This week has been a rollercoaster for the EURGBP currency pair, marked by shifts in market expectations fuelled by the UK inflation report. The report, revealing year-over-year inflation of 3.9%, surprised many by coming in below the consensus of 4.4%. This unexpected figure led to speculations about potential interest rate cuts by the Bank of England in the early months of the upcoming year.

However, the intrigue continued on Friday with additional data. Despite the UK’s year-over-year GDP growth matching consensus at 0.6%, an upside surprise came from retail sales, surpassing expectations at 0.1%. This marked a notable improvement from the previous -2.5% and exceeded the consensus of a -1.3% prediction. As the week concludes, the Pound may draw strength from this data, setting the stage for a tug-of-war between conflicting signals in the market.

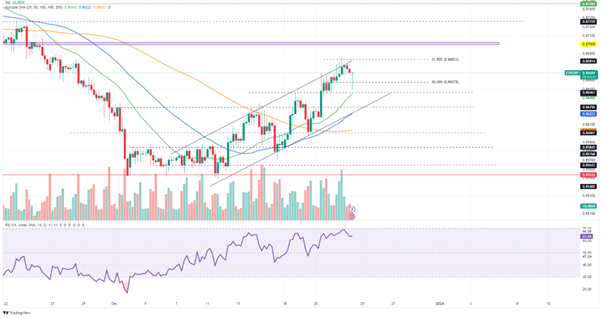

Technical

An ascending channel has formed on the 4H chart, with the dynamic resistance preventing sustained upside in the recent sessions. The shorter-term 25-SMA (green line) and 50-SMA (blue line) trends above the 100-SMA (orange line), confirming the presence of buyers, but strong resistance at the 61.8% Fibonacci golden ratio of 0.8683 presents a strong hurdle to the bullish momentum.

If this resistance holds, the currency pair could look for support at 0.8658, the Fibonacci midpoint. The 25-SMA is established not far below, at 0.8646, and could prevent the currency pair from falling toward the channel support at 0.8629, where a breakdown could occur. In this case, the bears could look toward 0.8601 as a potential level of interest.

However, if the resistance at 0.8683 fails to withstand the buying momentum, a psychological supply zone near 0.8703 could become a pivotal level. While a retracement is possible here, an additional leg higher could set the currency pair up for convergence with higher resistance at 0.8726.

Summary

After a slew of data releases, the EURGBP currency pair finds itself up almost a percent for the week, as the British Pound lost some ground. Resistance at 0.8683 could now be a level to watch as the week comes to a close to gauge whether the current bullish momentum will be sustained.

Sources: Koyfin, Tradingview, Reuters

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.