Imagine a world without iconic sportswear brands like Nike and Adidas. Unthinkable, right? These two global giants have not only revolutionized athletic footwear and apparel but have also become cultural symbols.

Brief History And Growth Of The Brands:

Adidas, the elder statesman, traces its lineage back to Germany in 1924 when two brothers, Adolf and Rudolf Dassler, founded the “Dassler Brothers Shoe Factory”. However, sibling rivalry led to a split, and each brother set up his own empire. Adolf’s “Adidas” emerged, while Rudolf’s “Puma” became a fierce competitor.

In contrast, Nike sprinted onto the scene in 1964 and started as “Blue Ribbon Sports” in the USA, created by the dynamic duo of Bill Bowerman and Phil Knight. Bowerman, a renowned athletics coach, and Knight, a former student, formed the global giant, which quickly morphed into Nike, Inc., in 1971.

With a relentless focus on innovation, Nike rose to become the world’s largest athletic shoe and apparel manufacturer, symbolized by its iconic “Swoosh” logo.

Fun fact: Bowerman and Knight’s initial stake was 50-50, later evolving into 51-49, with Knight holding the slight majority.

Presence In The Market:

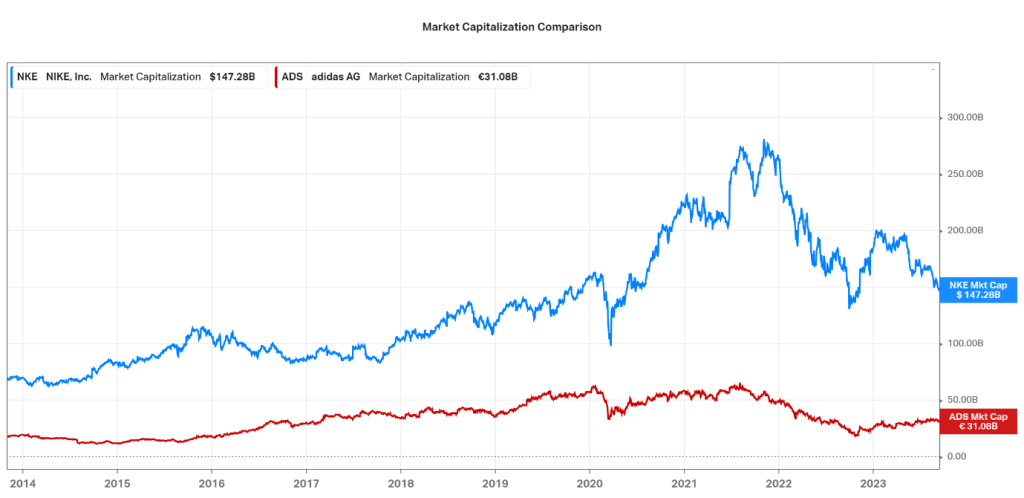

Market Capitalization: As of 10 October 2023, Nike boasts a staggering market capitalization of over $147.28 billion (~€138.14 billion), dwarfing Adidas with a market capitalization of around €31.08 billion (~$33.14 billion). Nike’s dominance is particularly evident in its home market, North America, which contributes around 41% of its total revenue, while Adidas garners only 25% from this region.

Global Reach: It is worth mentioning that both brands have been very successful in branching into regions outside their domicile and have achieved a remarkable global reach. Nike, with its “Just Do It” ethos, mainly targets the domestic market but has a strong international presence.

Adidas, on the other hand, predominantly focuses on the European market but has also made substantial inroads into other regions. The battle for market share is global, with both companies vying for supremacy.

The Brands’ Business Models:

Both brands have crafted unique business models. Nike focuses on innovation, consistently pushing the envelope with products that scream, “Just Do It.” With over 770 products, they cater to all genders and sports enthusiasts.

On the flip side, Adidas’ ability to cater to diverse customer needs sets them apart. Offering a staggering 1830+ products, they take pride in the meticulous design, especially for men, but still provide a comprehensive range for women and are a worthy adversary with a slightly different approach.

The Cool Factor:

The “Cool Factor” is essential in the world of sportswear. Nike’s iconic “Just Do It” tagline, born in 1988, has become a cultural phenomenon and a symbol of motivation. Its origins trace back to death row inmate Gary Gilmore’s infamous last words, “Let’s do it.”

Adidas counters with “Impossible is nothing,” conveying their belief in conquering challenges. In 2019, Adidas unveiled “Creating the New,” a testament to their dedication to innovation.

