Oracle Corporation (NYSE: ORCL) unveiled its second-quarter earnings on Monday, triggering an 8.5% drop in after-hours trading for its shares. Despite a robust 40% surge in the past year, attributed to the rapid expansion of its cloud computing venture, investor apprehension emerged. The market expressed unease about the growth path of this business as the latest metrics fell short of analyst expectations.

Revenue reached $12.9 billion, reflecting a 5% increase but missing the consensus of $13.1 billion, settling within the lower bounds of the company’s previously stated growth range of 5%-7%. Adjusted earnings per share rose by 10.74% to $1.34, in line with the consensus of $1.33. Nevertheless, the market’s primary concern centred on the decelerating sequential growth in Oracle’s cloud computing business, casting uncertainty on the business’s trajectory in the upcoming years.

Technical

On the 1D chart, a falling wedge pattern has experienced a breakout, confirmed by the crossing of the 25-SMA (green line) above the longer-term 50-SMA (blue line) and 100-SMA (orange line) in recent sessions. However, a psychological supply zone at $117.57 has resisted continuous upside and triggered a potential retracement toward the initial breakout level.

With the pre-market movement on the share price potentially forcing an open below the 61.8% Fibonacci golden ratio of $106.64, the retest could occur in the upcoming session. If the price remains below $106.64, the market could look for support at $99.90, where the bottom of the wedge was formed. The future directional trend could be determined here, as a breakdown could amplify the losses toward lower support at $96.78 and $93.48.

However, if the gap closes in the upcoming session, the price could retrace toward the Fibonacci midpoint of $108.74. The 50-SMA resistance at $110.34 could be a major hurdle to the retracement’s sustainability. However, a crossing above this level could fuel the market, potentially triggering a breakout above the supply zone, with the estimated fair value of $133.84 then being a focal point in the longer term. This level presents a 16% potential upside from Monday’s close.

Fundamental

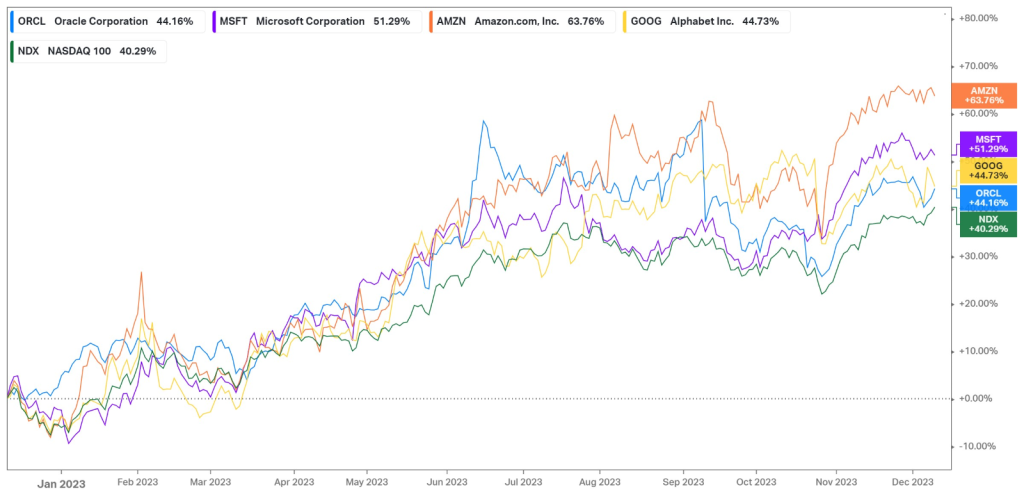

Over the last year, Oracle’s share price has appreciated an impressive 44.16%, boosted by the general adoption of generative AI and its implications for the technology market. The enterprise resource planning giant has emerged as one of the major cloud service providers, up there with Microsoft (51.29%), Amazon (63.76%) and Google (44.73%). All of these technology behemoths outperformed the Nasdaq 100 (40.29%) in the latest year, and their growth prospects seem far from diminishing, exemplified in Oracle’s latest quarterly report, where the company acknowledged that the demand for its cloud infrastructure and generative AI services are increasing at an astronomical pace.

