Update 29 April

Sasol Update Reveals Challenges, Investor Confidence Shaken

Sasol’s production update caused a meltdown. Share prices plunged after news of lower production (down 3%), weak chemical prices (down 20% YTD), and safety incidents (5 fatalities). Despite initial hope from high oil prices and a weak Rand, the outlook is shaky. While fuel and gas may hold steady, chemicals are struggling, and mining’s productivity gains (up 4%) are overshadowed by safety concerns. Hedging offered mixed results; success with currency (gaining R531 million) was offset by losses on oil price hedging (R819 million). CEO Baloyi expects continued challenges due to economic and political factors, along with disruptions from South African utilities. Sasol is focusing on internal improvements to weather the storm, but investor confidence is shaken.

Capitec Bank Holdings Ltd. (JSE: CPI)

Capitec Bank emerged from the year with a celebratory 16% profit increase, thanks in large part to a digital revolution in the latter half. Customers enthusiastically embraced the bank’s online offerings, leading to a 30% surge in transaction and fee income. This digital wave propelled Capitec forward, demonstrating the growing importance of user-friendly online banking services.

However, the path to profit wasn’t entirely smooth. In late 2021, anticipating a robust post-pandemic economic recovery, Capitec loosened its lending criteria. This optimistic move backfired when the Russia-Ukraine conflict sent shockwaves through the global economy. Inflation skyrocketed, and interest rates climbed, making loan repayments a burden for many borrowers. As a consequence, unpaid loans experienced a concerning 38% rise. By February 2023, the bank observed a worrying trend of delinquencies and an increase in customers resorting to debt review programs.

Despite the challenges on the lending front, Capitec found success in other areas. Their insurance division enjoyed a healthy 12% profit increase, showcasing the bank’s diversification beyond traditional loan products. Similarly, the business banking unit thrived, boasting a remarkable 23% profit jump. These bright spots demonstrate Capitec’s ability to generate revenue beyond consumer lending.

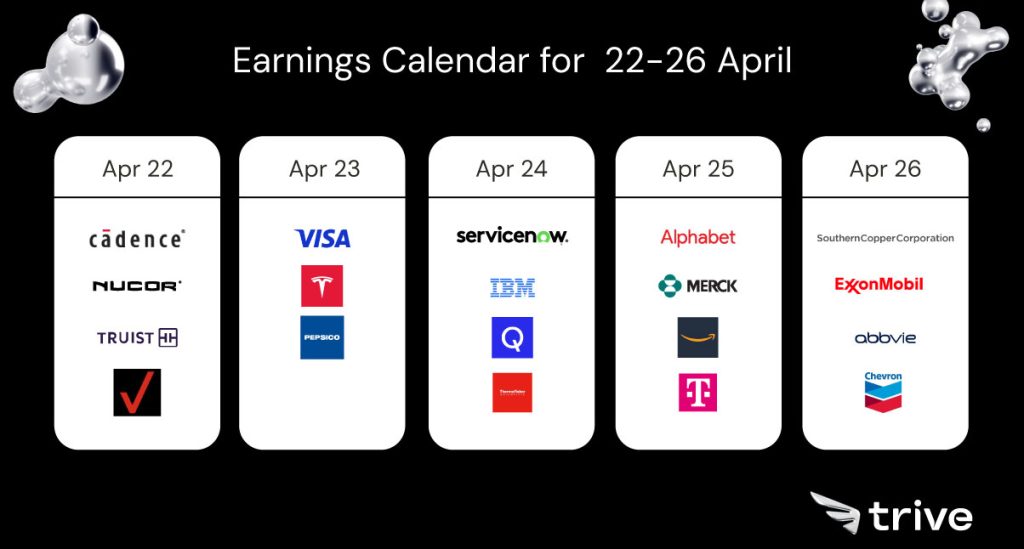

Alphabet Inc (NASDAQ: GOOG)

Alphabet, Google’s parent company, beat analyst expectations with a strong earnings report. The growth was fueled by a surge in Google Cloud revenue (28%), which reached $9.6 billion. This impressive rise is attributed to the company’s focus on integrating AI into its cloud offerings, helping them compete with industry giants like Amazon and Microsoft.

However, a looming challenge exists. Google’s core business, search advertising (generating $46.2 billion), faces potential disruption from AI chatbots like ChatGPT. These chatbots offer information in a conversational way, potentially threatening Google’s traditional search dominance. Further uncertainty comes from an ongoing antitrust lawsuit.

Despite these concerns, Alphabet expressed optimism. The company announced its first-ever dividend (20 cents per share) and a hefty $70 billion stock buyback program, demonstrating confidence in its future. Investors echoed this sentiment, sending Google’s stock price soaring.

Balancing investment in cutting-edge AI with the profitability of its search business is a crucial task for Alphabet. To free up resources for AI development, the company has implemented layoffs across various departments. While AI presents both risks and rewards, it’s undeniably a central focus for Alphabet’s future trajectory.

Sources: MoneyWeb; Bloomberg.

Piece written by Trive Sales Trader, Kealeboga Molefe

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.