Entering the new year, Anglo American Platinum Limited (JSE: AMS) hopes for a potential turnaround after facing severe challenges in 2023. The company witnessed a substantial decrease in its share price, losing nearly 40% of its value amidst a challenging environment for mining companies in South Africa. The decline was primarily attributed to the falling prices of Platinum Group Metals (PGM), placing considerable pressure on their operations.

The company’s financial performance for the six months ending June 2023 reflected the tough conditions, with headline earnings plummeting by 71%, dropping from R26.7 billion to a modest R7.9 billion. Additionally, the top-line revenue experienced a significant 24% contraction to R64.68 billion, signalling a notable downturn in operational metrics compared to the previous year.

As the eagerly anticipated full-year report for 2023 approaches, slated for release towards the end of February, the question arises: will Anglo American Platinum Limited continue to grapple with operational challenges, or is a positive shift on the horizon?

Technical

On the 1D chart, an ascending channel emerged after consolidation at the bottom of a prior downtrend. The 25-SMA (green line) and 50-SMA (blue line) have crossed above the longer-term 100-SMA (orange line), signalling a potential shift in the market’s shorter-term sentiment.

The 25-SMA at R845.84 aligns with the dynamic support of the channel, creating a strong hurdle for the sellers to clear if they want to enforce a breakdown. If this support holds, the share price could continue within the channel formation and attempt to clear the prior Fibonacci midpoint again at R891.84. The crucial levels to look for if the uptrend persists are the resistance at R938.86 and R964.30, the Fibonacci golden ratio. Clearance above these levels could clear a path for convergence with higher resistance at R1,085.18.

However, if the 25-SMA resistance fails to withhold the selling momentum, a channel breakdown could send the price plummeting toward R816.51 and R772.94, close to the 50-SMA. This could trigger a retracement of the recent uptrend, bringing lower support at R728.57 back into the equation.

Fundamental

The graph below highlights the struggles that the mining sector in South Africa has faced in recent years. Two of the main PGM producers, Anglo American Platinum and Impala Platinum, contracted by 40.82% and 62.53%, respectively, from January 2023. This significant contraction happened over the same time the JSE Top 40 Index lost a mere 4.31%, suggesting deeper factors playing a role rather than just adverse movements of the general equity market. So, let’s delve deeper into these factors that have caused the company such headaches over the recent year.