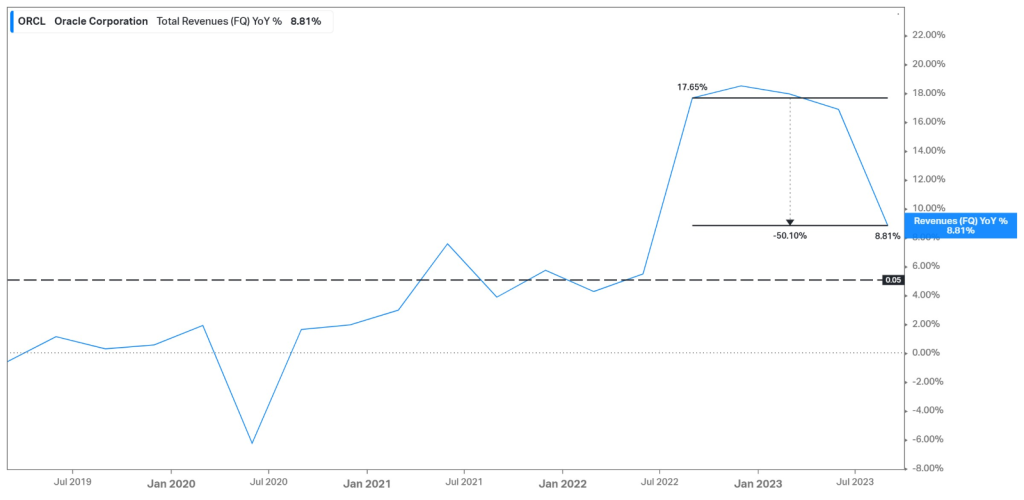

In the latest quarter, Oracle’s revenue amounted to $12.9Bn, up 5% from the prior year. When this growth rate is compared to its historical growth rates, a concerning picture comes to light, as seen below. Last year, the company was racking up growth rates of close to 18% on its top line, and leading up to this earnings report, these growth rates have more than halved. From the previous quarter, its top-line growth has fallen even more, raising the question of how sustainable its growth trajectory is. Its cloud services comprise of $4.8Bn and advanced 25% in the latest quarter. While that seems healthy, it represents the second successive quarter where the growth in this segment has slowed down. Within this segment, cloud infrastructure revenue was up 52% to $1.6Bn, while its cloud application revenue was up 15% to $3.2Bn. Together with license support, cloud revenue makes up 74% of the company’s total revenue, with hardware and services accounting for another 20%, at $756M and $1.37Bn, respectively. The other 9% of its revenue comes from cloud licenses and on-premise licenses, currently at $1.18Bn.

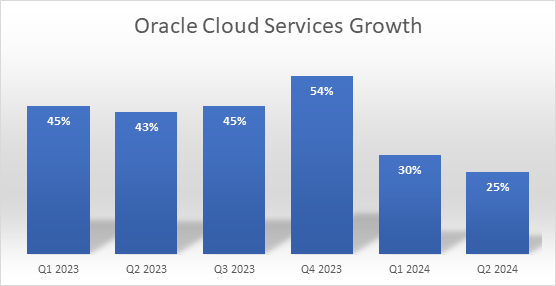

The slowdown in its cloud business can be seen below. In the closing three quarters of the company’s 2023 financial year, it realized sequential growth in its top-line expansion within this segment, reaching 54% in the last quarter of that financial year. Since then, the growth has eased, now advancing at half the pace it used to. However, the slowdown is not due to a lack of demand. The company’s remaining performance obligations (RPOs) amount to over $65Bn, which is more than its annual revenue. Executives of the company also stated that if Oracle had more capacity, there would be hundreds of millions of dollars more to recognize as revenue.

