Anglo American Platinum Limited (JSE: AMS) has faced numerous headwinds this year, grappling with a notable downturn in both its revenue and profitability. This dynamic has propelled the mining heavyweight into an intensive quest for sustainable prosperity. Amidst the backdrop of shifting commodity prices, the company has confronted formidable hurdles, from the strain of load shedding to substantial operational expenses required to maintain its vital processes. At the same time, Eskom’s load-curtailment has cast a shadow on its production prowess.

In its 2023 interim report, the company recorded net revenue of R64.68Bn, a 24% decline from the R85.85Bn it generated in the year-ago period. Net revenue per ounce declined by 15% to R34,764/PGM oz, while its cost of sales saw a 23% rise to R53.67Bn. As a result, its gross profit on metal sales declined by a significant 74% from R42.06Bn to R11.01Bn, bringing its gross profit margin down from 49% to 17%. Headline earnings per share (EPS) followed suit, falling 71% to 2,984 cents.

Technical

On the 1W chart, a notable downtrend has resulted in a 60% decline since the November peak last year. The 200-SMA (orange line) has crossed above the 50-SMA (blue line), resulting in a death cross, signalling further downside ahead. However, a falling wedge has emerged, leaving open the possibility for a breakout to the upside.

If the dynamic support of the wedge fails to prevent an additional leg down from current levels, the share price could continue its downtrend, where the first level of support is established at R487.79. Neckline support exists at R415.72, where the market could look for buyers in the longer term.

However, if the dynamic resistance of the wedge fails to withstand a breakout, a push toward the 25-SMA (green line) could confirm a sustainable reversal. Resistance at R933.42 and R1,133.27 could prove challenging to break through, but a retest of the 61.8% Fibonacci retracement level could result from such a move. The company’s estimated fair value is R1,367.92, close to the 200-SMA, and presents a massive 109.26% potential upside from current levels if the fundamentals turn favourable in the longer term.

Fundamental

Anglo-American Platinum is one of many domestic mining companies that has had a challenging year. The graph below demonstrates the industry’s weakness over the last year, with Anglo losing 48% of its value, followed closely by Impala, whose share price contracted by 43%. The industry has faced challenges from declining commodity prices, resulting in lower average basket prices, while Eskom load-curtailment pressures production capacity. In the latest second-quarter production report, Anglo-American Platinum revealed that the Eskom load-curtailing impacted 29 production days, resulting in a significant build-up of work-in-progress inventory of 38,900 Platinum Group Metals (PGM) ounces. Inflationary pressures and volatility in the foreign exchange markets have also resulted in higher mining and processing costs, which are tightening the margins of companies operating in the industry. As a result of these headwinds, no company in the industry has been able to match the 14% return on the JSE Top 40 index over the last year.

The graph below shows the sharp year-to-date decline in Platinum (-18.54%) and Palladium (-32.95%) prices, with Rhodium (-66.53%) suffering the sharpest contraction over the last nine months. These decreases have resulted in a 29% decrease in the PGM dollar basket price for the first half of 2023, from $2,671/PGM oz to $1,885/PGM oz. However, the weakening of the South African Rand against the US dollar mitigated the overall price impact on the rand basket price. The average exchange rate received for the interim period in 2023 was R18.21 compared to R15.40 in the 2022 period, resulting in a decline of the rand basket price per PGM ounce of only 15%.

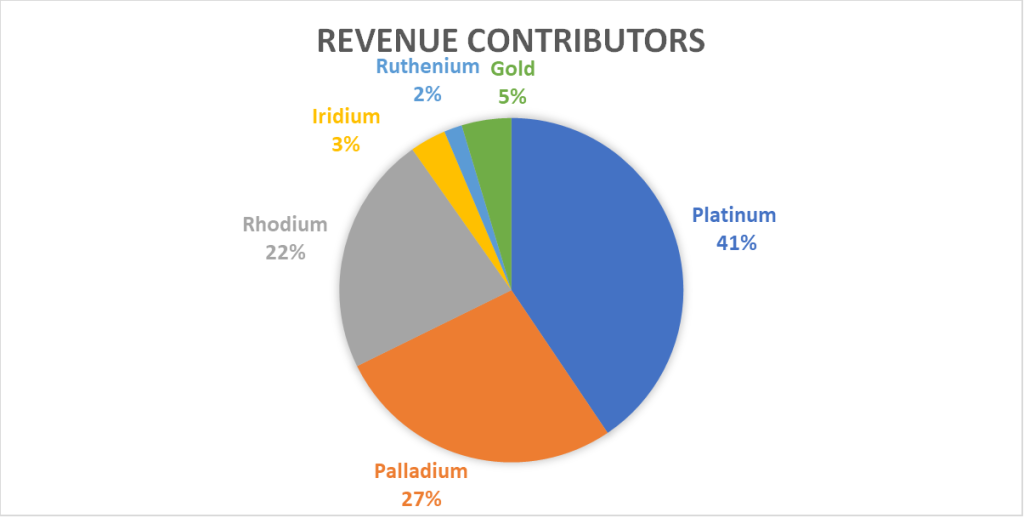

However, these commodity headwinds are not something of the past. For the 2023 interim period, the average market price achieved on Platinum was $1,008/oz, with the price subsequently decreasing to its current level of around $879.40/oz. Platinum contributes 41% of the company’s PGM revenue, and Palladium, which contributes 27%, has decreased from the average price of $1,532/oz to around $1,200/oz. Rhodium, which contributes 22% of PGM revenue, realized an average price of $9,034/oz in the latest interim period and currently trades at around $4,100/oz. Clearly, commodity price pressures continue to strain the company’s operations and could contribute to another challenging six months ahead.

