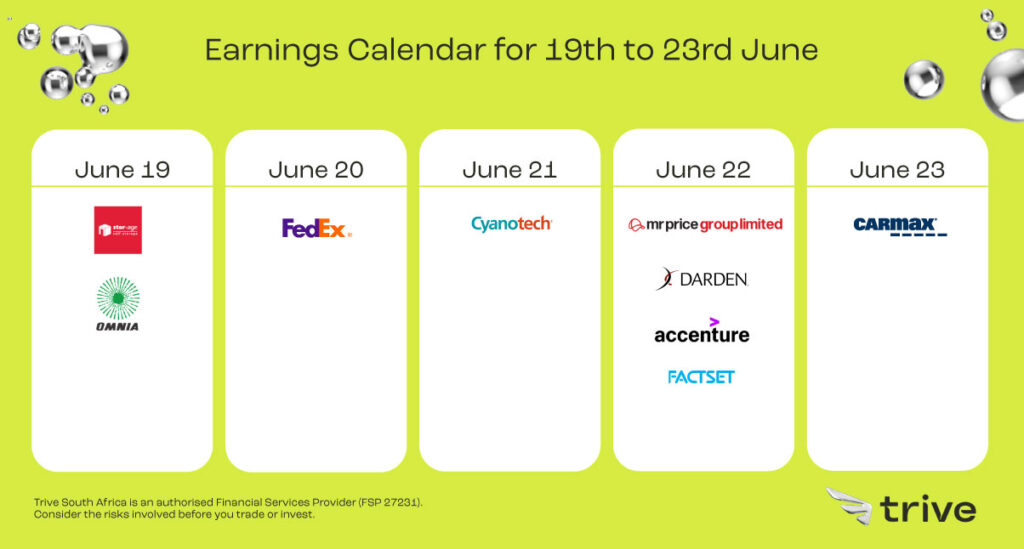

investors should keep a close eye this week as notable companies, including FedEx, Mr Price Group Limited, and Stor-Age Property REIT, gear up to unveil their earnings reports.

Update 26 June

Assessing FedEx’s Q4 Report and ECB’s Interest Rate Decision

This week we dive into the captivating realm of global logistics champion FedEx and the game-changing decisions of the European Central Bank (ECB).

The European Central Bank (ECB) made a widely anticipated move during its June meeting by raising interest rates by 25 basis points. This marked the eighth consecutive rate hike as the ECB aimed to address inflation rates that have consistently exceeded their target of 2%. In line with expectations, consumer price inflation in the euro area for May was confirmed at 6.1%, reaching its lowest level since February 2022. The decline in inflation was primarily driven by a decrease in energy prices, which experienced a 1.8% drop following a 2.3% increase in April.

The latest data also revealed a slowdown in cost pressures across various components of inflation. Prices for food, alcohol, and tobacco saw a modest easing, with the increase decreasing from 13.5% to 12.5%. Non-energy industrial goods experienced a similar trend, with inflation slipping from 6.2% to 5.8%. Additionally, the services sector witnessed a marginal slowdown, with inflation decreasing from 5.2% to 5.0%.

Furthermore, the core inflation rate, which excludes volatile items such as food and energy, also showed signs of moderation. Core inflation eased to 5.3% in May, marking its lowest level since January.

In light of these developments, the ECB’s decision to raise interest rates aligns with its goal of maintaining price stability and addressing inflationary pressures.

Stor-Age Property REIT Ltd (JSE: SSS)

The group showcased a resilient performance across its portfolios in South Africa (SA) and the UK, demonstrating significant year-on-year improvements in key metrics. Despite facing macroeconomic challenges, the group sustained positive momentum in occupancies and experienced growth in average rental rates throughout the year. In SA, same-store rental income rose by 9.8%, while in the UK, it increased by 8.9%. Decreased move-outs and higher average rental rates primarily drove these increases. The occupancy rate closed at 92.2% in SA and 85.4% in the UK. Moreover, the closing rental rate saw a year-on-year increase of 8.3% in SA and 6.2% in the UK.

Looking ahead, the group’s pipeline of projects is promising. Two joint venture developments, one in the UK and one in SA, began trading shortly after the end of the year. Additionally, the group has scheduled the completion of six more developments, three in each geography, during FY24. The group has also acquired the four-property Easistore portfolio in the UK, valued at £82.0 million, in a joint venture with Nuveen Real Estate.

FedEx Corp (NYSE: FDX)

FedEx (FDX) recently released its late Q4 report for the 2023 fiscal year, revealing mixed results. The company reported a 28% drop in earnings to $4.94 per share, while revenue fell by 10.2% to $21.9 billion. Analysts had expected earnings to decline to $4.85 per share on $22.55 billion in sales. Net income for the quarter was $1.25 billion, down from $1.8 billion in the same period the previous year.

In April, FedEx announced its ‘DRIVE’ initiative, which aims to consolidate its operating companies, including FedEx Express, FedEx Ground, and FedEx Services, into a single entity called the Federal Express Corporation under the FedEx brand. The company expects ‘DRIVE’ to result in $4 billion in permanent cost reductions by 2025, following the full implementation of the transition in June 2024.

According to a note from Raymond James, the ‘DRIVE’ initiative is expected to drive improved margins, earnings, and free cash flow in the coming years. The focus on cost reduction, capital allocation, and a shareholder-friendly capital return program is anticipated to enhance returns for FedEx.

In addition to the DRIVE initiative, FedEx announced the retirement of Executive Vice President and CFO Michael Lenz, effective July 31. The company is actively searching for a successor to fill Lenz’s role, ensuring a seamless transition. Lenz will continue to be an integral part of the company until the end of the year, playing a pivotal role in facilitating the smooth handover of responsibilities.

Sources: WallStreet Journal, Bloomberg, FedEx Corp

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.