The Foschini Group Limited (JSE: TFG) has experienced a remarkable surge of nearly 11% in the past few days following an optimistic trading update for the third quarter of the 2024 fiscal year. Notably, the group’s turnover exhibited a 4.5% increase compared to the same quarter last year and a robust 9% expansion for the nine months ending on December 30, 2023.

This growth is particularly noteworthy given the challenges faced in all operational territories, spanning Africa, London, and Australia. The impressive performance stands out, especially considering the tough comparison with the exceptionally strong post-Covid-19 recovery witnessed last year. Now, the question arises: could this be the catalyst the company needed to spark a positive upswing in its share price, especially considering the 2.36% dip in the initial weeks of the year?

Technical

On the daily chart, the recent surge initiated a breakout from the descending channel, with the share price breaching the 50-SMA (blue line) in a potential signal of a bullish momentum shift. However, the 61.8% Fibonacci golden ratio at R109.90 resisted the optimism, opening the potential for a pullback and retest in the upcoming sessions.

If this resistance continues to hold, the price could look for confirmation of the bullish break at R107.03, the Fibonacci midpoint. If buyers are found here, the momentum could push the price above the R111.36 resistance toward R115.40. This resistance has proven challenging in previous sessions and could act as a pivot point for a bearish rebound. However, if the price clears, it could converge with R119.23 in the coming weeks.

In the case that the support at R107.03 fails to initiate the uptrend, the price could reverse all of its gains to look for support at R103.64. The 100-SMA (orange line) could provide buyers at this level, but an additional leg lower could be detrimental to the share price, which may then have to look for support at the demand zone near R100.36.

Fundamental

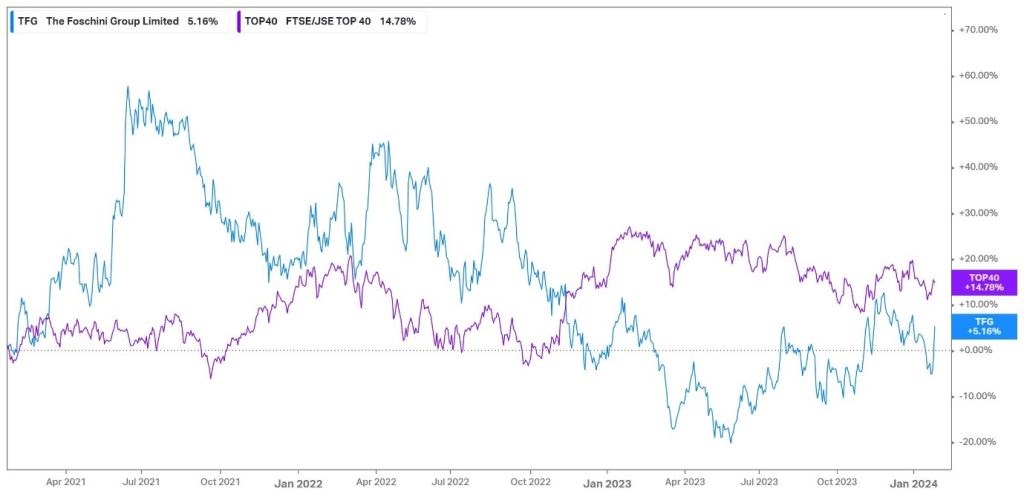

The Foschini Group has been navigating multiple headwinds over the last few years, particularly in South Africa, where continued load-shedding and port delays impacted its results materially. In addition, high inflation and rising interest rates have strained consumers’ spending power, resulting in a pullback in purchasing volumes and presenting a further headwind to the company. As a result, it has largely underperformed the JSE Top 40 Index with a mere 5.16% expansion over the last three years, less than half of the top 40’s 14.78%. However, with inflation seemingly reaching a peak and central banks globally shifting toward monetary easing, the headwinds may fade as we head into a fresh year.