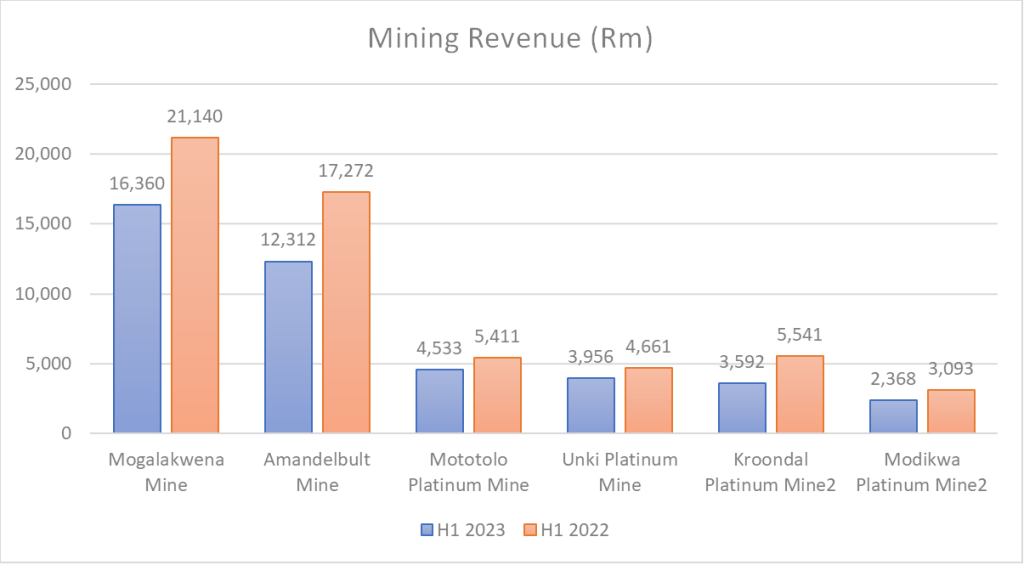

Along with price pressures, production levels have also declined. In the interim period for 2023, total PGM M&C production declined by 7%, while the PGM ounces produced per employee contracted by 13%. In the latest quarterly production report, total PGM production was reduced by 9%, impacted by short-term operational challenges, infrastructure closures at the Amandelbult mine, and lower grades at Mogalakwena. As previously mentioned, the effects of Eskom’s load curtailment further reduced its production capacity. The graph below shows the diminishing revenue-generating capabilities of the company’s respective mines, with its two biggest revenue-generating mines, namely Mogalakwena and Amandelbult, showing marked declines in its top lines.

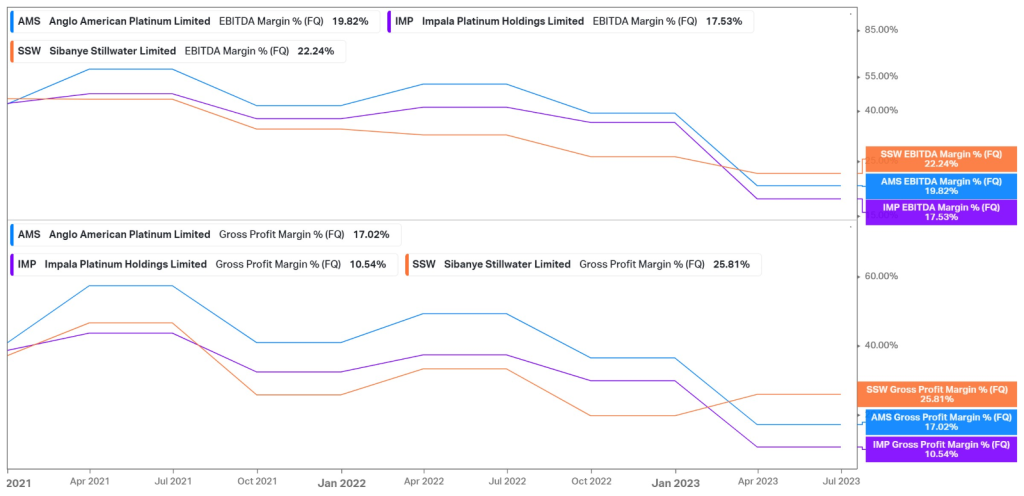

Due to lower price realizations and elevated input costs, the company’s margins have been under threat of severe tightening. In the latest interim period, the adjusted EBITDA declined by 69% from R42.76Bn to R13.45Bn. Price and foreign exchange movements accounted for R20Bn of this decline, while sales volumes adversely attributed an additional R8Bn and a further R2Bn being put down to cost increases. As a result, the company’s mining EBITDA margin contracted from 59% to 42%, while total adjusted EBITDA faltered from 50% to 20%. However, this is an industry-wide concern, with Anglo-American Platinum’s gross profit margin of 17% still situated within the average industry margin, suggesting a cyclical shift within the industry. All major players have shown significant reductions in both EBITDA and gross profit margins in recent quarters, suggesting that these risks can not be diversified away within the industry and rather stem from the systematic risks of mining and metals.

Summary

Anglo-American Platinum recently unveiled a disappointing set of interim results, reflecting continuous headwinds that have affected all domestic mining companies in South Africa. While these headwinds show no signs of fading, the large drawdown in the company’s share price could potentially open up longer-term opportunities. The estimated fair value of R1,367.92 presents a 109.26% potential upside from current levels, albeit at higher risk in the current macroeconomic environment.

Sources: Koyfin, Tradingview, Reuters, Anglo American Platinum Limited

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.