Currency correlations, a cornerstone of strategic forex trading, offer valuable insights into the interconnectedness of currency pairs. This knowledge empowers traders to make informed decisions regarding diversification, hedging, and overall portfolio management.

Understanding the Correlation Spectrum

Currency correlation refers to the statistical relationship between the price movements of two forex pairs. It essentially measures the tendency of one pair to move in the same direction (positive correlation) or the opposite direction (negative correlation) as another pair. Additionally, there can be no correlation, indicating independent price movements.

The correlation coefficient, a numerical value ranging from -1 to +1, quantifies the strength of this relationship. Here’s a breakdown:

| Correlation Coefficient | Explanation | Typical Example |

| +1 | Perfect positive correlation – the pairs move in lockstep (rare in reality) | N/A |

| +0.7 to +0.9 | Strong positive correlation – the pairs tend to move together most of the time | EUR/USD and GBP/USD |

| +0.3 to +0.6 | Moderate positive correlation – the pairs sometimes move together | EUR/USD and USD/JPY |

| +0.2 to -0.2 | Little to no correlation – the pairs’ movements are independent. | USD/JPY and USD/CHF |

| -0.3 to -0.6 | Moderate negative correlation – the pairs tend to move in opposite directions, but not always. | USD/CAD to USD/JPY |

| -0.7 to -0.9 | Strong negative correlation – the pairs usually move in opposite directions | USD/CAD and EUR/USD |

| -1 | Perfect negative correlation – the pairs always move in perfect opposition (rare) | N/A |

Strategic Applications of Correlation

By analysing currency correlations, traders can employ various strategies:

- Diversification

Traditionally, diversification involves spreading investments across different asset classes. However, currency correlations allow for diversification within the forex market itself. For instance, EUR/USD and AUD/USD exhibit a positive correlation.

A trader with a bullish bias on the US dollar could buy both pairs, potentially amplifying profits if the US dollar strengthens.

- Hedging

This strategy utilises negatively correlated pairs to mitigate risk. Imagine buying EUR/USD based on positive Eurozone data but also fearing potential geopolitical tensions that could weaken the Euro.

To hedge this risk, selling USD/CHF could be implemented. If the Euro weakens against the US dollar, the Swiss Franc (CHF) is likely to strengthen, offsetting some losses in EUR/USD.

Real-World Examples

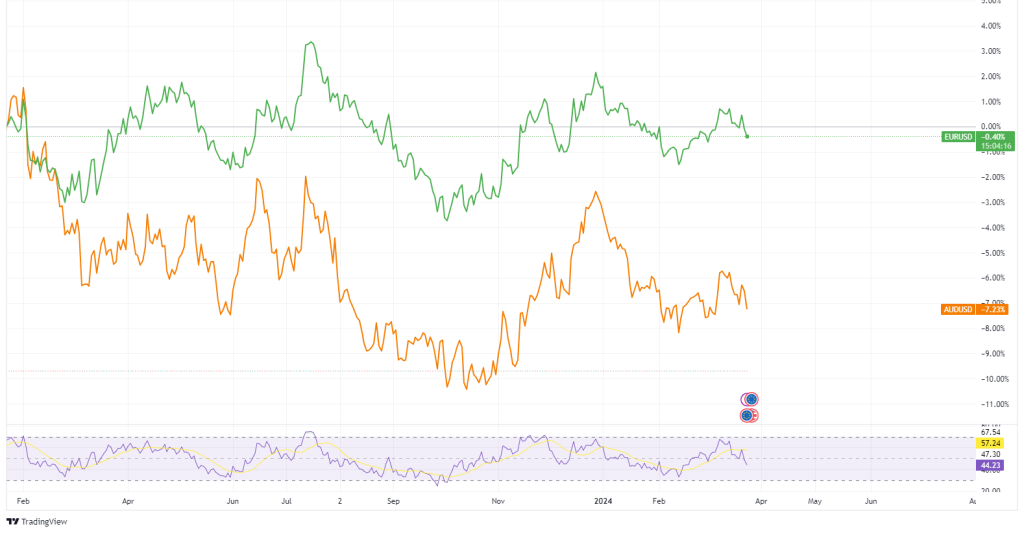

- EUR/USD and AUD/USD (Positive Correlation):

Strong economic data in the Eurozone might boost the Euro against the US dollar (EUR/USD rises). Historically, the Australian dollar (AUD) has often benefited from a stronger Euro due to its close economic ties (AUD/USD also rises).

