Absa Group Limited (JSE: ABG) reported an increase in half-year profit in its August interim report, reflecting its dominant positioning in the domestic financial sector. Absa is among the top five private banks in South Africa and is well known for having a well-capitalized balance sheet while maintaining conservative lending practices to minimize its balance sheet risk. However, despite this, the high interest rate environment due to elevated inflation levels has strained banks’ loan books, creating an industry-wide headwind for the second half of the year.

Total income for the interim period ended 30 June 2023 was up 13% at R52.31Bn, resulting in a 7% expansion in profit from R11.79Bn to R12.59Bn. Profit attributable to its ordinary equity holders similarly advanced 5% to R11.24Bn, resulting in basic earnings per share (EPS) of R13.31, a 5% increase from the prior period’s R12.69. Offsetting the company’s benefit from higher interest rates in the form of net interest income expansion was a 60% incline in credit impairment charges, a worrying sign for the company, with headline earnings showing a mere 2% expansion to R11.16Bn.

Technical

On the 1D chart, a descending triangle has emerged, with the share price testing the dynamic resistance in an attempt to prevent the triangle breakdown. However, the 50-SMA (blue line) offers additional resistance at R179.00, with the 200-SMA resistance (orange line) at R180.45 not far above. However, the 25-SMA (green line) provides support close to the 38.2% Fibonacci retracement from the early August peak at R175.59.

If the dynamic resistance holds, the share price could continue within the triangle pattern, where a breakdown at R175.59 could lead the price to the Fibonacci midpoint of R171.30. Psychological support at the bottom of the triangle around R169.04 could prevent additional downside, but a breakdown could result in the emergence of a stronger downtrend. In this case, the 61.8% Fibonacci golden ratio is the first level of support at R167.02, before lower support at R164.59 and R161.06 can come into play in the longer term.

However, should the price break through the triangle resistance, a leg above the 200-SMA could confirm the breakout, bringing resistance at R182.18 into play. The estimated fair value of R189.04 is not far out of reach at this point, presenting a 6% potential upside from current levels.

Fundamental

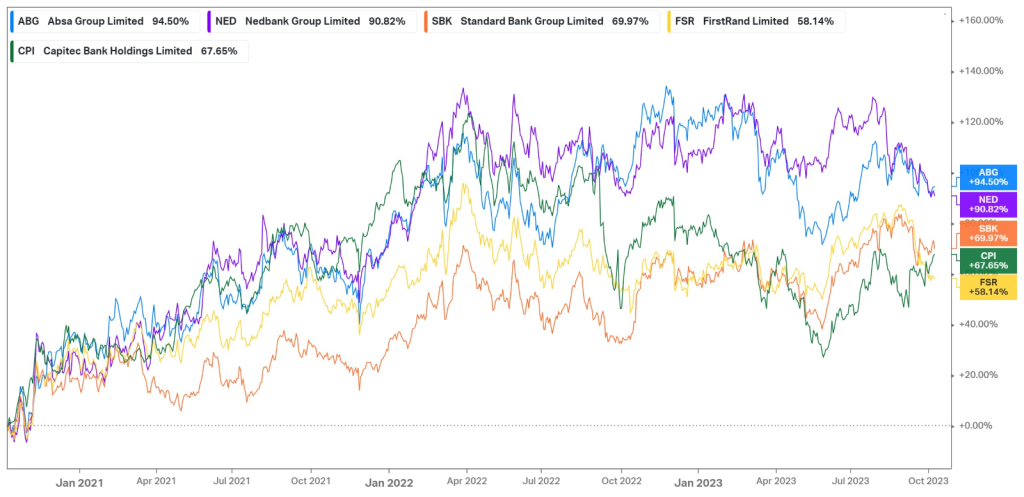

Over the past three years, Absa has stood out as the top performer among its industry peers, with an impressive 94.5% price appreciation. The group serves over 11.8M customers while holding over 20% of the market share of assets in South Africa. With 3.5M digitally active customers, the company boasts an R142.3Bn market capitalization and has firmly established itself as one of the most popular banks in the continent. Nedbank has provided the most competition in terms of price return with a 90.82% expansion, with these two banks leading the pack as Standard Bank and Capitec lag behind with returns of 69.97% and 67.65%, respectively, over the same period. The question, however, is whether these returns can be maintained as the macroeconomic conditions have slightly shifted, resulting in a pullback in recent months.

In its latest interim report, Absa’s top line benefitted from higher interest rates, as its net interest income grew 16% from R28.56Bn to R33.01Bn. Non-interest income also performed well, rising 8% from R17.82Bn to R19.30Bn. Within its non-interest operations, insurance revenue advanced 5% to R5.83Bn, while its gains from banking and trading activities were up a further 8% at R4.39Bn. Fee and commission income advanced a mere 2% toward R13.75Bn, rounding off a solid top-line report.

