The Satrix S&P 500 Feeder Portfolio (JSE: STX 500) emerged as a shining star in 2023, showcasing an impressive 38.72% price appreciation. This remarkable feat was achieved amidst one of the steepest interest rate hiking cycles in recent history by the Federal Reserve.

Designed to mirror the performance of the S&P 500 index in rand value, the fund strategically invests in the iShares Core S&P 500 UCITS ETF. Its success comes as no surprise, considering the S&P 500’s record-breaking ascent and the resilient US economy. As global sentiment leans towards the end of the interest rate hiking cycle, speculation now centres on the timing of potential rate cuts.

While the prospect of trading at all-time highs raises concerns of a market correction triggered by profit-taking, the outlook remains optimistic. Goldman Sachs, for one, maintains confidence in the US equity market, revising its 2024 S&P 500 target to 5,200, a 4% increase from current levels. The brokerage anticipates enhanced earnings among index companies, buoyed by easing inflation and anticipated rate cuts by the Federal Reserve.

Moreover, attention is drawn to the earning potential of mega-cap stocks, often referred to as the “Magnificent 7”, which constitute a significant portion of the index. With advancements in artificial intelligence (AI) and robust consumer spending, the brokerage believes these companies are poised for revenue growth and margin expansion in the coming year.

In light of these developments, the question arises: How does the current positioning of the ETF reflect these promising trends?

Technical

On the daily chart, a steep uptrend has emerged in the form of an ascending channel. The price has briefly pushed through the 161.8% Fibonacci extension from the prior downtrend, and the crossing of the 25-SMA (green line) above the longer-term 50-SMA (blue line) and 100-SMA (orange line) confirms the presence of bullish momentum. However, potential divergence on the RSI signals that a pullback remains on the cards as we advance.

The 161.8% Fibonacci extension at R100.15 offers resistance to the continuation of the trend despite a recent breakthrough. If the price fails to clear this level, the pullback could commence. Support at R98.02 could act as a last line of defence against a potential channel breakdown. If the breakdown occurs, the price could fall below the 25-SMA toward R95.10, where the 50-SMA backs support. This creates a psychological support level that could be a landmark for a retracement of the selloff.

However, if the price clears the R100.15 resistance once more, the ascending channel could persist. The last hurdle is established at R101.07, and a sustainable clearance of this resistance could set the price up to continue forming new highs in the coming weeks.

Fundamental

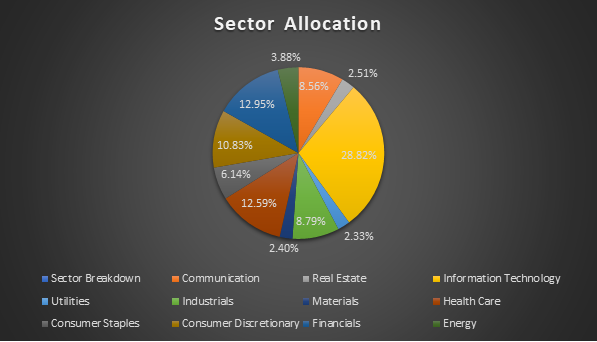

As of 31 December 2023, the sector allocation of the underlying portfolio of the ETF is shown below. Technology dominates with a 28.82% exposure, reflecting more than twice the allocation of the second-largest sector in the fund, which is financials, with a 12.95% exposure. Along with healthcare (12.59%), the top three sectors in the portfolio make up over 54% of its exposure. So, with the underlying fund being largely driven by these three sectors, it’s worth looking into their performance over the last year and how this performance is expected to turn over into the new year.

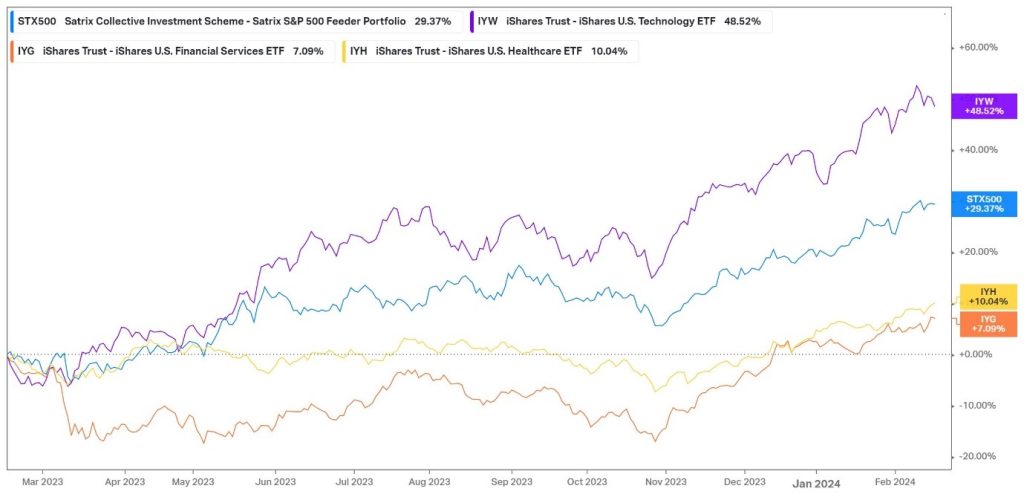

The chart below shows the performance of ETFs reflecting these sectors over the last year. Evidently, technology was the largest outperformer, pulling the fund’s returns upward as it expanded nearly 50%. Healthcare and Financial Services returned 10.04% and 7.09%, respectively, over the last year. The technology sector benefitted largely from the widespread adoption and growth of AI. While high-interest rates and inflation generally create challenges for high-growth companies in this sector, the optimism around the potential for AI and its implications for businesses worldwide outweighed these headwinds, leading to an exceptionally profitable year. According to Fidelity, AI will be a transformative trend for this year and beyond, and could be the driver of the sector. However, Fidelity remains aware of the possibility of a recession, which could temporarily slow the sector in the upcoming year.

