside Absa’s target range of 0.75% to 1.00% and is higher than its competitors.

While Absa’s profit missed analyst expectations (falling short of the predicted 21.5 billion rand), rivals like Nedbank even managed to grow their earnings by 14%. This highlights Absa’s struggles in the current economic climate.

Adobe Inc (NYSE: ADBE)

Adobe’s first quarter was a stellar performance, exceeding expectations with record revenue of $5.18 billion. This marks an 11% year-over-year jump, driven by robust growth across all segments. The Digital Media segment, which houses their popular creative and document software, shined the brightest with a 12% increase.

This success can be attributed to several factors. They’ve doubled down on innovation, particularly in harnessing the power of generative AI, which is evident in their product portfolio. Additionally, their subscription model is thriving, reflected in the significant increase in Annualized Recurring Revenue (ARR). This indicates not only customer acquisition but also successful customer retention and expansion.

Financially, Adobe remains rock-solid. Their operating income and net income, both GAAP and non-GAAP, showcase strong profitability. Their commitment to shareholder value is further emphasized by the announcement of a new $25 billion share repurchase program, demonstrating confidence in their financial health and future prospects.

Looking ahead, Adobe expects continued momentum in the second quarter with projected revenue between $5.25 billion and $5.30 billion. Investors can gain further insights into their long-term strategy and vision for the future, including their roadmap for AI integration, at the upcoming Investor Meeting during Adobe Summit 2024.

Standard Bank Ltd (JSE: SBK)

Standard Bank, Africa’s largest lender, reported a strong 27% rise in annual profits to R42.9 billion ($2.31 billion). This growth is attributed to higher interest rates and a 20% increase in net income. Net interest income surged by 25%, while non-interest revenue grew by 13%.

However, the report highlights concerning economic factors. Inflation, high interest rates, and logistical issues are straining Standard Bank’s retail and small business clients, leading to increased loan defaults

The bank’s performance varied across regions. International operations saw a robust 49% jump in profits, exceeding analyst expectations. This strong performance was offset by only 3% growth in the South African business due to the country’s economic struggles.

Despite the profit increase, Standard Bank’s stock price fell, reflecting investor concerns. The proposed dividend also missed analyst estimates.

Sources: Bloomberg; MoneyWeb; The Wall Street Journal; Yahoo Finance

Piece written by Trive Sales Trader, Kealeboga Molefe

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.