However, a 60% rise in credit impairment charges from R5.18Bn to R8.28Bn offset the revenue increases and chipped away at its profitability. This resulted from the higher interest rate environment and elevated inflation levels that have rapidly increased the cost of living for consumers in its SA retail portfolio. So, can Absa afford to keep bearing the brunt of increased delinquencies as we advance, considering the lack of optimism around a pivot in the current macroeconomic environment?

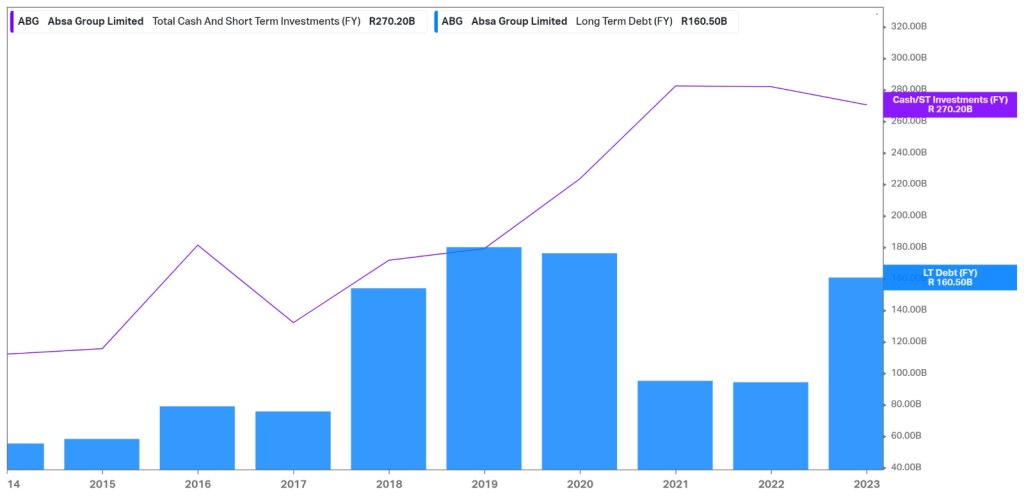

Firstly, the company’s balance sheet looks healthy, as it holds long-term debt of only R160.50Bn, almost half of its available R270.20Bn cash and short-term investments. Therefore, the bank has a lot of liquidity, showing positive signs of its ability to service its debt and meet its interest obligations.

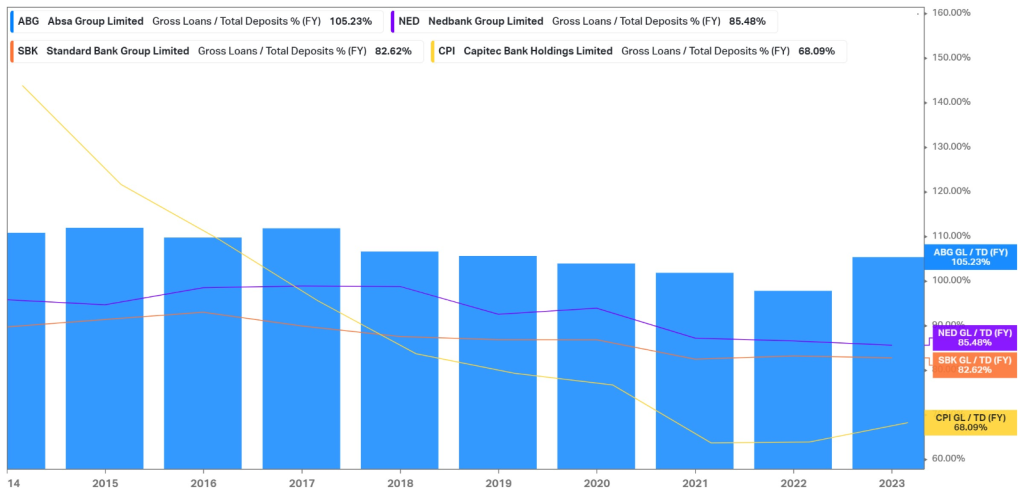

However, a concern to the company’s liquidity position is its elevated level of gross loans to total deposits, as shown in the graph below. This high ratio could suggest that most of its deposit inflows are used to generate interest income, leaving fewer deposits on its balance sheet to service this debt. However, with its healthy cash and short-term investments, the company can afford a higher ratio in order to maximize its top-line potential while maintaining lower balance sheet risk.