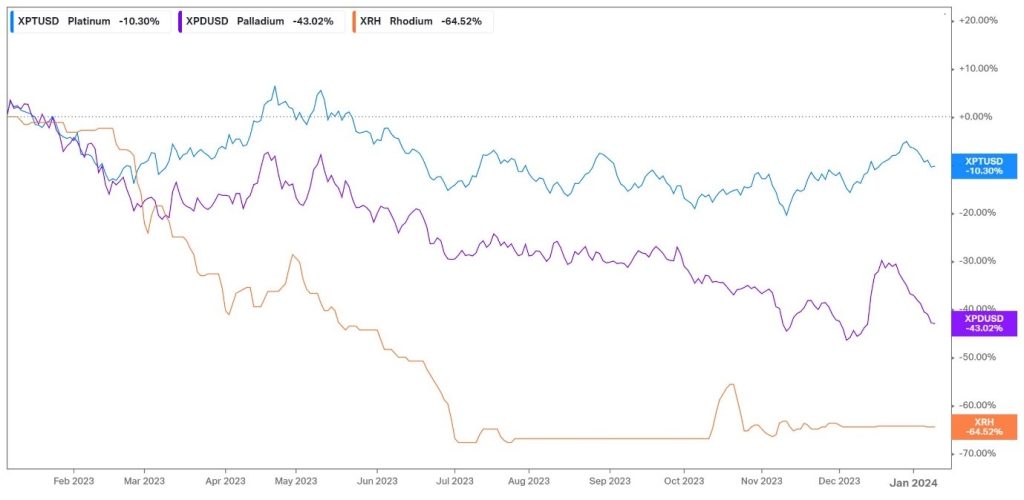

Firstly, the rapid decline of PGM prices over the past year is shown below. Palladium and Rhodium declined by 43% and 65%, respectively, while Platinum prices shed an additional 10% over the last twelve months. The driving forces behind these declines could be the de-stocking of the metal inventories that were built up during the Russian invasion of Ukraine. At the same time, depressed economic growth in China remains a major contributor to the headwinds in the metal market. To put this into perspective, Rhodium prices reached almost $30,000 per ounce in 2021, with Palladium trading close to $3,400 per ounce during Russia’s invasion of Ukraine. In contrast, for the interim six months of the 2023 financial year, Anglo American Platinum realized an average price of only $9,034 per ounce for Rhodium, a decline of 47% from the year-ago period, while the average price for Palladium during the interim period was only $1,532 per ounce, a 29% contraction. Overall, the PGM dollar basket price for the period contracted by 29% to $1,885 per ounce. As we approach the full-year report, Rhodium is trading close to $4,400 per ounce, while Palladium is near $1,000 per ounce, suggesting another disappointing six months for the company’s price realization.

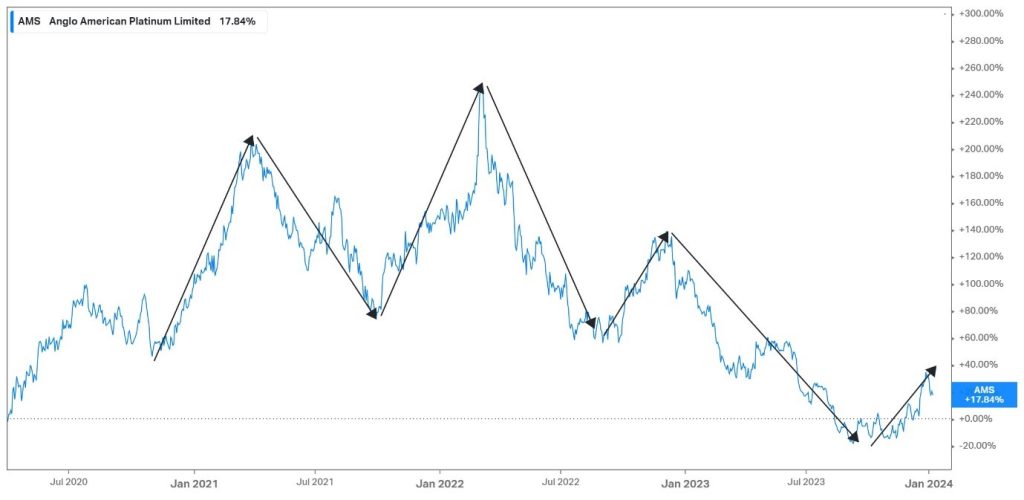

However, when looking at the company’s share price over a longer timeframe, it becomes clear that it is highly cyclical. Significant downturns have often been followed by strong recoveries when the market conditions become favourable once more. When closely inspecting the current trend, it seems like a potential bottom has formed after the extensive downturn through 2023, and over the last three months, the share price has recovered over 35%. This begs the question of whether there is an opportunity currently to buy into a potential recovery at lower valuations.

