Stor-Age Limited has consistently paid out dividends of 9.5% since listing on the Johannesburg Stock Exchange and keeping a payout ratio of approximately 100%. Today is the last day to trade in the share to receive the latest dividend of 58.09 ZAc per share.

Stor-Age Limited, the leading and largest self-storage property fund and brand in South Africa and the first and only self-storage Real Estate Investment Trust (REIT) listed. For its niche market, the company is well-positioned for the current state of the economy, where people are downscaling their lifestyles and others are looking to relocate internationally.

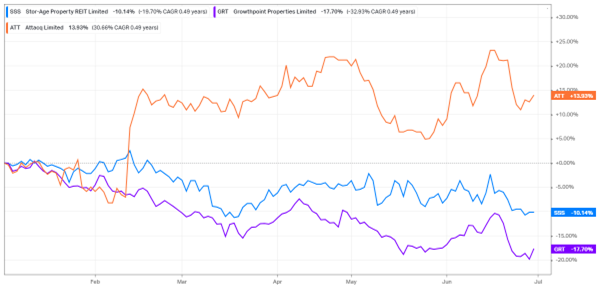

The property sector had been hit initially by load shedding and Covid 19 at the beginning of the decade but is now starting to find its feet. A strategy review has been in focus, with high-interest rates and inflation still hurting the consumer and REITs. Stor-Age Limited has been making impressive pivots and is uniquely positioned with its business model.

REITs have been making deals and expanding locally and internationally, such as Vukile Property Fund Limited’s capital raise of R700 million for South Africa and Spain. Furthermore, Africrest Properties also has a strategy to expand by turning office properties into residential properties following a purchase of PwC’s head office campus from Attacq Limited for north of R76 million in January 2021.

Figure 1: Comparative share performance for Stor-Age Limited, Growth Point Limited and Attacq Limited for 2023

Issues in the property sector

- Load shedding hit

At the beginning of the year, load shedding was intense, and only recently have the schedules for load shedding been shorter. In the last annual results, the operation of generators has eaten at the net income of several businesses through the installation and purchase of diesel. For Stor-Age Limited, electricity costs at our properties account for approximately 4.0% of SA direct operating costs and less than 1.0% of SA property revenue.

- Interest rates

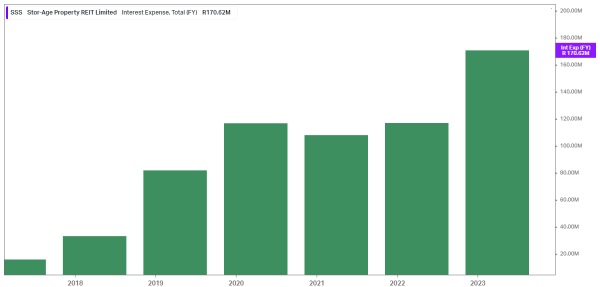

The interest rate increases have not been kind to the property sector as payments toward loans have been going up. Stor-Age Limited has been slowly building its asset base and has been hit with the growing pains of larger payments toward interest.

Figure 2: Total interest expense for Stor-Age Limited

Business Outlook

The company has acknowledged a challenging time ahead. Still, it remains optimistic as the demand levels for self-storage remain elevated, and third-party management revenue, occupancy, and rental rate growth align with management’s forecast. South Africa’s prevailing issue, overshadowing all else, continues to be prolonged and severe level 4 load shedding. In parallel, during the financial year of 2024, interest rates increase by more than 50bps in South Africa and 25bps in the United Kingdom.. The company has a portfolio comprising 93 trading properties across South Africa and the United Kingdom, providing storage to 49 000 customers. The combined value of the portfolio, including properties managed in our joint venture partnerships, was R12.9 billion, including the pipeline and ongoing developments exceeding 620 000m².

