Pan African Resources PLC (JSE: PAN) has emerged as a standout performer on the Johannesburg Stock Exchange (JSE), with its share price marking an impressive 25% year-to-date gain. This substantial uptick reflects a sustained positive trajectory, following a trend set in 2023.

Bolstering investor sentiment is the company’s robust half-year results, which showcased a remarkable 46.1% surge in half-year earnings per share (HEPs), alongside a 6.7% uptick in production and a staggering 130% increase in cash generation. Notably, Pan African Resources has enjoyed four consecutive weeks of share price gains since the release of its stellar results.

This commendable outcome is attributed to the company’s focus on operational efficiencies and stringent cost management practices, reinforcing investor confidence in its growth prospects. With a promising outlook, the Group remains well positioned to meet its 2024 production guidance of 180,000oz to 190,000oz of gold, with potential for upward revisions. This stellar performance has surpassed benchmarks like the JSE Top 40 Index, underscoring investor confidence in Pan African Resources’ resilience and strategic direction.

Source: Trive – TradingView, Nkosilathi Dube

Technical

Pan African Resources’ share price demonstrates a compelling upward trajectory, supported by technical indicators signalling a bullish market sentiment.

Notably, the share price’s consistent trading above the 100-day moving average validates this uptrend, highlighting sustained investor interest. The formation of an ascending channel pattern further accentuates this trend, with recent upward momentum driving the share price beyond the pattern’s confines to the upside, indicating increased bullish sentiment.

A significant milestone was reached last week as the share price surpassed a three-year high, underscoring the strength of the ongoing uptrend. This surge in momentum, initiated from the R3.97 per share level following the release of upbeat half-year results, has established a notable support level, enhancing the stock’s resilience to potential downturns.

Looking ahead, the R5.47 per share resistance level, formed in January 2021, presents a key hurdle for further gains. However, with the bullish momentum intact, the share price may target the R5.47 per share level. Conversely, given the prevailing overbought RSI condition, in the event of a market correction, the R3.97 per share level is likely to serve as a strong support, attracting bargain hunters and limiting downside potential. Overall, market sentiment remains positive, suggesting continued optimism surrounding Pan African Resources’ price action.

Fundamental

Pan African Resources’ half-year results showcase a robust performance underpinned by key drivers and strategic initiatives that have propelled the company forward amidst challenging market conditions.

The notable increase in gold sold volumes by 8.9% to 98,458 ounces reflects the company’s operational efficiency and ability to capitalize on favourable market conditions. This surge in production has contributed significantly to the impressive 46.7% rise in profit for the period, reaching US$42.4 million, and a remarkable 134.5% surge in net cash from operating activities, totalling US$27.2 million.

Several factors have driven these exceptional results. Firstly, the company’s focus on increasing gold production has yielded positive outcomes, with a 6.7% increase in gold production compared to the previous year’s corresponding period. Despite inflationary pressures, Pan African Resources has managed to maintain steady production costs, resulting in a slight reduction in all-in-sustaining costs (AISC) to $1,287 per ounce.

Furthermore, the company has benefitted from higher gold prices realized during the period, with a significant 14% jump to $1,961 per ounce. This favourable pricing environment has bolstered revenue and profitability, enhancing shareholder value.

Looking ahead, Pan African Resources remains committed to driving growth through ongoing projects and strategic initiatives. The Mogale Tailings Retreatment (MTR) project, expected to achieve steady-state production by December 2024, is poised to deliver incremental annual production of approximately 50,000 ounces at an expected cost per ounce of approximately US$900 over the 20-year life-of-mine (LoM). Additionally, the Evander Mines Expansion Project, slated for completion in 2024, is set to enhance production efficiencies and output, further strengthening the company’s competitive position.

Moreover, the commissioning of solar plants and exploration efforts in Sudan underscore Pan African Resources’ commitment to sustainability and resource expansion. These initiatives not only mitigate costs but also position the company for long-term growth and value creation.

