The Nedbank Group Limited released its results this morning before the markets opened. In the interim results, we saw that the headline earnings and the group’s revenue increased by 10% and 13%, respectively. However, the bank’s credit loss ratio went up 41% in these interim results to 121 bps compared to 85 bps in the previous comparable period. As market participants react to results, the stock price has climbed this morning and is currently up by 1.95%. The group’s balance sheet metrics remained very strong, enabling the declaration of an interim dividend of 871 cents per share, up by 11%, at a payout ratio of 57%.

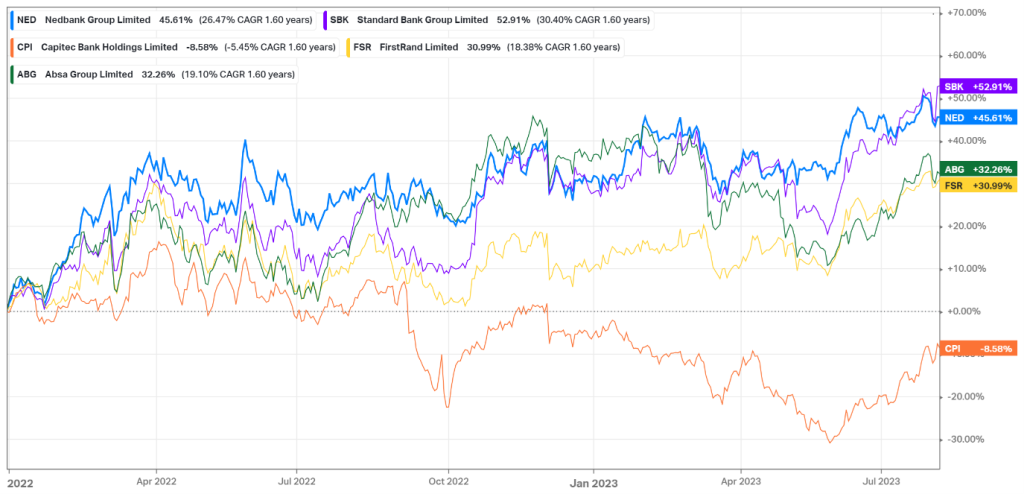

The bank has been doing quite well compared to its competitors, with Standard Bank Group Limited being the only one to surpass Nedbank Group Limited. This week, Nedbank Group Limited is the first bank to report financial results, and we’ll be waiting for ABSA Limited and Standard Bank Group Limited to do the same the following week, on the 14th and 17th, respectively. The remaining two banks will only be announcing their results in September.

Figure 1: Banks’ performance since 2022

Operating environment

The second quarter’s operating environment remained unfavourable. Even if the nation’s electrical supply slightly increased, power outages continued to be long and infrequent. Consumers were compelled to restrain their spending increases due to elevated inflation and rising interest rates. The first half of the year saw a considerable decline in household finances. Real personal disposable income growth slowed down even more due to chronically high inflation and little job creation. Despite a slight increase in household debt levels to 62,1% of disposable income in the first quarter, debt servicing costs increased by 475 basis points since 2021 to 8,4% of disposable income, up from a 16-year low of 6,7% in the last quarter of that year.

From a peak of 1,5% in the third quarter of 2020, the personal savings rate fell to -0,2% in the first quarter. After accelerating over the previous year to reach a high of 7,9% in January 2023, the growth of household loans and advances decreased to 6,7% YoY in May 2023. After a recent high of 13,8% in September 2022, the development of company loans slowed to 8,3% in June 2023. Overdrafts, general loans, and commercial mortgages had the most downturn. In contrast, leasing finance and installment sales continued to grow.

Positively, the rate of headline inflation began to decrease over the second quarter, easing to 5,4% in June from 7,1% in March. The Monetary Policy Committee held interest rates steady in July 2023 as long as inflation remained within the South African Reserve Bank’s (SARB) target range. This marked a pause after ten straight rate increases since October 2021, which raised the repo rate by 4.75% to 8.25% and the prime lending rate by 11.75% overall.

Technical analysis

The share price has been fluctuating sideways in the range of R 202 and R 240 since the run-up at the start of 2022. When we look at the 200-day and 50-day exponential moving averages for this period, we see that, except for a small period in June of this year, the shorter time frame EMA has been trading above, the longer time frame the entire time.