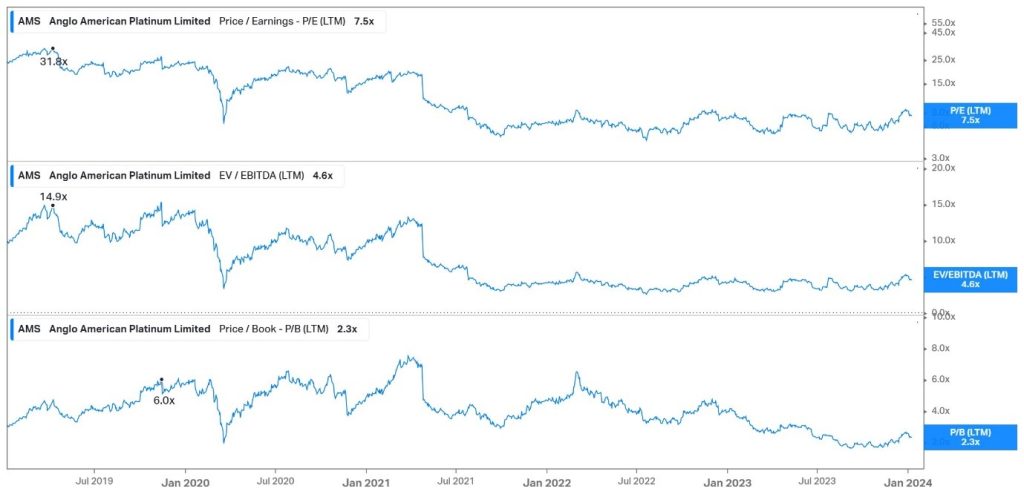

When taking a closer look at the company’s current valuations, it is unsurprising to see lower valuations based on its current fundamentals compared to a few years back. Its P/E has fallen from around 32X to 7.5X, while its EV/EBITDA has contracted from the peak of 14.9X to a mere 4.6X. Similarly, its P/B valuation currently sits at 2.3X, much lower than the 6.0X it traded at a few years back. From this perspective, the share price seems to trade at a fundamental discount, potentially offering an opportunity for a long-term play.

However, this does not mean that the risks inherent in the metal market have disappeared. In fact, the CEO of Anglo American Platinum recently admitted that he expects the low PGM prices that the company has battled with to persist, forcing him to realign the strategic positioning of the business. Additional risks on the horizon also come in the form of a potential slump in demand for PGM metals that are used to remove pollutants from the fumes of the exhausts of combustion-engine vehicles. The rising presence of battery-electric vehicles poses a threat to the demand for these metals, which could add to the current pressures in the years to come. As a result, the company has been forced to cut costs in the upcoming year to offset the falling prices and attempt to regain margin stability. The company plans to cut R5Bn in costs in the upcoming year, partly through a production reduction. These are all factors that play into the company’s risk profile despite promising signs that a recovery is on the table.

Summary

After a lacklustre 2023, Anglo American Platinum looks upon a new year with the hope of a successful strategic restructuring to help the company navigate the headwinds the metal market faces. Its earnings report for the full-year ending 2023 looms and could hold the first catalyst for a significant directional price move, posing a threat to the optimistic recovery we have seen over the last few months.

Sources: Koyfin, Tradingview, Reuters, News24, Anglo American Platinum Limited

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd (hereinafter referred to as “Trive SA”), with registration number 2005/011130/07, is an authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002. Trive SA is authorised and regulated by the South African Financial Sector Conduct Authority (FSCA) and holds FSP number 27231. Trive Financial Services Ltd (hereinafter referred to as “Trive MU”) holds an Investment Dealer (Full-Service Dealer, excluding Underwriting) Licence with licence number GB21026295 pursuant to section 29 of the Securities Act 2005, Rule 4 of the Securities Rules 2007, and the Financial Services Rules 2008. Trive MU is authorized and regulated by the Mauritius Financial Services Commission (FSC) and holds Global Business Licence number GB21026295 under Section 72(6) of the Financial Services Act. Trive SA and Trive MU are collectively known and referred to as “Trive Africa”.

Market and economic conditions are subject to sudden change which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. Trive Africa and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered. Please consider the risks involved before you trade or invest. All trades on the Trive Africa platform are subject to the legal terms and conditions to which you agree to be bound. Brand Logos are owned by the respective companies and not by Trive Africa. The use of a company’s brand logo does not represent an endorsement of Trive Africa by the company, nor an endorsement of the company by Trive Africa, nor does it necessarily imply any contractual relationship. Images are for illustrative purposes only and past performance is not necessarily an indication of future performance. No services are offered to stateless persons, persons under the age of 18 years, persons and/or residents of sanctioned countries or any other jurisdiction where the distribution of leveraged instruments is prohibited, and citizens of any state or country where it may be against the law of that country to trade with a South African and/or Mauritius based company and/or where the services are not made available by Trive Africa to hold an account with us. In any case, above all, it is your responsibility to avoid contravening any legislation in the country from where you are at the time.

CFDs and other margin products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. See our full Risk Disclosure and Terms of Business for further details. Some or all of the services and products are not offered to citizens or residents of certain jurisdictions where international sanctions or local regulatory requirements restrict or prohibit them.