Source: Trive – Koyfin, Nkosilathi Dube

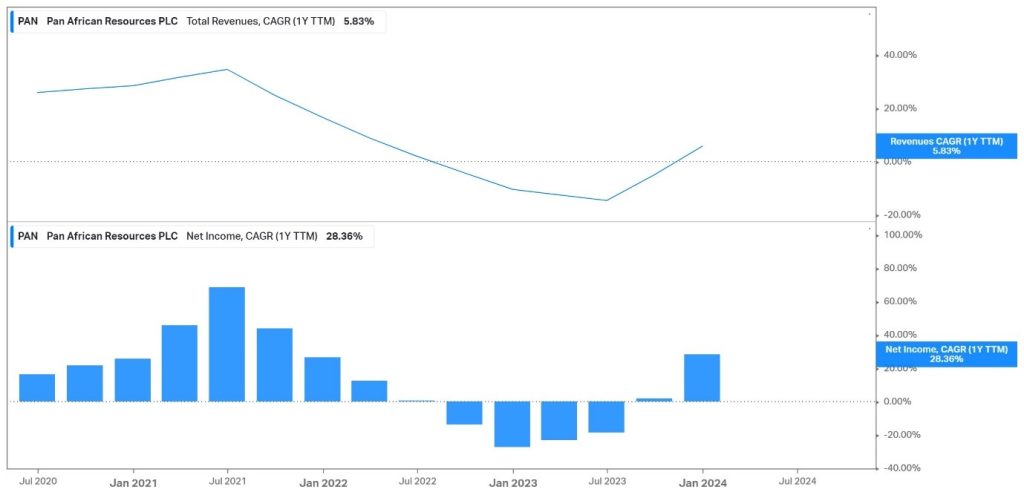

Pan African Resources has successfully rebounded from a challenging period experienced a year ago. Initially, the company faced difficulties stemming from rising costs, driven by global inflationary pressures affecting gold producers. Additionally, declining gold prices throughout much of 2022 further exacerbated the company’s financial and operational challenges. Consequently, Pan African Resources witnessed a slump in both revenue and net income compounded annual growth rates (CAGRs) during this period.

However, the company’s fortunes have taken a positive turn with the resurgence of gold prices, increased production, and declining inflation rates. Pan African Resources now boasts impressive CAGRs of 5.83% for revenue and 28.36% for net income over the latest twelve-month period. This remarkable turnaround reflects the company’s resilience and ability to adapt to changing market conditions, positioning it for sustained growth and profitability in the future.

Source: Trive – Koyfin, Nkosilathi Dube

Pan African Resources demonstrates a robust EBITDA margin of 40.06% on a latest twelve-month basis, significantly surpassing the average EBITDA margin of 24.50% among prominent JSE-listed gold miners. This high EBITDA margin underscores Pan African Resources’ efficiency in generating earnings before interest, taxes, depreciation, and amortization relative to its revenue. It indicates strong operational performance and effective cost management, positioning the company favourably within the gold mining sector. This exceptional margin suggests that Pan African Resources may be more adept at converting its revenue into operating profits compared to its industry peers, highlighting its competitive advantage and financial strength.

Source: Trive – Koyfin, Nkosilathi Dube

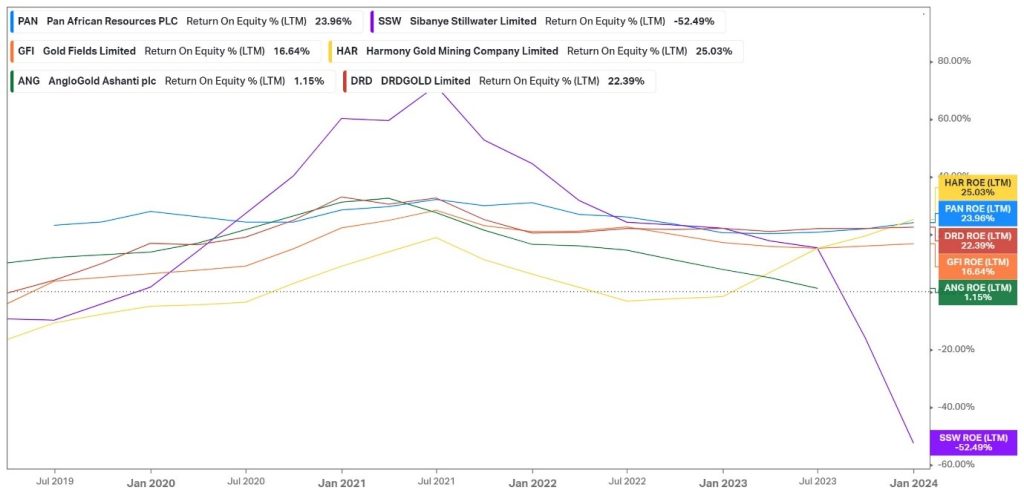

Pan African Resources exhibits a remarkable return on equity (ROE) of 23.96% on a latest twelve-month basis, far exceeding the average ROE of 6.11% among prominent JSE-listed gold miners. This signifies the company’s exceptional ability to generate profits from shareholders’ equity, reflecting efficient utilization of resources and effective management practices. Pan African Resources’ superior ROE suggests strong financial performance and value creation for shareholders compared to its industry peers. Investors may view this high ROE as an indicator of the company’s profitability, growth potential, and overall attractiveness as an investment opportunity within the gold mining sector.

Source: Trive – Koyfin, Nkosilathi Dube

Pan African Resources boasts a Price/Earnings (P/E) Ratio of 7×, positioning it at the lower end of the range compared to other prominent JSE-listed gold miners. However, despite this relatively modest valuation, the company outperforms its peers across several key metrics, including profitability margins and returns on equity. This suggests that Pan African Resources may be undervalued relative to its industry counterparts.

After discounting for future cash flows, a fair value of R5.61 per share was derived.

Summary

Pan African Resources showcases resilience and growth, which is evident in its impressive financial performance and operational excellence. With a robust EBITDA margin of 40.06% and a remarkable return on equity of 23.96%, it surpasses industry benchmarks. Despite a P/E ratio of 7×, potential undervaluation hints at untapped investment opportunities, with key technical levels indicating a bullish trajectory ahead.

Sources: Pan African Resource PLC, BusinessDay, Mining Weekly, Koyfin, TradingView

Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.