Therefore, a trader might expect AUD/USD to also rise alongside EUR/USD. Correlation analysis allows traders to anticipate potential price movements in the second pair based on the behaviour of the first.

However, it is worth mentioning that correlation doesn’t guarantee identical movements. While EUR/USD might rise 50 pips, AUD/USD might only rise 30 pips.

.

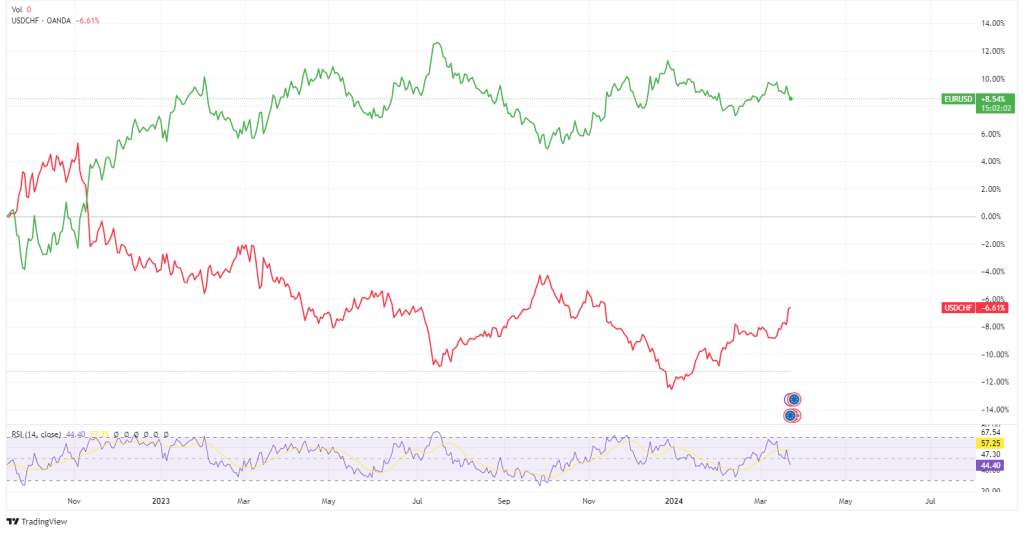

- EUR/USD and USD/CHF (Negative Correlation)

If a trader believes the US dollar will weaken due to rising interest rates in Europe, they could buy EUR/USD (expecting it to rise) and hedge by selling USD/CHF (expecting it to fall as the US dollar weakens).

This way, if the initial assumption about the US dollar is wrong, the gains in USD/CHF could help offset any losses in EUR/USD.

The Evolving Landscape of Correlations

Currency pair correlation is a valuable tool for forex traders, offering insights into market dynamics and potential trading opportunities. However, currency correlations are also dynamic and can fluctuate based on various factors like economic data releases, political events, and central bank interventions. Regular monitoring of correlations using tools and resources offered by forex brokers is essential to ensure trading strategies remain effective.

Conclusion

Understanding currency correlations empowers traders to navigate the complexities of the forex market with greater strategic direction. By incorporating correlation analysis into trading strategies, traders can potentially improve diversification, implement effective hedging techniques, and ultimately enhance their overall risk management.

So, the next time you analyse currency pairs, consider the correlation between them—it could be the key to unlocking profitable opportunities in your trading journey.

Sources: TradingView, Investopedia, Emory University, ScienceDirect.

Piece written by Mfanafuthi Mhlongo, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.