The resort, hotel, and gaming company Sun International Limited (JSE: SUI) released strong results yesterday, following a record-breaking, triple-digit growth in the income generated from SunBet, smashing the business’s 5-year target. Occupancy levels were also up during the period, reported to be 67%, following an increase in business travel, specifically in Cape Town.

In spite of the current economic conditions, the business has been able to achieve favourable results and has been able to weather the load-shedding crisis and the continued pressure on consumers by inflation and interest rates.

Technical

Figure 1: Trive – Trading View, Odwa Magwentshu

The technical has been in an upward trend since the beginning of July of this year and has formed an Elliot Impulse Wave in the channel. From the beginning of April, the price action has been in a downward trend until July, following a solid rise in the share price following the release of the annual results in March, breaking through the resistance level of R36.50.

Yesterday, the share price rallied by 6.82% by the closing bell following impressive interim results and completed the Elliot Impulse Wave. Should the price action continue on the upside, we could see the price go to the soft resistance line of R42.35. On the lower end, the share price could fall back to the bottom of the channel, which is subsequently on the support line of R36.50.

Looking at the MACD indicator, We observe that the moving averages are currently above the neutral line, and the signalling moving average indicates further upside with the green histogram increasing in size. The exponential moving averages in the main chart also suggest that the momentum to the upside and the 50-day moving average are moving further away from the 200-day moving average.

Fundamentals

Figure 2: Trive – Trading View, Odwa Magwentshu

The nearest competitor for Sun International is Tsogo Sun, and in the graph illustrated above, the share price performance has moved four times more than Tsogo Sun. The two businesses are almost identical, with the only difference being the inclusion of SunBet for the former. The online business has proven to be of great value while needing little capital expenditure. Sun International Limited (JSE: SUI) has outperformed Tsogo Sun Limited (JSE: TSG) since the 2016 fiscal year and will continue to do so through 2020. Tsogo Sun was able to surpass Sun International in performance in 2021 alone, with SUI marginally regaining the lead in 2022, and in 2023, Tsogo Sun Limited released its annual results in May, while Sun International Limited just released its interim results.