Along with the high growth and volatility that comes with the technology sector, the healthcare sector provides some counter-cyclical safety. Last year was a bit more challenging for this sector, as a ‘COVID-Induced Hangover’ as labelled by BlackRock created a problematic year for comparisons as the revenue generated from vaccines died down. However, some optimistic developments have emerged with the emergence of GLP-1 drugs as weight loss treatments. This led to pharmaceutical giants such as Eli Lilly and Novo Nordisk to significantly outperform its peers. Looking to the upcoming year, BlackRock sees a favourable risk-reward environment and believes that healthcare’s 12-month forward earnings growth is positioned to lead all other sectors on a year-over-year basis, with sales growth expected to trail only information technology and consumer discretionary.

Financial services faced an up-and-down year in 2023, from the selloff during the banking crisis earlier in the year to lucrative revenue and margin expansion due to the higher interest rates boosting the net interest income generation from larger banks. However, according to Deloitte, banks’ ability to generate income while managing costs will be tested in 2024. The Federal Reserve is expected to cut interest rates in the upcoming year, which could weigh into net-interest-income generating abilities, forcing banks to prioritize noninterest income in the forthcoming year. Deloitte expects banks focusing on advisory, underwriting, and corporate banking to have more room to grow fee income.

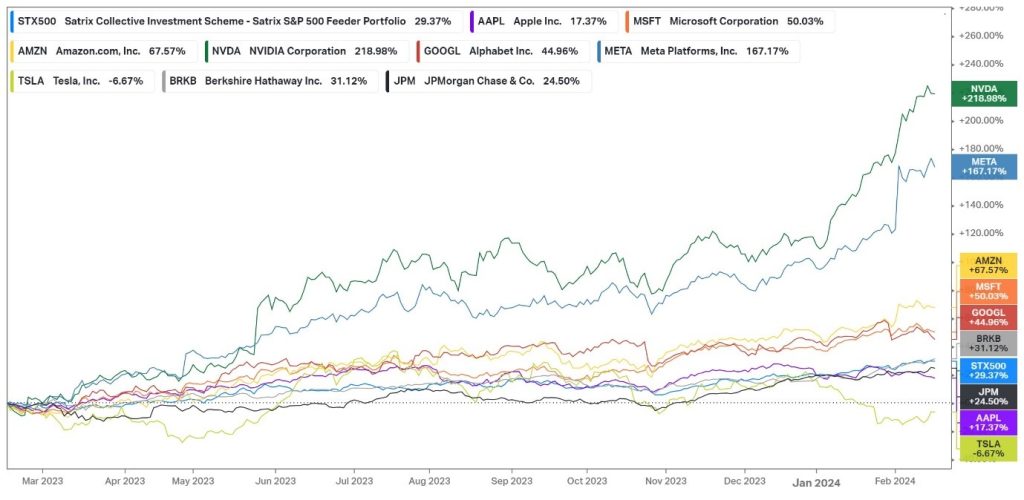

That said, it is worth looking at the top underlying securities that drive the fund’s performance. The fund’s top 10 holdings make up a significant 31% of its total exposure. The chart below shows the performance of the top 10 holdings over the last year. Nvidia (218.98%) and Meta (167.17%) have been significant outperformers and account for approximately 5% of the fund’s allocation. Fidelity believes that the semiconductor industry continues to look attractive. Nvidia has invested in AI for over ten years, with its advanced graphics chips being the lifeblood of generative AI systems. The forecast from Goldman Sachs regarding lucrative margin expansion for the ’Magnificent 7’ companies could play well in favour of this fund as well, as it has a 28% allocation to these companies and could drive the price in the year ahead.

However, there are macroeconomic risks to consider in the upcoming year. Foreign exchange volatility could play a role in the ETF’s returns. As things stand, the CME FedWatch Tool has assigned a 34% chance that the Federal Reserve could cut rates in May, a probability that has fallen from 84% just a month ago. The market has shifted its expectations toward June, with a 74% chance of rates being lower after this meeting, with the probability of a 25bps reduction rising from 16.7% a month ago to 52.2%, showcasing the rapid repricing the market undertakes in reaction to new developments in the economic data. This creates uncertainty in the foreign exchange market and could result in a volatile year for the USDZAR currency pair as the Federal Reserve embarks on its easing policy.

Summary

With significant exposure to the technology sector and holding securities that have been performing exceptionally well, the Satrix S&P 500 Feeder Portfolio has started the new year on the front foot with a 7.23% YTD return. However, with the S&P 500 trading near all-time highs and uncertainty looming large over the potential timeline of Federal Reserve rate cuts, there could be some volatile times ahead.

Sources: Koyfin, Tradingvew, Reuters, Goldman Sachs, Fidelity, Deloitte, CME Group

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.