Following a volatile Tuesday session, the USDCNH currency pair seems to have charted its course in anticipation of the upcoming Federal Reserve interest rate decision. During Tuesday’s developments, US inflation dipped slightly from 3.2% to 3.1%, aligning with expectations. Core inflation remained steady at 4%, presenting no surprises. Initially retreating, the dollar rebounded as supercore inflation, reflecting service costs excluding energy and housing, indicated resilience in certain underlying metrics.

Meanwhile, in China, the Central Economic Work Conference (CEWC) disappointed the market by lacking substantial stimulus measures to bolster demand, placing pressure on the Chinese Yuan. Looking forward, Jerome Powell’s remarks following the interest rate decision may hold the key to whether market-predicted rate cuts will materialize on schedule, potentially influencing further directional shifts in price action.

Technical

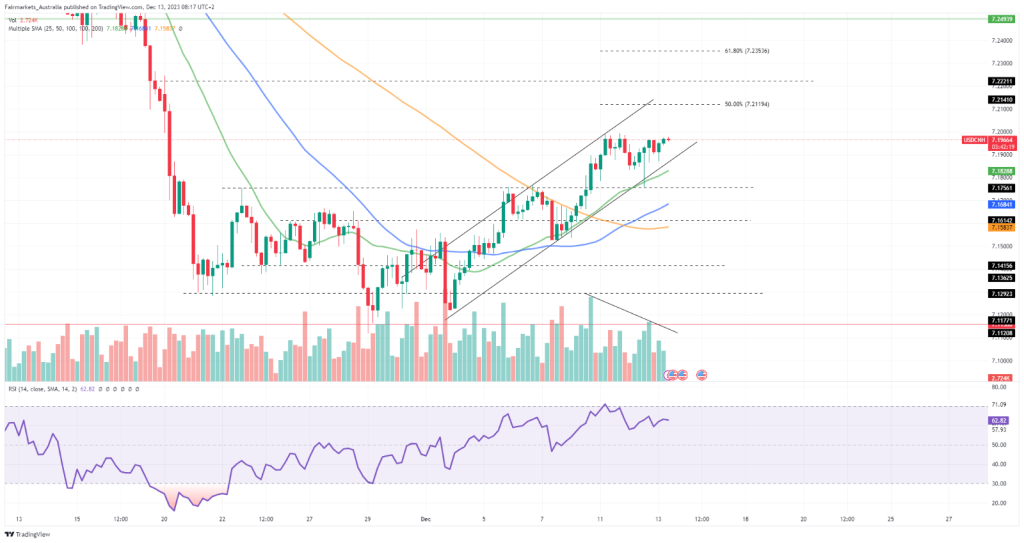

On the 4H chart, an ascending channel remains in play, with the bullish momentum confirmed by the crossing of both the 50-SMA (blue line) and 25-SMA (green line) above the longer-term 100-SMA (orange line). However, with volumes declining and a crucial resistance level approaching, the action is far from over.

The next hurdle to the bullish momentum is the Fibonacci midpoint at 7.2119. At this point, a pullback could occur for a continuation of the channel formation. However, a breakout could result in a steeper uptrend, where higher resistance is established at 7.2221 and 7.2354, the 61.8% Fibonacci golden ratio.

Should the 7.2119 resistance hold, a pullback could see the pair test the dynamic support of the channel close to the 25-SMA at 7.1829. A breakdown below 7.1756 could signal confirmation of the breakdown, bringing the 50-SMA support at 7.1685 into play in the upcoming sessions.

Summary

The USDCNH currency pair is currently engaged in a strong uptrend within an ascending channel formation. The Fibonacci midpoint at 7.2119 could be crucial in the upcoming sessions to determine the sustainability of the current momentum.

Sources: Koyfin, Tradingview

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.