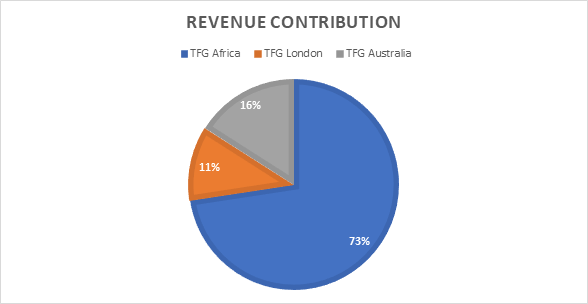

The chart below shows that Africa is by far the group’s largest revenue contributor. In the latest quarter, revenue from this segment grew by 5.1%, reflecting 0.7% like-for-like growth. For the first nine months of the fiscal year, turnover in this segment grew by 11.7%. Its cash turnover, which now comprises 75.8% of the TFG Africa segment and 84.2% of the group’s turnover, increased by 6.6% in the quarter. As previously mentioned, this region, especially in South Africa, has been heavily affected by load shedding and logistical issues at ports, impeding the general planned flow of inventory. As a result, the group was forced to increase volumes from its local manufacturing to offset the delays. Furthermore, the turnover in this region was affected by a slower-than-anticipated Black Friday period, which was slightly offset by strong festive season sales. Its other segments, namely TFG London and TFG Australia, suffered declines in turnover of 3% and 7.3%, respectively, but faced tougher comparisons from a successful COVID-19 recovery in the prior period.

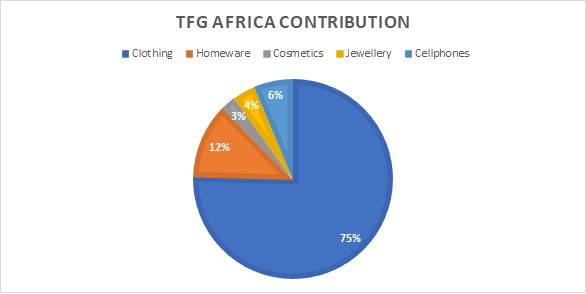

In its largest segment (TFG Africa), clothing and homeware are the main revenue drivers, together accounting for over 87% of the segment’s revenue. In the latest quarter, these segments expanded by 6.4% and 0.9%, respectively, offsetting the 2.6% decline in jewellery turnover. Cell phones and cosmetics both advanced by 3.4%, rounding off solid performance across all of its operations. For the first nine months of the year, its homeware sales growth of 30.8% stands out, although it is non-comparable due to the acquisition of Tapestry Home Brands.

It is worth noting that the company’s online sales have rocketed by 44.8% for the third quarter of 2024 and now contribute 4.2% of the turnover in the TFG Africa segment. The consolidation of all of the TFG Africa retail brands on the number one South African fashion shopping app, Bash, has turned out to be successful, driving its reach in the online shopping market. Further aiding its growth was the opening of 42 new stores during the quarter, bringing its total count to 3,633 at the end of December 2023. The combination of growth in its online presence with the opening of new physical stores shows the company’s capacity for growth as it continues to expand its operations. This has further aided in recovering the company’s gross margin, which suffered from increasing promotional activity in the first half of the 2024 fiscal year as it was required to clear excess inventory due to load shedding’s impact. Compared to December 2022, inventory levels have declined by 11.6%, a promising sign of consumer demand, which could aid its bottom line as we advance, as promotional activity could ease.

Summary

The Foschini Group has been facing numerous headwinds, especially in its South African operations, that have weighed heavily on its operations in the first half of its 2024 fiscal year. However, its latest quarterly update showed promising signs that these headwinds may ease in the upcoming months. Strong performance in its TFG Africa segment was well met by investors, and its continuous growth in online sales, combined with the opening of numerous new stores, presents opportunities to increase its capacity for growth once the challenging macroeconomic conditions start to normalise.

Sources: Koyfin, Tradingview, Reuters, Moneyweb, The Foschini Group Limited

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.