Having experienced a setback of nearly 1.5% in the previous week, the US Dollar Currency Index (DXY) initiated the new week with another downturn. This decline unfolded as the Federal Reserve opted to maintain its current rates during the December meeting, concurrently hinting at the possibility of three cuts in the coming year.

Although the dollar managed to recover some of its recent losses following remarks from New York Fed Bank President John Williams, cautioning against premature discussions on rate cuts, prevailing market sentiment continues to lean towards expectations of monetary easing in March. Notably, the week’s focal point lies in the anticipated release of the PCE Price Index data. This data holds the potential to provide the market with enhanced insight into the inflationary landscape of the economy, thereby influencing the sustainability of the optimistic outlook that currently shapes the market’s expectations.

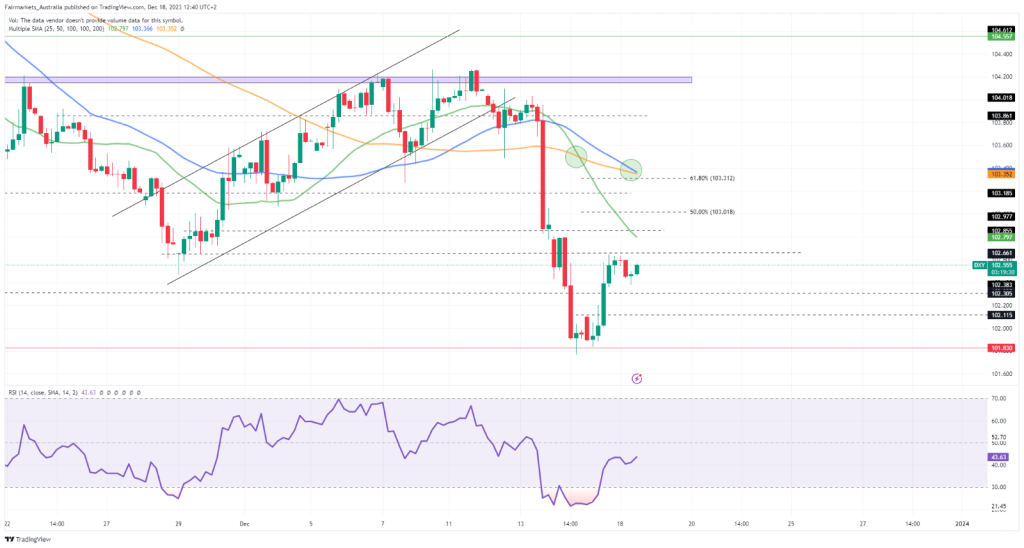

Technical

On the 4H chart, the bearish momentum is evident by the recent crossing of the 25-SMA (green line) below the 100-SMA (orange line), while the 50-SMA (blue line) looks to do the same since the breakdown occurred from the ascending channel. However, the price is currently moving sideways in a narrow range, a testament to the market’s caution after a period of prolonged selling pressure.

Resistance at 102.661 is keeping the sellers in play, but a breakout above this level could lead to the ultimate test of the 25-SMA at 102.797. The Fibonacci midpoint could come into focus at 103.018 if the price breaches this level, while higher resistance is established at 103.185. If the buying pressure is sustained, the 61.8% Fibonacci golden ratio could provide psychological resistance at 103.312, with the 50-SMA and 100-SMA not far above.

However, if resistance at 102.661 holds, the downturn could continue. Support at 102.305 and 102.115 could be the only support levels preventing the sellers from retesting the prior bottom, around 101.830.

Summary

The US Dollar Index is moving sideways in a narrow range, anticipating its next directional move after the recent selloff. Resistance at 102.661 could be crucial in determining whether the current retracement will be sustained.

Sources: Koyfin, Tradingview

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.