In the latest development in the AI world, Oracle Corporation (NYSE: ORCL) unveiled its first-quarter earnings for the 2024 financial year, with high expectations following its prior report, where cloud revenue exceeded all estimates. In a plot twist that left analysts both intrigued and a tad perplexed, Oracle’s earnings report delivered a tale of two lines. The bottom line, a star-studded hero emerged triumphant, gleaming with financial splendour, surpassing all forecasts with a flourish. Yet, the top line, the plot’s co-star, seemed to have missed its cue, leaving investors yearning for a bit more as the share price faltered in a 10.46% after-market drop.

Total revenue for the quarter amounted to $12.5Bn, growing 9% from the year-ago period but falling short of the $12.47Bn consensus from the market. Meanwhile, its earnings per share (EPS) rose from $1.03 to $1.19, exceeding the $1.15 forecast. The big concern, however, was the rate at which cloud revenue expanded. While a 29% year-on-year expansion sounds healthy, it lags significantly behind the 55% the company mustered last quarter. So, is this slowdown due to a cyclical shift, or is Oracle losing out on the massive bet made on its AI development?

Technical

On the 1D chart, a falling wedge breakout has led to the share price meeting resistance at $127.33, a level it previously failed to breach, causing a retreat leading up to the earnings release. However, with the after-market move set to cause a significant contraction, there could be a retest at the breakout level of around $114.07 on Tuesday’s open.

If the sellers capitalize further on the disappointing results, the $114.07 level could act as resistance to send the share price further down to $107.66. Lower support at $102.97 could serve as a last line of defence if the downside persists.

However, the 25-SMA (green line) recently crossed the 50-SMA, suggesting the bullish momentum remains in the medium term. If support is found at $114.07, investors could be enticed to buy into the company’s prospects at a lower price, which could cause a high volume rebound on Tuesday. In this case, the estimated fair value of $133.84 could come into play in the longer term, presenting an 18% potential upside from the current after-market move if the share price breaches the supply zone around $121.33.

Fundamental

Over the last three years, Oracle has returned a whopping 121.02% to shareholders in the form of price appreciation, significantly outperforming the S&P 500 (34.39%) and its closest industry peers, Adobe (18.53%) and Salesforce (-9.08%). Seen as one of the primary beneficiaries of the AI boom, investors came flocking in for a slice of the Oracle pie, resulting in a 55.02% year-to-date (YTD) expansion. However, with the tight macroeconomic environment, cloud spending by corporations are slowing down, prompting the question of whether this was an overreaction from the market.