Nike appeals to those who strive to “Just Do It,” while Adidas targets the creators of tomorrow.

Financial Snapshot:

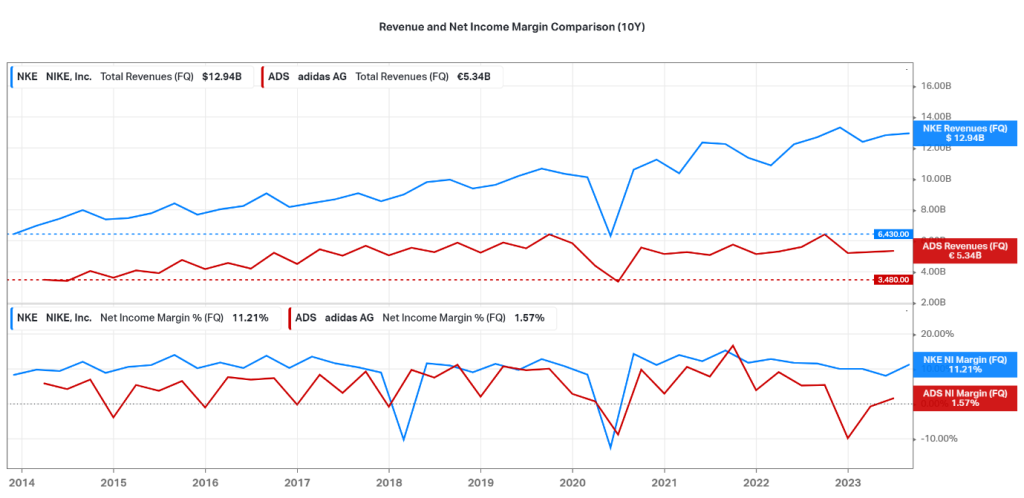

In the most recent quarter, Nike reported revenue of $12.94 billion (~€11.93 billion), a significant increase from $6.43 billion a decade ago. The net income margin has also improved from 8.3% to 11.21%. In contrast, Adidas reported revenue of approximately €5.34 billion (~$5.83 billion) in the past quarter, showing modest growth from about €5.05 billion (~$4.80 billion) ten years ago. However, Adidas’ net income margin decreased from 5.86% to 1.57% over the same period.

Nike has also outperformed Adidas in terms of share performance over the past decade. Nike’s share price has increased by 175.70% over the past ten years, while Adidas’ share price has increased by 107.08%.

However, it is important to note that Adidas’ stock price has underperformed the Nasdaq 100 Index (black line) and the S&P 500 Index (green line) over the past ten years. The Nasdaq 100 Index has returned 368.28% over the past ten years, while the S&P 500 Index has returned 161.90%.

Overall, Nike has outperformed Adidas in terms of financial performance over the past ten years. Also, Adidas’ stock price has underperformed the Nasdaq 100 Index and the S&P 500 Index over the past ten years.

Sports Sponsorships:

Both Nike and Adidas understand the allure of sports sponsorships. Nike has an impressive roster of athletes, including British long-distance runner Mo Farah, golf legend Tiger Woods, football sensation Cristiano Ronaldo, Brazilian soccer player Roberto Firmino and the iconic basketball legend Michael Jordan.

Adidas counters with stars like Argentinian soccer maestro Lionel Messi, American footballer Von Miller, French soccer player Paul Pogba, English golfer Justin Rose, and Canadian hockey hero Sidney Crosby. These sponsorships help both brands create a compelling public image and attract a dedicated fanbase.

Future Plans:

The battle between Nike and Adidas is far from over. Both brands continue to innovate and expand into new markets. Nike’s digital marketplace is a testament to its commitment to growth. Meanwhile, Adidas is poised to capitalize on its strong presence in Europe and other regions.

Conclusion:

In the world of athletic giants, Nike and Adidas stand tall, each with its unique strengths and strategies. Nike’s relentless innovation and iconic branding make it a formidable force, while Adidas’ ability to cater to diverse markets and its European stronghold should not be underestimated.

The rivalry continues, and as consumers, we can only look forward to more groundbreaking products and thrilling marketing campaigns from these legendary brands. So, which side are you on in the Nike vs. Adidas showdown? It’s not just a matter of sportswear; it’s a cultural statement.

Sources: KoyFin, Business Outreach, Stock News, Startup Talky, Statistica, Seeking Alpha, World Finance, Medium, Newswire.

Piece written by Mfanafuthi Mhlongo, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.