In a resounding testament to its formidable position in the African financial landscape, Standard Bank Group Limited (JSE: SBK) recently solidified its status as the continent’s foremost lender by assets. The company’s mid-year report, unveiled in August, revealed not only impressive expansion in both its revenue and profit margins but also its ability to navigate and triumph over challenging economic conditions.

With rising inflation and borrowing costs causing headaches for the local banking sector, many players witnessed an uptick in loan defaults. However, Standard Bank’s strategic prowess came to the fore, as it skilfully harnessed the higher interest rates to bolster its net interest income, effectively counteracting the surge in delinquencies. This remarkable performance has, in turn, placed the company ahead of the curve, outperforming the JSE Top 40 index year to date and promising a bright and optimistic second half.

In the interim report, total income increased from R67.71Bn to R87.16Bn, on which the company generated profit attributable to shareholders of R21.92Bn, a sharp rise from the prior R16.10Bn. Headline earnings advanced an impressive 35% to R21.23Bn, resulting in headline earnings per share (HEPS) of R12.82, a 34% increase from the prior R9.56.

Technical

On the 1D chart, a recent breakdown from a longstanding uptrend met support at R175.62, where a pivot was initiated toward R190.42, close to the 50-SMA (blue line). With the 25-SMA (green line) recently crossing below this level and an RSI indicating possible divergence to the uptrend, there could well be a reversal of the retracement on the cards.

From resistance R190.42, a pullback could meet support at R179.71 before retesting the prior bottom around R175.62. From the late August peak, the Fibonacci midpoint at R173.48 and 61.8% golden ratio at R167.43 could offer additional support, potentially limiting the downside damage.

However, if the share price clears the 50-SMA at R189.32, the retracement from the prior breakdown could sustain into an uptrend, where higher resistance could be tested at R197.28. At this level, resistance at R199.28 could be the only level preventing convergence with the estimated fair value of R203.94, which presents an 8.4% potential upside from current levels.

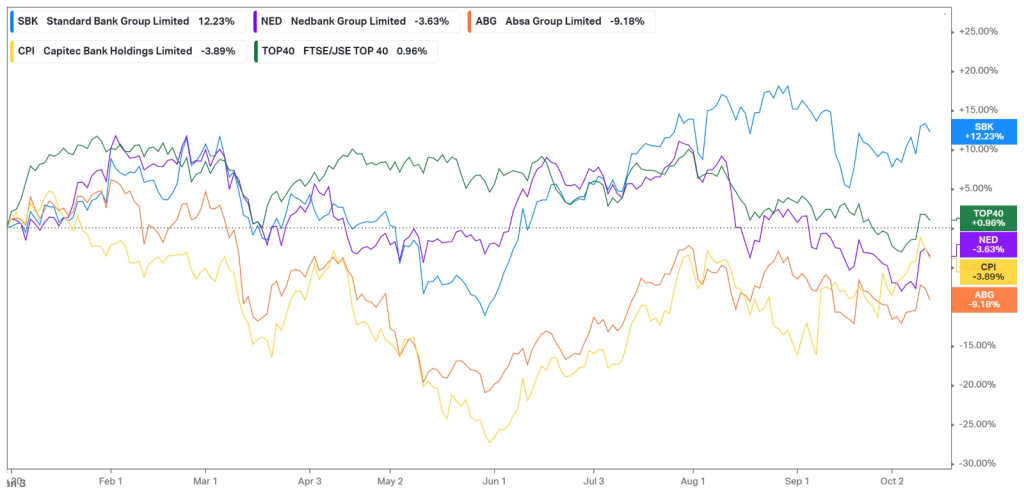

The year-to-date performance of the major domestic banks is shown in the graph below, with Standard Bank being the only bank that has sustainably generated positive returns, advancing 12.23% year to date. This is higher than the broader JSE Top 40’s 0.96% return and speaks volumes about the macroeconomic environment in South Africa. Local power blackouts have disrupted the business environment, and interest rates have risen by a massive 350 basis points (bps) over the last 12 months. However, with a strong balance sheet and conservative lending practices, Standard Bank has navigated these uncertainties with strength, and due to its ability to generate higher net interest income in this environment, they have continued to perform resiliently in the opening six months of its financial year.