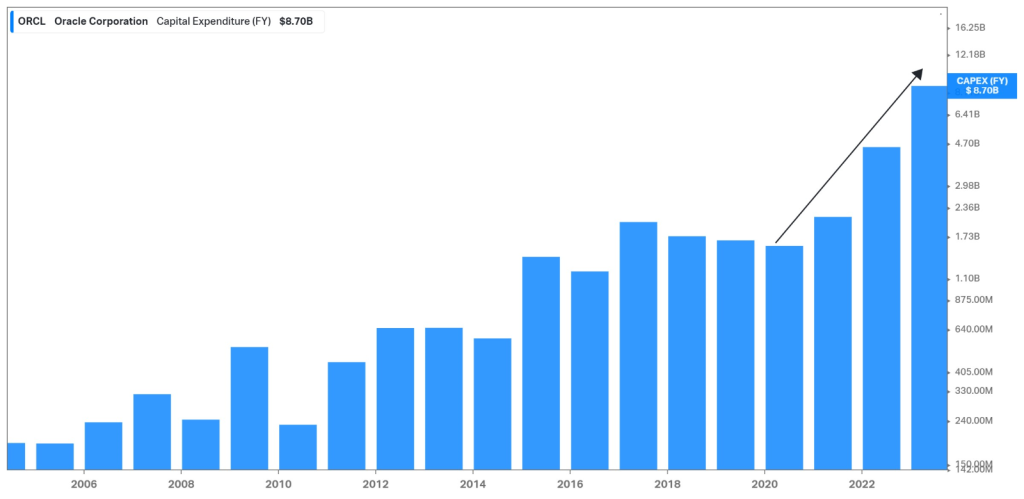

However, the company has ramped up its capital expenditure over recent years to invest in the infrastructure necessary to meet the rising demand. This can be seen in the graph below, as the company is spending significantly more. In the latest quarter, the company acknowledged that it is in the process of expanding its existing 66 data centres and building 100 more in order to meet the growing demand. These expenditures could, however, limit the free cash flow available to the company to reward its shareholders, and when looking closer at its balance sheet, the sustainability of these capital outflows comes under question.

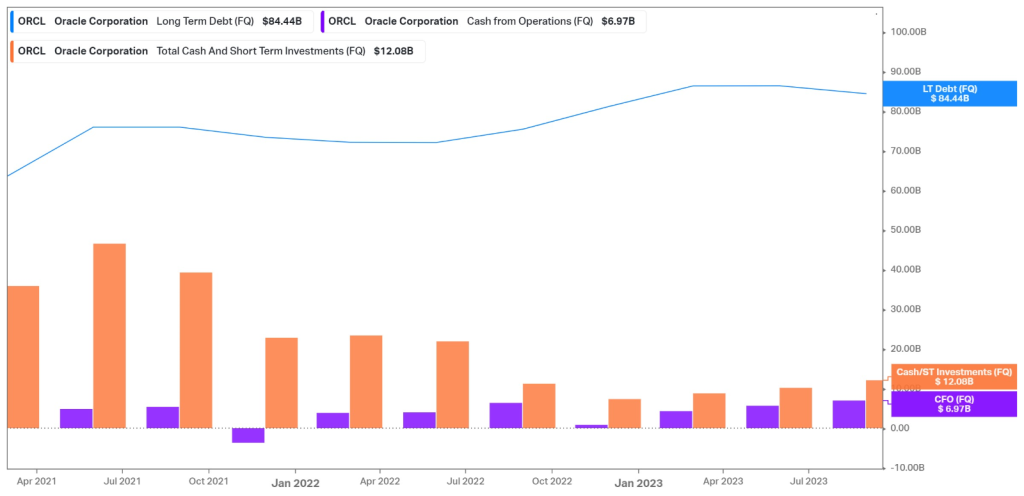

With a substantial debt position of $84.44Bn, the company generates around $7Bn in cash from operations per quarter while holding a cash and short-term investment position of merely $12Bn. This may not be a near-term concern and could be seen as a trade-off between current cash flow and future growth. However, it remains to be seen whether these significant cash outflows will pay off with sufficient returns to cover its debt position when it comes due without sacrificing the capacity to maintain its growth path and reward investors in the form of dividend payments.

Summary

Oracle Corporation has lost close to 9% after-hours on Monday after reporting its latest quarterly earnings report. Investors are concerned about the slowdown of growth in its cloud division, which has caused uncertainty over the company’s future trajectory. However, management has reaffirmed that demand remains strong, and it is investing aggressively in infrastructure to meet this demand, which could set it up for lucrative growth in the future.

Sources: Koyfin, Tradingview, Yahoo Finance, Investor’s Business Daily, Oracle Corporation

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.