Figure 2: Nedbank’s daily candle stick chart since 2022

Since June, the share price has been trending upward in a channel with a bottom trendline positioned at the 50-day moving average. As mentioned earlier, the Elliot Wave within the channel is also close to completion, and last week’s candlestick shape suggests that the Elliot Wave may be about to complete. Finally, you can see that the MACD is still above the neutral line at the bottom of the chart, which supports the upward trend.

Fundamental analysis

The business’ segments to its operations, namely, Nedbank Corporate and Investment Banking, Nedbank Retail and Business Banking, Nedbank Wealth, and Nedbank Africa Regions. Looking at the performance of the different segments in total income, Nedbank CIB increased by 5%, Retail and business banking was relatively flat and only increased by 2%, Nedbank wealth climbed by an impressive 20%, and the most significant increase came from Nedbank Africa Regions, which is up 42%. Net interest income (NII) increased by 18%, non-interest revenue (NIR) increased by 7 or 10 percent on a like-for-like basis, and associate income rose by 53%. Productivity increased, as seen by the cost-to-income ratio falling from 56,1% in the first half of 2022 to 52,9% today.

The strategy of Nedbank is carried out through five strategic value unlocks, which are: providing cutting-edge, market-leading client solutions; engaging in ongoing disruptive market activities; concentrating on value-creating areas; developing efficient execution; and producing positive impacts, including realising their purpose of using their financial expertise for good. Outside the group’s strategy to unlock value was an R5 billion capital optimisation initiative to be executed through a share repurchase and an odd-lot offer announced at the 2022 annual results in March 2023. The business has continued progressing towards its 2023 year-end financial targets of a return on equity (ROE) greater than the 2019 level of 15,0% and a cost-to-income ratio lower than 54% (2019: 56,5%).

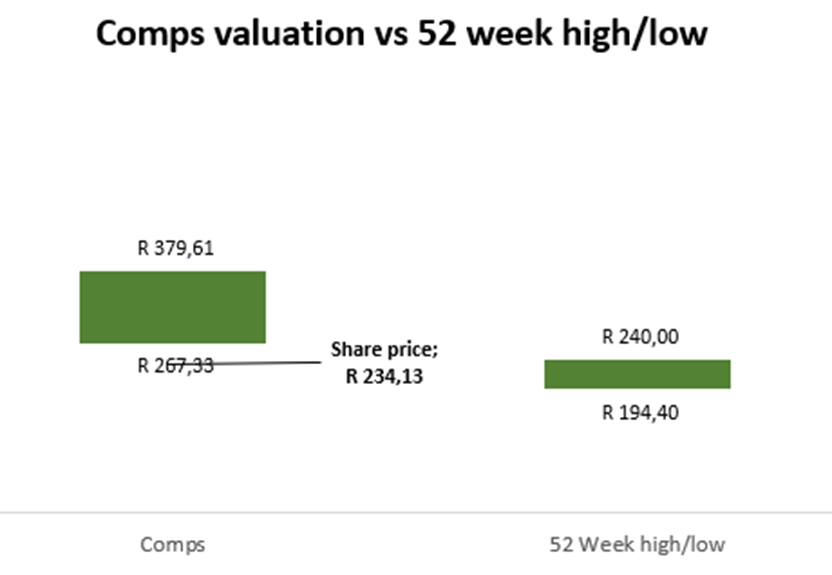

Comparable valuation analysis

Figure 3: Comparable analysis for Nedbank Group Limited

After doing a comparative valuation analysis on Nedbank Group Limited, we can deduce that the company is relatively undervalued across the three valuation ratios used. The company’s highest valuation comes from the EV/Revenue ratio, which was R379.61, and the lowest valuation is from the Price/Earnings ratio at R267.33. The top-end valuation is significantly higher than the share’s all-time high of R 314.14.

Summary

Nedbank has been able to continue to grow its revenue despite facing a challenging economic environment, and this can be attributed to the group’s strategy that they have implemented. Furthermore, high-interest rates have been favourable to banks, and Nedbank being the first bank to release their results, it is plausible to have similar sentiments towards the release of results from the other banks.

Sources: MoneyWeb, Nedbank, Trading View, and KoyFin

Author: Odwa Magwentshu FMVA

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.