Kumba Iron Ore Ltd (JSE: KIO) has been a noteworthy player in the global iron ore market, showcasing resilience and growth amid various challenges. In 2023, the company celebrated a significant milestone as its share price surged by a fifth, marking its second consecutive year of market value expansion.

This success was fuelled by a robust operational performance in the first half of the year, where iron ore production rose by 6% to reach 18.8 Metric Tonnes (Mt), driven by production enhancements and improved efficiency across its operations. Despite facing hurdles such as rail line disruptions and cable theft affecting transportation to Saldanha Bay Port, Kumba maintained a commendable average realized price of US$106 per wet metric tonne (wmt), 4% higher than the benchmark, mitigating the impact of slightly lower sales volumes.

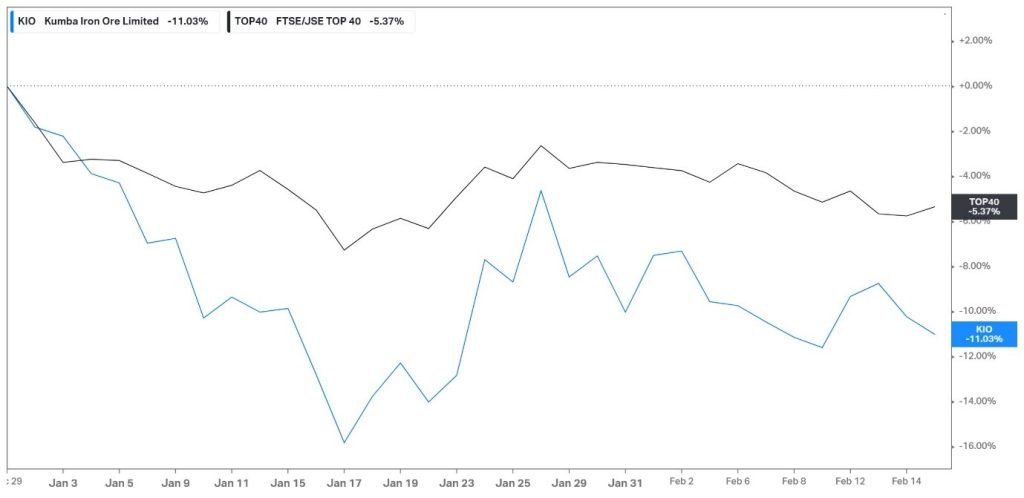

However, the onset of 2024 has brought a different narrative, with Kumba’s share price experiencing an 11% decline year-to-date, surpassing the downturn in the JSE Top 40 Index (JSE: J200). This downward trend has raised investor caution, particularly concerning factors such as decelerating Chinese economic growth, potential reductions in steel demand in China, and broader global economic fragility, alongside subdued commodity prices. With China serving as the largest importer of iron ore, its economic trajectory significantly influences Kumba’s operations and investor sentiment.

Source: Trive – Koyfin, Nkosilathi Dube

Technical

Kumba Iron Ore’s share price journey in January marked a notable departure from its previous upward trajectory, experiencing a significant 10% decline, thus ending a streak of four consecutive months of gains.

Throughout 2023, the share price exhibited a bullish trend, trading within an ascending channel pattern above the 100-day moving average. However, a breakdown below this pattern signalled a shift in momentum, with the share price succumbing to selling pressure, notably converging with the 100-day moving average.

Initially, the upward movement originated from a support level established at ZAR 416.10 per share following a decisive rejection of the level on October 5, 2023. As the Relative Strength Index (RSI) approached overbought conditions, a resistance level materialized at ZAR 637.98 per share, prompting a retracement due to heightened selling pressures. Despite the downturn, downside momentum found a temporary halt at the 50% Fibonacci Retracement level, coinciding with oversold RSI conditions and the 100-day moving average, leading to a subsequent reversal and upward movement.

A sustained upward push may see a retest of the ZAR 637.98 resistance level, while a breakdown below the 50% retracement level could signal intensified selling pressure, potentially leading to further declines. Bargain hunters could eye the 61.80% Golden Ratio or the ZAR 416.10 support level for opportune entry points amidst market volatility and shifting sentiment.

