The NZDUSD currency pair is poised for an impressive eighth consecutive day of gains, brushing off concerns raised by a weaker-than-expected retail sales report. Speculation surrounding a potential hike in the Reserve Bank of New Zealand’s 5.5% cash rate at next week’s policy meeting has provided a significant boost. However, the recent downturn in retail sales figures may influence these expectations. Year-over-year figures declined from -3.4% to -4.1%, while quarterly numbers dropped to -1.9% from the previous -0.8%.

In the US, the market remained relatively unfazed by the release of the FOMC minutes, indicating a cautious approach among members toward rapidly easing rates. This stance had already been factored into market expectations. As the week progresses, the question looms: will the currency pair maintain its winning streak until the week’s end?

Technical

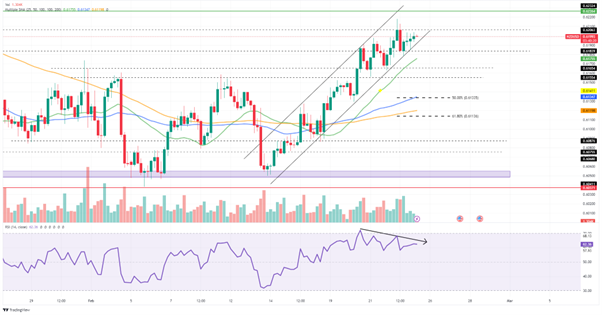

On the 4H chart, an ascending channel is in play as the currency pair continues to move higher. The 25-SMA (green line) has surpassed the 50-SMA (blue line) and 100-SMA (orange line), confirming a bullish tilt, but divergence in the RSI signals a potential pullback in the upcoming sessions.

Resistance at 0.6206 could be the first barrier to the continuous bullish momentum. If a pullback gets triggered at this level, the breakdown could occur. Support at 0.6184 could then be in focus for a potential retracement, but an additional leg lower could shift the spotlight toward 0.6165 and 0.6155 to provide potential buyers.

However, the impressive ascent could continue if resistance at 0.6206 gets cleared. At the higher end of the channel, resistance is established at 0.6226 and could be a level of interest if the bullish momentum is sustained in the week’s closing session.

Summary

Despite a slump in New Zealand’s retail sales, the NZDUSD currency pair has maintained its winning streak intact and looks poised to complete eight consecutive days of gains. Resistance at 0.6206 could be worth keeping an eye on in the upcoming session to determine whether the bulls can maintain their upper hand within the channel.

Sources: Koyfin, Tradingview

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.