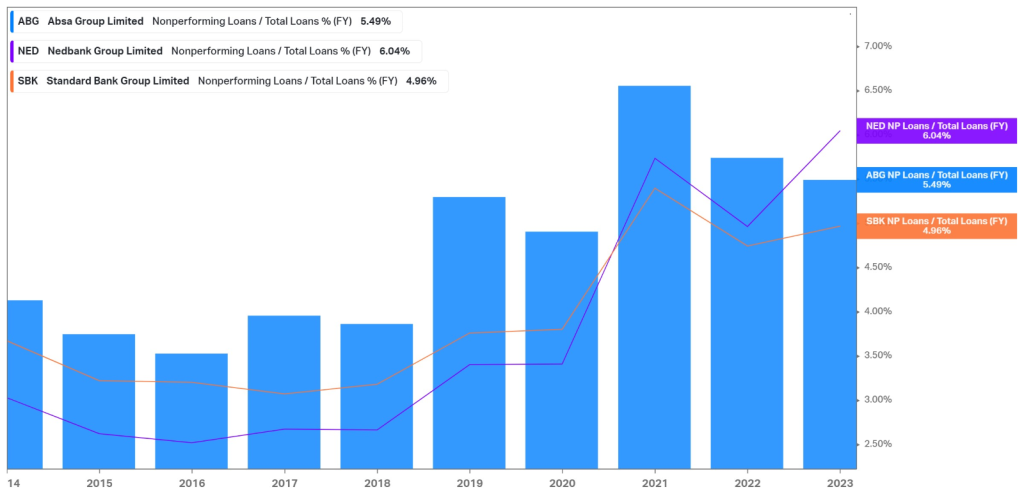

This fact is further exaggerated in the graph below, showing a comparison of the percentage of non-performing loans in its loan book. With a higher proportion of its deposits going toward loan issuance, Absa only has a 5.49% non-performing loan ratio, which is well within the industry range compared to other major banks. Due to the current economic conditions weighing on the consumer’s ability to repay its debt obligations, this ratio has slightly increased over the past year for both Standard Bank and Nedbank, while Absa has bucked the trend with a notable decline in non-performing loans, perhaps reflecting its conservative lending requirements.

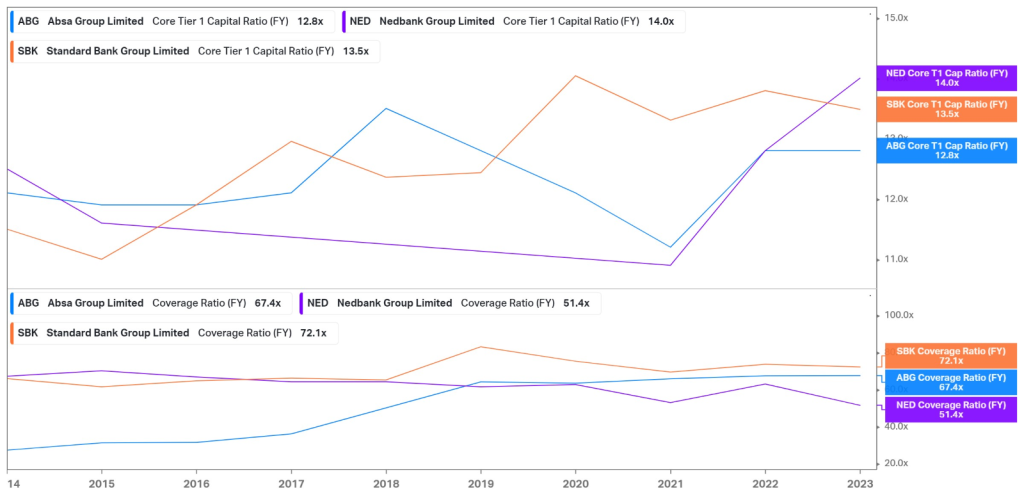

In addition to its healthy cash position and non-performing loan ratio, Absa’s core tier 1 capital ratio of 12.8x showcases a healthy ratio of equity, capital, and disclosed reserves relative to its risk-weighted assets. While slightly below the ratio obtained by Nedbank and Standard Bank, as seen below, this ratio remains well above the regulatory requirements and the board’s target range. Similarly, its coverage ratio further confirms the company’s ability to meet its financial obligations and service its debt, as it generates healthy operating income compared to its debt position.

Summary

Absa Group Limited has been the best-performing domestic private bank in terms of share price appreciation over the last three years. The company operates with a higher loan-to-deposit ratio, allowing it to take advantage of the higher interest rates in its ability to generate net interest income. While maintaining healthy liquidity with a large base of current assets, the bank has shown a resilient ability to service its debt and meet its financial obligations while expanding its top-line performance. With an estimated fair value of R189.04, the share price currently offers a 6% potential upside if the price can escape a breakdown from the descending triangle.

Sources: Koyfin, Tradingview, Reuters, Absa Group Limited

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.