Fundamental

Kumba Iron Ore’s first half-year financial results reflect a mixed performance amid ongoing operational strength. Despite an uptick in production volumes, challenges in logistics, particularly with Transnet, led to a 4% decline in sales volumes, amounting to 18.9 million tonnes. Iron ore sales notably decreased by 7% compared to the previous year, primarily influenced by China’s economic slowdown and a subsequent dip in steel demand during the second quarter.

These factors collectively impacted Kumba’s financial metrics, with the EBITDA margin contracting by 200 basis points to 52%, while headline earnings per share experienced a notable 17% decline to ZAR 30.04. Despite these challenges, Kumba’s robust operational performance underscores its resilience amidst evolving market dynamics, positioning the company to navigate through uncertainties and capitalize on opportunities in the iron ore sector.

Source: Trive – Kumba Iron Ore Limited, Nkosilathi Dube

Kumba Iron Ore’s latest guidance reflects the ongoing challenges posed by logistics constraints, leading to adjustments in production forecasts for both 2023 and the next three years. The company anticipates ending 2023 with production between 35 – 36 million tonnes, slightly lower than the previous estimate, due to the impact of these constraints on stock levels. Sales are expected to align closely with production, ranging from 36 – 37 million tonnes. The company also foresees improved C1 unit costs over the next three years, ranging between US$38 – 40 per tonne, attributed to ongoing cost optimization initiatives.

Kumba’s strategic review aims to align production with logistics capacity, ensuring sustainability. Moreover, the company’s engagement with steel manufacturers for carbon reduction interventions underscores its commitment to environmental responsibility and market adaptability. Despite short-term challenges, Kumba maintains a positive outlook on iron ore fundamentals, poised to leverage its high-quality products in the evolving steel industry landscape.

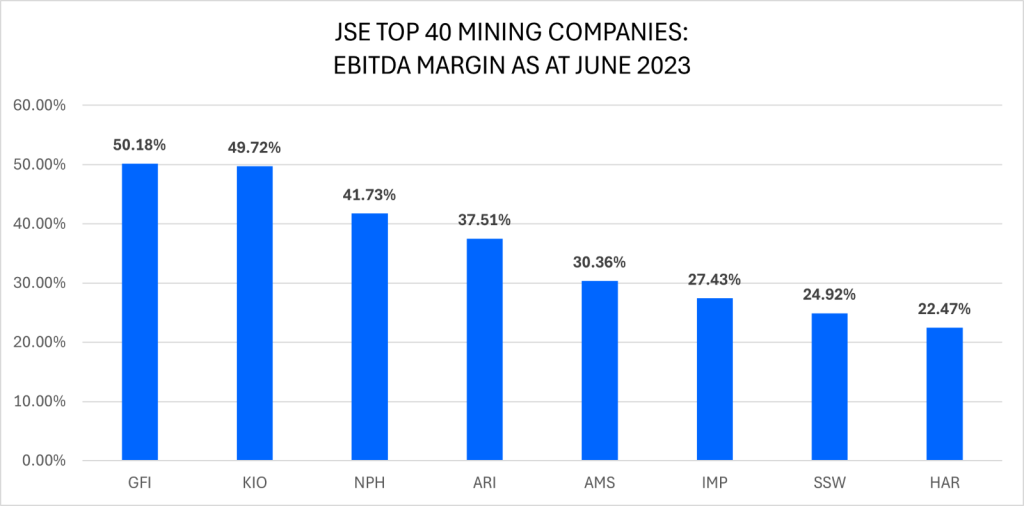

Overview of Mining Companies in the JSE Top 40 Index:

As of June 2023, Kumba Iron Ore (JSE: KIO) boasts an impressive EBITDA margin of 49.72%, positioning it as one of the top performers among the JSE Top 40 mining companies. This places Kumba Iron Ore just behind Gold Field Ltd (JSE: GFI), which leads with a slightly higher EBITDA margin of 50.18%. Kumba’s robust EBITDA margin underscores its strong operational performance and effective cost-management strategies within the mining sector, reaffirming its position as a formidable player in the market.

