Sasol Limited (JSE: SOL), a global leader in fuel and chemical production from coal and gas, has recently captured widespread attention with the release of its half-year earnings results.

Despite its prominent position in the industry, Sasol has recently encountered significant challenges, casting shadows over its financial performance and investor sentiment. The company’s share price has witnessed a steep decline, plummeting by 31% last year and continuing its downward trajectory with a 22% year-to-date decrease.

The half-year earnings report revealed a notable 34% decline in profit, attributed to adverse factors such as weakened oil and petrochemical prices along with escalating costs. Consequently, Sasol announced a reduction in its interim dividend from R7 to R2 per share, reflecting the strain on its financial health.

Several key challenges have contributed to Sasol’s struggles, including higher inflation, subdued economic growth, weak global chemicals demand, and power constraints in South Africa. This weakened performance is starkly evident in its year-to-date loss of 22.80%, compared to the JSE Top 40 Index’s 4.65% loss during the same period. The deeper year-to-date loss compared to the JSE Top 40 Index paints a clear picture of the eroded investor confidence in Sasol. As Sasol navigates through these turbulent waters, investors are keenly observing its strategies for mitigating risks and restoring confidence in its prospects.

Source: Trive – Koyfin, Nkosilathi Dube

Technical

Sasol’s share price has been entrenched in a downtrend, evident from its position below the 100-day moving average and within a descending channel pattern.

The emergence of a resistance level at R165.39 per share, coupled with oversold RSI conditions, underscores the prevailing selling pressures. The recent selloff has brought Sasol close to a critical support level at R123.50, representing a 3-year low and reflecting a historical zone of buying interest observed in December 2020.

With the RSI signalling oversold conditions, there’s potential for a rebound if selling pressures subsides. In the event of a turnaround, the R165.39 resistance level could serve as a significant point of interest for optimistic investors. Conversely, if downward pressure persists, investors could eye the R123.50 level for bargain-hunting opportunities, given its past significance as a price level where demand for Sasol’s stock exceeded supply.

Fundamental

Sasol’s performance in the first half of 2024 fell short of expectations compared to the same period in the prior year.

With revenue totalling R136.3 billion, a notable decline from R149.8 billion previously, the company faced significant challenges, particularly stemming from lower chemical product prices across all regions. This decline in revenue had a cascading effect on earnings before interest and tax (EBIT), which plummeted by 34% to R15.9 billion compared to the prior period.

One of the most concerning aspects of Sasol’s performance was the steep drop in cash generated from operating activities, which plummeted by 31% to R14.7 billion. Both of Sasol’s core business segments, Energy and Chemicals, experienced setbacks, primarily due to weaker prices across their operating regions. Brent crude oil prices, a key factor affecting the Energy segment, were down 10% to $85 per barrel, while natural gas prices plummeted by a staggering 75%, significantly impacting the segment’s top line.

Source: Trive – Sasol Ltd, Nkosilathi Dube

The Chemicals segment also faced challenges, with Ethane prices declining by 44% and Polyethylene prices down by 19%. This decline in prices had a direct impact on the segment’s earnings before interest, taxes, depreciation, and amortization (EBITDA), which witnessed decreases across most of Sasol’s operating segments.

Mining EBITDA dropped by 39% due to lower coal export prices and operational challenges, while Gas EBITDA declined by 19% as a result of lower margins. The Chemicals Africa segment saw a significant decline in EBITDA by 44%, attributed to operational and supply chain challenges. Similarly, the Chemicals Eurasia segment experienced an 84% decline in EBITDA due to weak demand and lower utilization rates, leading to lower sales prices and margins. However, the Chemicals America segment was a bright spot amidst the challenging environment, registering EBITDA growth driven by higher sales volumes and improved margins.

Source: Trive – Sasol Ltd, Nkosilathi Dube

In response to the weaker financial and operational performance, Sasol made the difficult decision to slash its dividend by a staggering 71% to R2 per share. This move reflects the company’s commitment to preserving capital and navigating through the current economic challenges. As Sasol strives to address the headwinds impacting its performance, investors are keenly observing its strategies for recovery and future growth in the dynamic energy and chemicals landscape.

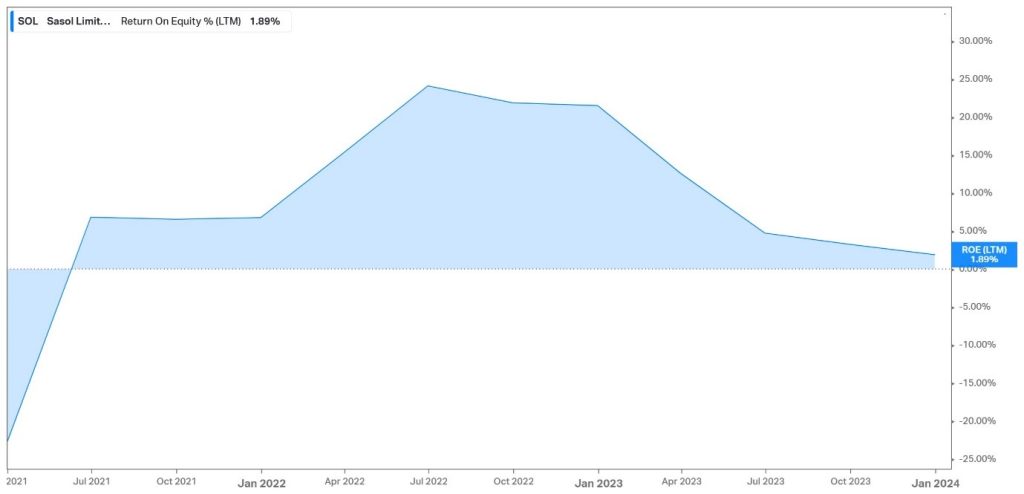

Sasol’s return on equity on the latest twelve-month basis has declined, reaching 1.89%, indicative of reduced earnings amidst macroeconomic challenges impacting product pricing. This figure represents a low in the company’s post-pandemic recovery phase, signalling ongoing financial strain for Sasol amid challenging market conditions.

Source: Trive – Koyfin, Nkosilathi Dube

Despite experiencing mixed results, Sasol reaffirms its dedication to fundamental values, prioritizing safe and dependable operations, ongoing enhancement of productivity, and efficient cost control measures despite prevailing economic challenges. A potential rebound in energy and chemicals prices, coupled with a global economic recovery, may provide favourable conditions for Sasol’s operational and financial resurgence. However, in the interim, the outlook appears bleak.

Summary

Amidst challenging market conditions, Sasol Limited faces significant headwinds, reflected in its slashed dividend and declining return on equity. As it navigates through the downturn, Sasol remains committed to operational excellence and prudent financial management, aiming to restore investor confidence and drive future growth.

Sources: Sasol Limited, MoneyWeb, Koyfin, TradingView

Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.