Multinational technology behemoth Apple Inc. (NASDAQ: AAPL), renowned as the most valuable business in the world, saw its share price rally to an eight-month high on Friday, the 5th of May, as market participants digested a fruitful quarterly earnings call, primarily driven by higher-than-expected iPhone revenue. The company’s beat on revenue and earnings expectations is music to investors’ ears, with the tech giant raking in iProfits that will leave competitors feeling iPhone-envy.

Fundamental Analysis:

Even with famous value investor Warren Buffett referring to Apple as “probably the best business in the world,” the technology kingpin has recently endured its fair share of macroeconomic headwinds. However, stronger-than-expected iPhone sales provided fresh air to shareholders and investors alike, which saw Apple’s share price rally to its highest level since mid-August 2022. Despite total net sales for the quarter declining by 2.5% year-over-year to $94.84 billion, the company boasted a stellar 6.3% beat on earnings expectations, posting diluted earnings per share of $1.52, significantly higher than Wall Street estimates of $1.43 per share.

While delivering a sweet taste to investors, iPhone revenue arrived at $51.33 billion for the quarter, representing an impressive 5.1% beat on market expectations. Despite significant headwinds amidst prolonged periods of stagflation, Apple saw its quarterly iPhone revenue increase by 1.5% year-over-year, marking a noteworthy accomplishment given that the broad smartphone industry experienced a decline of almost 15% during the same period. While market participants were left surprised by the year-on-year growth in iPhone revenue, services revenue rose to a record high, increasing to $20.91 billion for the quarter, marking a 5.5% rise from the prior year’s figure of $19.82 billion.

With Apple’s services division experiencing remarkable growth, nearly doubling in size over the past four years, it is clear that this segment has become an increasingly significant component of the company’s overall operations. Apple executives say the company’s services segment is powered by its extensive network of active devices, which is a crucial growth driver. As such, Apple has recently introduced a high-yield savings account, marking yet another example of how the tech giant continues to find innovative ways to pave the way toward continued growth in services revenue. Leveraging off its devoted and loyal customer base, the ‘trillion-dollar’ multinational has already raked in close to $1 billion in deposits within the first week of launching the initiative. Remarkably, Apple’s new savings account saw an influx of $400 million in deposits on launch day alone, making waves within an already competitive and highly saturated financial services market.

Although iPhone and services revenue experienced impressive growth, Apple saw its revenue from Mac, iPad, and other products fall short of analyst predictions. Of particular note, Mac revenue saw a significant 31.3% year-over-year drop to $7.17 billion, which garnered attention from many market participants. However, according to CEO Tim Cook, this is not a cause of significant concern as last year’s numbers were artificially inflated as Mac revenue was still benefiting from the post-pandemic boom in PC sales. Moreover, iPad revenue declined by approximately 12.8% year-over-year to $6.67 billion, while revenue from wearables, home and accessories declined by a marginal 0.6% year-over-year to $8.76 billion.

Apple observed a decline in sales across most regions, except for the Asia Pacific area, where sales rose by 15.3% year-over-year to $8.12 billion, up from the prior period’s figure of $7.04 billion. As China continues to emerge from its Covid-related restrictions, many analysts predicted an uptick in net sales from Greater China. However, this did not come to fruition, as Apple posted a 2.9% year-over-year reduction in net sales from the region.

Apple Leads the Pack: Outperforming Peers in Share Price Performance

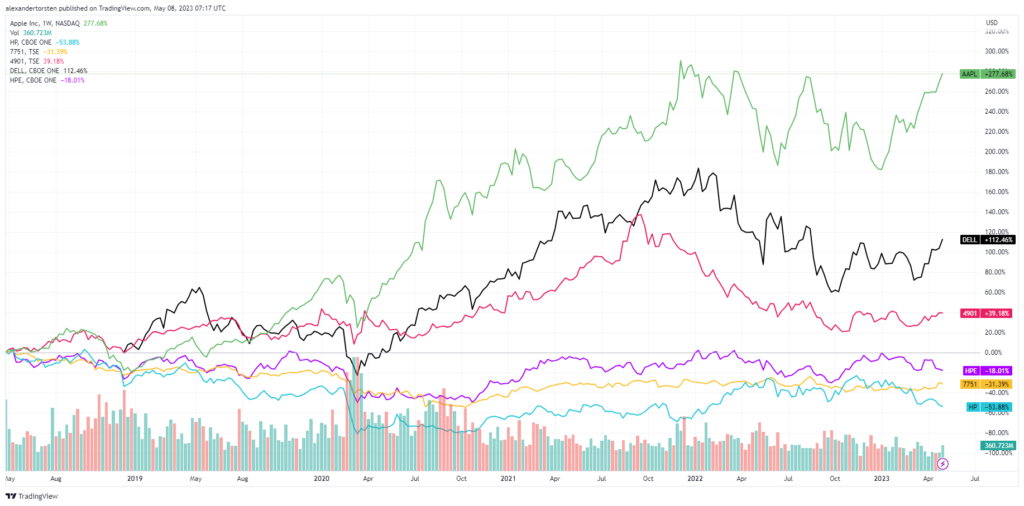

Concerning the price chart below, it is clear that Apple has delivered superior returns to its shareholders, boasting a stellar 278% cumulative return (green line) over the most recent five-year period. The world’s most valued company by market capitalisation has significantly outperformed its fellow peers, namely Dell Technologies Inc. (black line), HP Inc. (blue line), Canon Inc. (yellow line), FUJIFILM Holdings Corporation (pink line), and Hewlett Packard Enterprise Company (purple line).

The technology giant shows no signs of a slowdown in growth in years to come. Tim Cook recently expressed his optimism over the opening of the inaugural Apple retail store in Mumbai, India, in April, as Apple aims to gain traction in emerging markets. Apple’s current trailing twelve-month P/E ratio of 29.5x is notably higher than its historical five-year average P/E ratio of approximately 25x, indicating investors may be optimistic about its growth prospects.

Technical Analysis:

Looking at the weekly time frame for Apple Inc., it is clear that 2023 has been a phenomenal year for the American multinational conglomerate, with the share price returning more than 30% year-to-date. Despite approaching the primary support level at $123.70 (red line) in the early days of January 2023, Apple has seen its price action rally impressively over the past few months, reaching its highest level in nearly nine months.

Should Apple’s recent positive market sentiment persist, bullish investors could potentially see the share price increase and continue its impressive rally toward the significant resistance level at $181.29 (black dotted line), which will be watched closely for a potential breakout or possibly a retracement toward lower levels. If the current bullish rally loses steam amidst a change in market sentiment, the bears could see the price action on Apple retrace and possibly decline toward $155.78 (black dotted line), which could be the first support level for the bears.

Sources: Apple Inc., Bloomberg, CNBC, Forbes, Koyfin, The Motley Fool, Reuters, Trading View

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.