The business is also looking for growth in the two countries where it operates, with six developments scheduled for completion in FY24 (SA – 3; UK – 3) and entered into a joint venture with Nuveen Real Estate. The joint venture offers an appealing return on invested cash while enabling Stor-Age Limited to expand and reach further scale in the United Kingdom. The JV’s initial goal is to put the portfolio rebranding and management platform overlay into place with the medium-term objective of increasing Nuveen’s exposure to self-storage assets throughout the United Kingdom. The JV’s equity interests will be split between Nuveen and Stor-Age at 90% and 10%, respectively.

Technical Analysis

Figure 3: Technical analysis for Stor-Age Limited

The share price has not been trading in a downward trend since April 2022 and is currently below both the 200 and 50-day exponential moving averages. The share price in March reached a low which was last tested in November 2020, and we may see the level tested once more should the trend continue.

Fundamentals

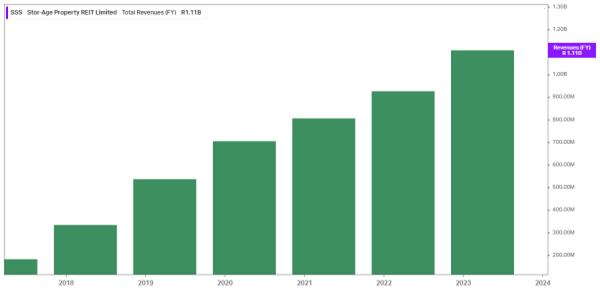

Figure 4: Total revenue for Stor-Age Limited since 2017

The business has been able to grow its revenue consistently, and in the last annual results released, the company broke the R1 billion mark and brought in R1.11 billion in total revenue. The company recently released an annual financial report in mid-June 2023 with rental and net property operating income up 17.3% and 15.3%, respectively. The South African and the United Kingdom same-store closing occupancy finished at a record high of 92.2% and 85.4%, respectively. This translated to the rental rate growth of 7.6% in South Africa and 8.0% in the United Kingdom, with the net investment property value up 12.2% to R10.4 billion.

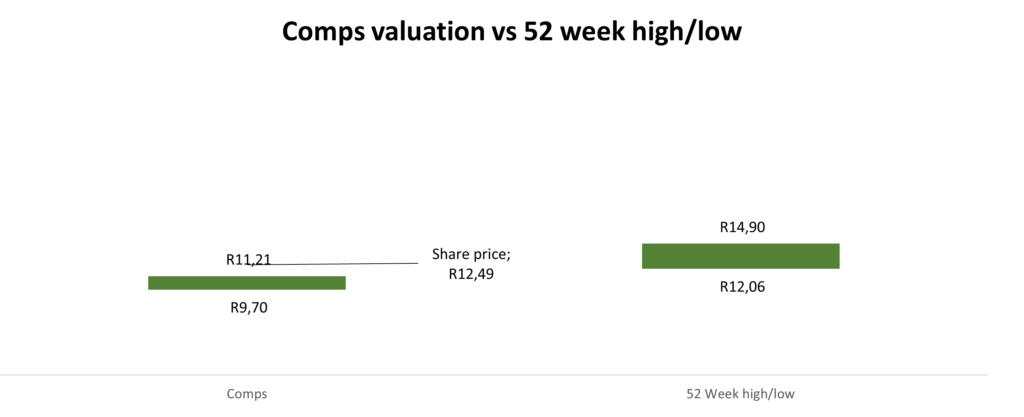

Figure 5: Comparable valuation versus 52-week high/low

The company has a comparative valuation below its current share price, indicating more potential downside for the share price action. If the comparative analysis is true, The share price may continue to drop below the ZAR 10 mark during the expansion phase of the company.

Summary

The business has been growing from strength to strength despite a challenging environment and is operating n a niche market. This brings the company growth opportunity as they continue to operate with little competition in South Africa and international interests in the United Kingdom. Furthermore, should the macroeconomic environment and load-shedding woes change, the industry would have a favourable operating environment. Currently, an investment in the business primarily benefits from a consistent payout in the dividends at an attractive price to purchase the share.

Sources: Trading View, KoyFin, MoneyWeb, Stor-Age Limited, Attacq Limited and Vukile Property Fund Limited

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.