Source: Trive – Koyfin, Nkosilathi Dube

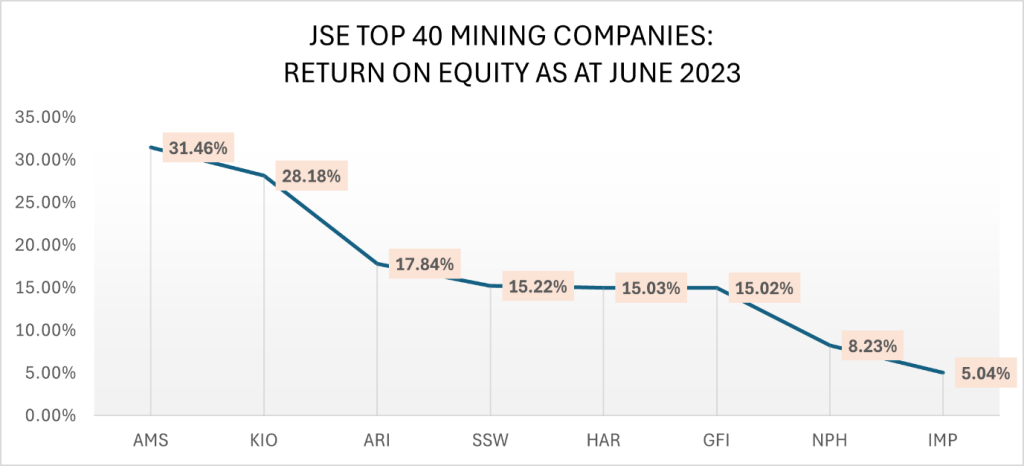

Kumba Iron Ore’s return on equity (ROE) of 28.18%, second only to Anglo American Platinum, highlights its efficient capital utilization and strong profitability. This positions Kumba as a leading investment choice in the mining sector, reflecting effective management and potential for sustained earnings growth. Its competitive advantage, indicated by its superior ROE, instils investor confidence and underscores its attractiveness for those seeking profitable opportunities. Overall, Kumba Iron Ore’s higher ROE relative to peers signals a well-managed and profitable business, making it a compelling investment prospect in the mining industry.

Source: Trive – Koyfin, Nkosilathi Dube

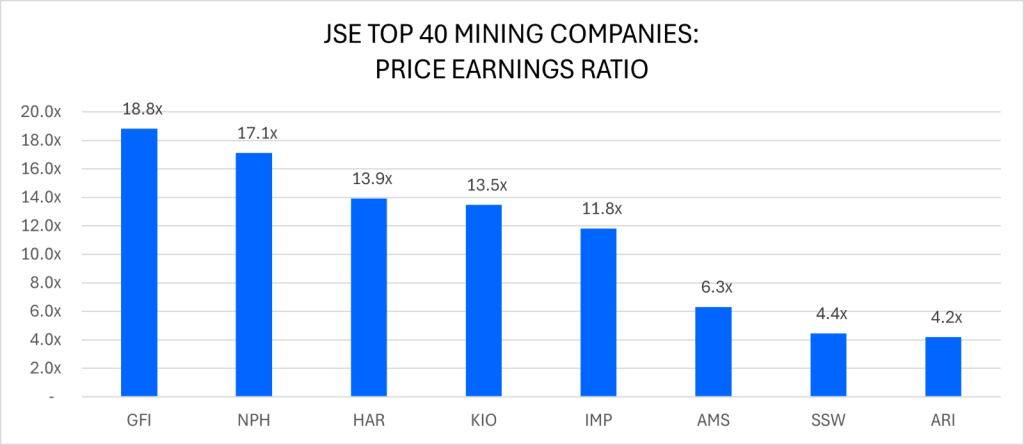

Kumba Iron Ore’s Price-to-Earnings (P/E) ratio of 13.5x exceeds the average P/E ratio of 11.3x for mining companies within the JSE Top 40 Index. This suggests that investors are willing to pay a higher premium for Kumba’s earnings compared to its industry peers. The higher P/E ratio could indicate favourable market sentiment towards Kumba, potentially driven by growth prospects, superior performance, or perceived lower risk.

Source: Trive – Koyfin, Nkosilathi Dube

Summary

Kumba Iron Ore’s resilience amid market challenges is evident through its robust operational performance and strong financial metrics, including impressive EBITDA margin, ROE, and P/E ratio. Key technical levels, like the ZAR 637.98 resistance and the 50% retracement support, offer valuable insights for investors navigating market volatility.

Sources: Kumba Iron Ore Ltd, National Bureau of Statistics of China, Reuters, Observatory for Economic Complexity, Koyfin, TradingView

Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.