Figure 3:Trive – Koyfin, Odwa Magwentshu

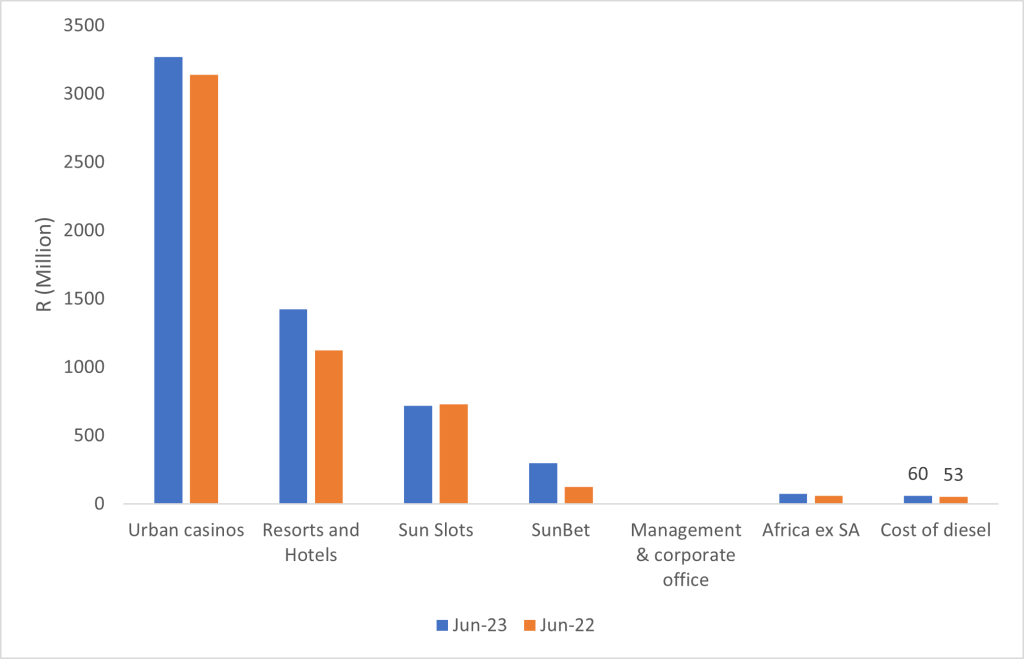

In comparison to the prior period, revenue for Sun International Limited in the six months that ended on June 30, 2023, increased by 11.7% to R5.8 billion. Disciplined cost control helped to raise adjusted EBITDA by 5.6% to R1.6 billion despite a considerable increase in diesel prices and other cost challenges. For the review period, adjusted headline earnings increased by 8.5%, with adjusted headline earnings per share rising by 10.1%. Looking at the different segments of the business, gaming revenue, which accounts for 78.0% of group revenue, continued to expand steadily with an increase of 6.6%. Casino revenue remained resilient and climbed by 3.2%. Load shedding affected Sun Slots’ operations, causing income to lag somewhat behind the previous comparison period. SunBet produced record earnings during the evaluation period, up 138.4% from the first half of 2022, and is on track to meet the ambitious growth objectives set for this company. The income from hotels and resorts saw an outstanding increase, rising by 26.9% throughout the observed period. The segmental breakdown of how the company’s revenue was generated between June 2023 and June 2022 is shown below. The diesel price for the comparable periods has been added, which can be seen on the far right of the graph.

Figure 4: Trive – Sun International, Odwa Magwentshu

The show’s undeniable star was SunBet, which has maintained a solid growth trajectory and has surpassed its five-year goals. For the reported period, revenue increased 138.4% overall. The review period saw an increase in adjusted EBITDA of 542.9% from the prior comparative period’s R14 million to R90 million, highlighting the company’s groundbreaking achievements. Unique active gamers increased by 702.8%, first-time depositors by 469.2%, and deposits by 216.2% in this business category.

The company has expanded its market share and is on track to meet its goal of more than 10% market share by 2026. The internet business model is easily adaptable to other regions, so they are on a focused quest to expand their present operational market and enter new markets. They have made solid progress in this area as they are ready to start operations in Ghana, Zambia, and Kenya, all of which have promising long-term growth prospects. The company expects that in the first half of 2024, they should fully function in these markets.

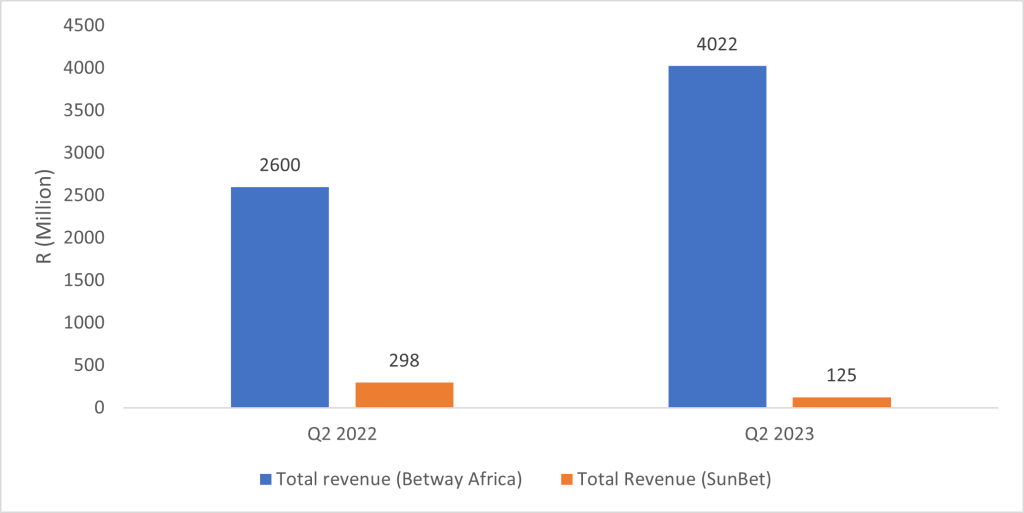

BetWay, a subsidiary of Super Group (NYSE: SGHC), is still a strong competitor in the online betting market for this particular industry category. In the graph below, we’ve compared SunBet’s total revenue to BetWay Africa’s total revenue.

Figure 5: Trive – Sun International and Super Group, Odwa Magwentshu

The group is in a healthy financial position with South African debt at R5.9 billion, which aligns with debt levels on December 31, 2022. To maximize shareholder value within core capital allocation rules, the business will continue to give expanding free cashflows and disciplined capital allocation top priority. With R2.3 billion in unutilized facilities, their balance sheet is healthy.

The company is currently trading well below the fair value of R189.40 for its current share price of R39 per share.

Summary

Although the climate in which they operate and the economic situation in South Africa remains challenging, it may be assumed that the business will continue to grow and profitability will rise in the second half of the year. They have a solid balance sheet and are concentrating on efficiency as the company works to safeguard and increase their income and margins. SunBet is hitting all-time highs in revenue, and its resort and hotel properties have kept up their remarkable performance. They stated that they will ensure that their strategy keeps producing the desired results due to their strong momentum and the excellent leadership they have in place.

Sources: Money Web, Simply Wallstreet, Sun International, Super Group, Business Day, Trading View, and Koy Fin

Author: Odwa Magwentshu, Sales Trader

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.