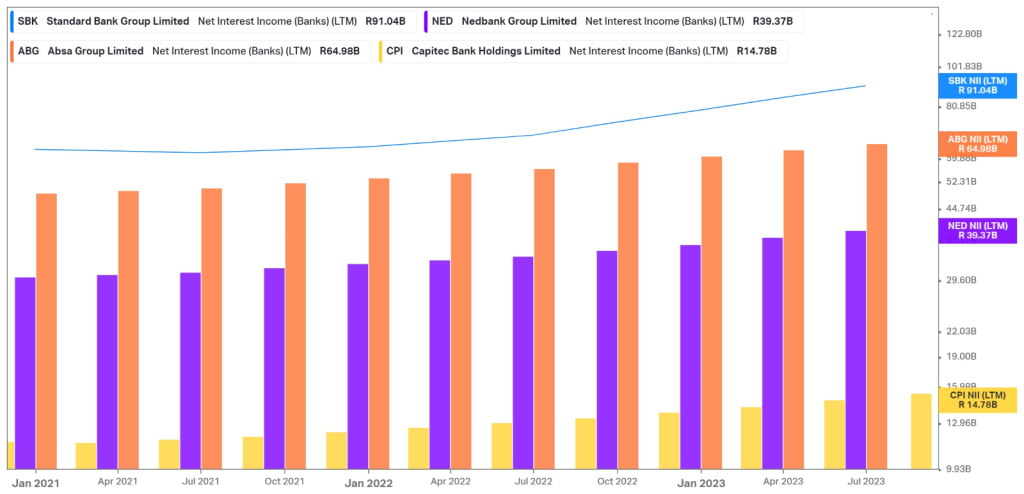

In the half-year, Standard Bank reported a 34% increase in its net interest income from R34.22Bn to R46.00Bn, boosting its net interest margin from 390bps to 477bps. The relative outperformance due to this increase is shown in the graph below, which compares the net interest income generated over the last twelve months by all major banks in the industry. Since Standard Bank is the largest bank by assets, its increased lending ability puts it well above the rest in terms of this metric, which is the main beneficiary for banks in a high-interest rate environment. After Standard Bank’s R91.04Bn over the last twelve months, Absa ranks second with a mere R64.98Bn, reflecting the current gap in that top-line potential.

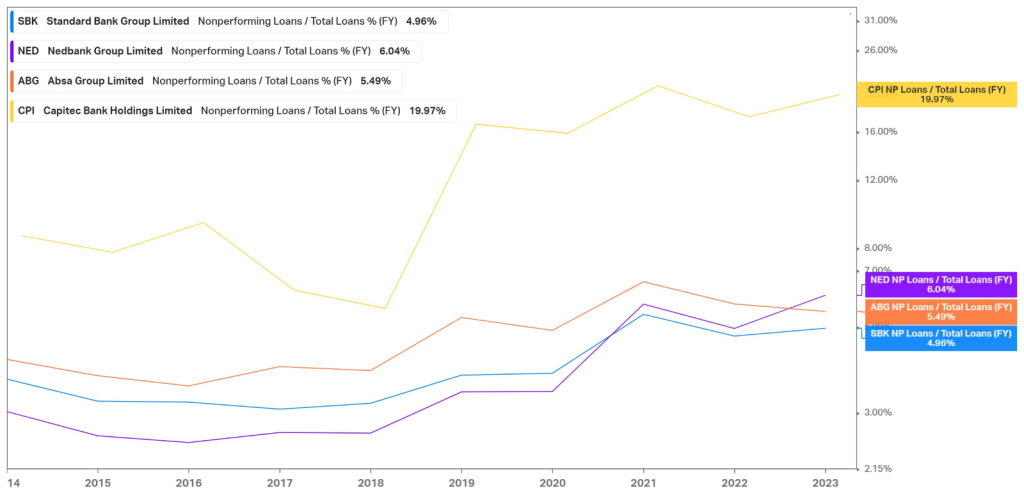

Additionally, the company operates with the lowest percentage of non-performing loans out of all its peers when looking at its latest financial year. While credit impairment charges were up 42% in the latest half-year from R5.93Bn to R8.45Bn, its credit loss ratio stood at 97bps, close to the upper end of its 100bps target range. Capitec is an outlier in terms of non-performing loans based on the fact that it caters to the lower-income consumer, which will be more adversely affected by the recent interest rate surges.

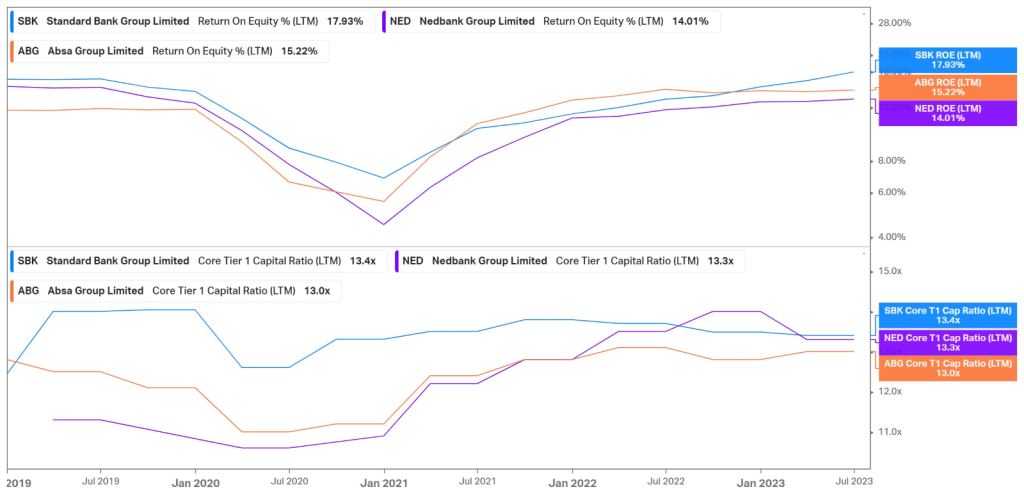

Finally, Standard Bank has also proven its efficiency, boasting the highest return on equity (ROE) among its peers, which recently increased in its latest interim report from 15.7% to 18.9%. This suggests higher profitability for each rand of shareholder investment, and all that while maintaining the highest core tier 1 capital ratio of 13.4. This is a testament to the company’s size and balance sheet stability, allowing it to maintain a healthy balance sheet while leveraging its significant asset base to generate profit through more loan generation.

Summary

Despite challenging macroeconomic conditions resulting in higher credit losses, Standard Bank has benefitted from higher net interest income, resulting in a profit increase in its latest interim report. As we advance, the 50-SMA resistance at R189.32 could offer resistance to the upside, potentially reversing the trend toward support at R179.71. However, the estimated fair value of R203.94 provides an 8.4% potential upside from current levels if the company can continue to sustain its resilient performance.

Sources: Koyfin, Tradingview, Standard Bank Group Limited

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.