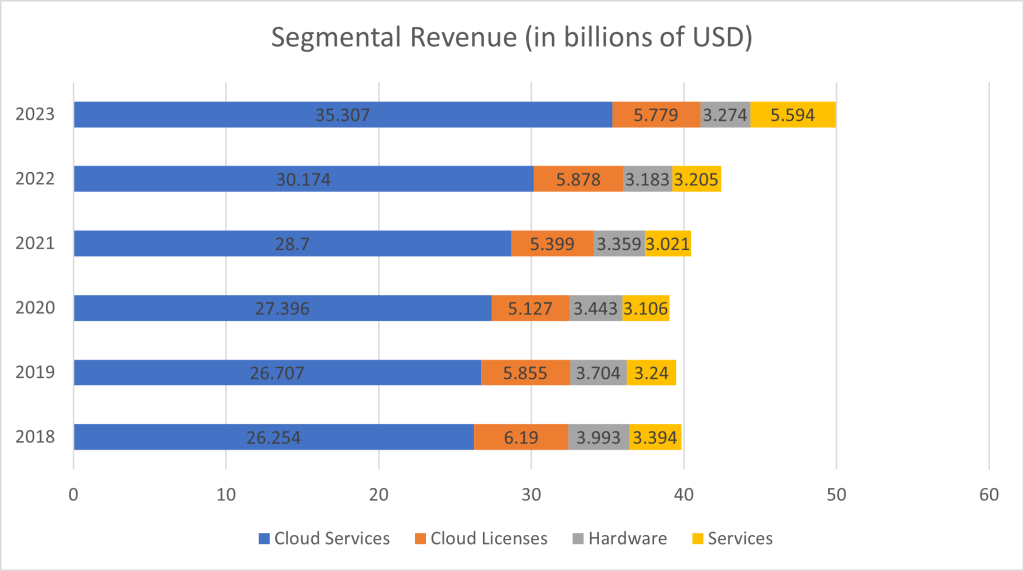

Total Cloud Revenue for the quarter amounted to $4.6Bn, benefitting from a 66% surge in Cloud Infrastructure to $1.5Bn. In total, Cloud services and License Support amounted to $9.55Bn, now accounting for 77% of the company’s revenue. In terms of its Software as a Service (SaaS) offerings, its Cloud Application revenue expanded 17% to $3.1Bn, while its Fusion Cloud ERP was up 21% to $800M, and NetSuite Cloud ERP came in at $700M, also realizing a 21% expansion. The graph below shows that the company has targeted its key growth area in its cloud offerings, now attributing a much larger share of its yearly revenue than it did a few years ago. With this business expanding at a healthy pace, it could offset its other lower growth parts, such as its hardware segment, which only expanded by 2% in the latest quarter. However, if its cloud revenue continues to grow at lower rates, it could become a concern, considering the massive bet made on this part of the company’s business.

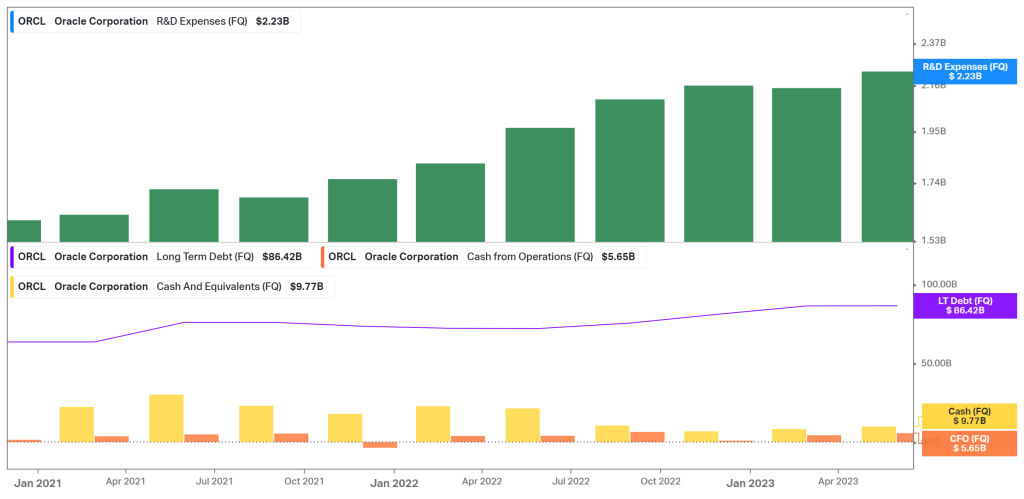

This spending can be seen in the graph below, showing the rapid rise in R&D expenditure in recent quarters. The company spent $2.23Bn in R&D in the current quarter, significantly increasing from the $1.7Bn in 2021. As a result of the effective capital allocation and spending in crucial areas, Oracle became one of the first cloud service providers to come to market with Nvidia’s SaaS products. However, there is a lot of balance sheet risk, shown by the high levels of debt compared to the cash from operations, which are seen to be growing slowly in recent quarters. With its cash flow and cash balance not nearly covering its debt obligations, there could be some cash flow concerns when the debt comes due unless it can reap the benefits from this spending in upcoming quarters to grow its top line at a faster pace and generate additional cash flow available to retire its debt.

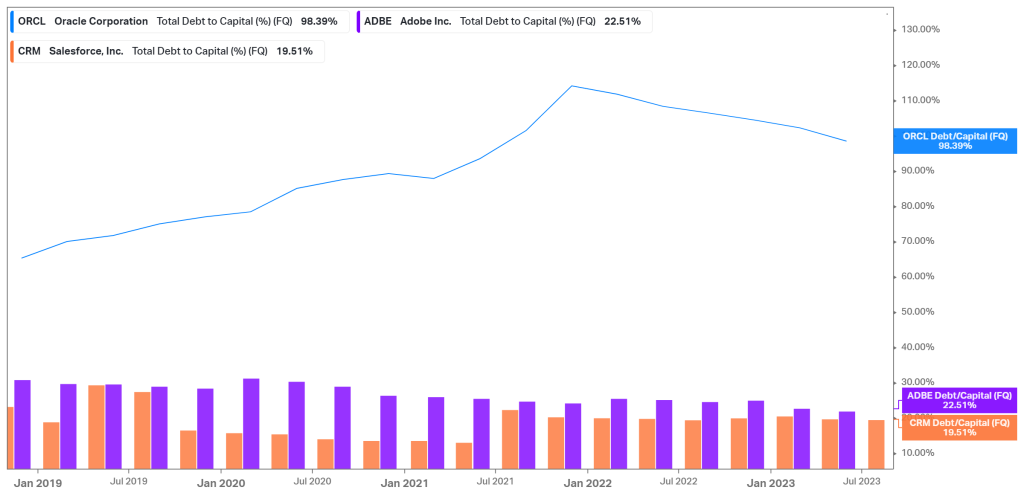

This concern is further highlighted below, with its debt-to-capital ratio trading significantly above its industry peers. With a 98.39% debt-to-capital ratio, its spending is almost entirely funded by debt, compared to the 22.51% and 19.51% of Adobe and Salesforce. While they have historically traded higher than their peers, it does pose a risk in the higher interest rate environment, especially if these conditions persist, which could force the company to refinance at higher rates in the future, considering the low cash flows compared to its debt position. While this is not a short-term concern, it is worth keeping an eye on as we advance to see how management handles its capital structure to de-leverage while maintaining its high spending levels on R&D and capital expenditure.

Considering its higher leverage, the company’s EV/EBITDA ratio of 21.2X suggests that it might still be relatively undervalued compared to Adobe (36.7X). However, the market is putting a high price on its growth, with its PEG ratio of 3.62X edging above Adobe’s 3.42X, suggesting that the market feels Adobe’s current price more accurately depicts its future growth prospects and Oracle’s surge in price over recent years might have just tipped it slightly into an overvalued range. However, these metrics are to be used with discretion, as it is up to the investor to decide what they are willing to pay for the company’s growth.

As we advance, all eyes will be on the growth in the company’s cloud offerings, as the market wants to see healthy growth at a faster pace than they managed in the latest quarter to justify the large amounts of expenditure that have gone into driving the long-term returns in this segment. While management signalled healthy demand by revealing that AI development companies have signed contracts to purchase more than $4Bn capacity in Oracle’s Gen2 Cloud, the revenue guidance for upcoming quarters disappointed investors. The firm forecasted Q2 revenue growth of 5% – 7%, missing the 8.2% consensus, while adjusted profit is expected to fall between $1.30 and $1.40 per share, in line with the $1.33 market expectation.

Summary

Despite being dubbed as one of the leaders in the AI space, Oracle was the victim of a challenging macroeconomic environment, which weighed on the growth of its cloud services. As we advance, all eyes will be on this segment, which holds the key to the company’s long-term growth. Suppose it can continue operating with the rapid growth rates seen in Q4 of its previous fiscal year. In that case, the share price can continue dominating on the upper end of its $133.84 fair value, presenting a 5.61% upside from Monday’s close.

Sources: Koyfin, Tradingview, Yahoo Finance, Investor’s Business Daily, Reuters

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.