JD.com, Inc. (NASDAQ: JD), the Chinese e-commerce giant and leading supply chain-based technology provider, delivered solid quarterly financial results for the three months that ended March 31, 2023, as the retail brand benefitted from an increase in consumer demand amidst China’s post-Covid recovery. The company has emerged as one of China’s most trusted retail brands in recent years, attracting a record number of third-party merchants to its JD.com platform during the first quarter of 2023.

Evaluating JD’s Share Price Alongside Industry Giants

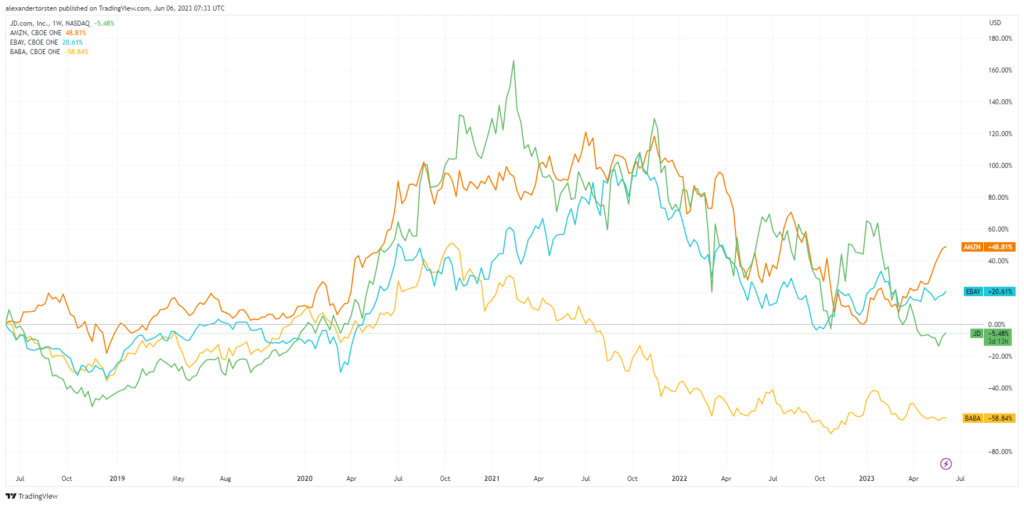

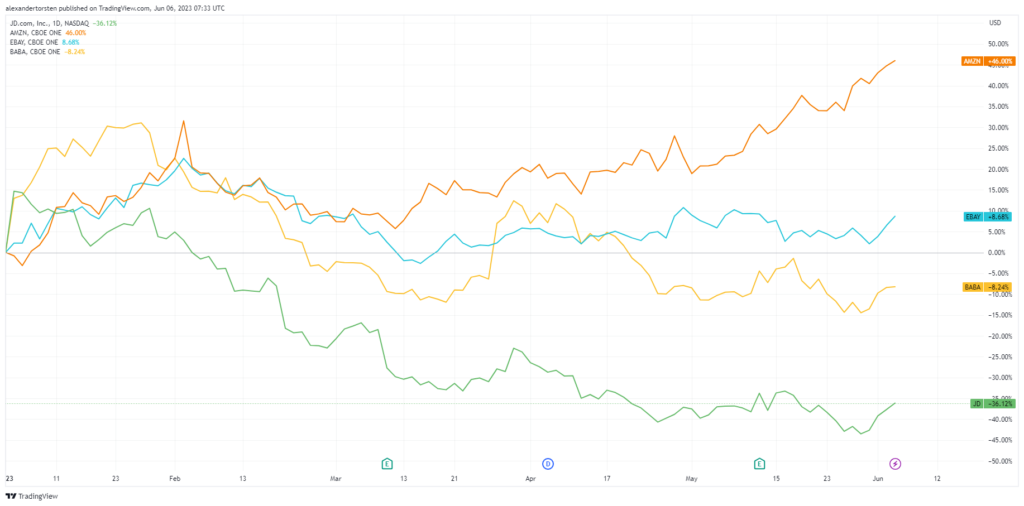

Concerning the price chart below, Amazon (NASDAQ: AMZN) has paved the way for e-commerce and cloud computing, boasting a cumulative return of nearly 50% (orange line) over the most recent five-year period. While eBay Inc. (NASDAQ: EBAY), the American multinational e-commerce company, posted a cumulative return of 20% (blue line) over the same five-year period, JD.com (NASDAQ: JD) has returned a measly -6% (green line) to shareholders. Despite failing to yield a positive return to shareholders over the last five years, JD.com has seen its share price fare far better than Chinese industry peer Alibaba (NYSE: BABA), whose share price has declined close to 60% (yellow line) over the last five years.

Year-to-date, JD.com, or Jingdong, has disappointed shareholders with a negative cumulative return exceeding 35% (green line) as the bears took control and lowered the company’s share price. Year-to-date, Alibaba’s share price has demonstrated more resilience to economic tailwinds than JD.com but still yielded a negative return of close to 10% since the beginning of the year (yellow line). Amazon has returned 46% year-to-date (orange line), not too far off its five-year performance, while eBay has returned just under 10% since the beginning of the year (blue line).

Fundamental Analysis

JD.com enjoyed a rather impressive first quarter of 2023 as the e-commerce giant benefitted from a resurgence in consumer demand following the easing of China’s Covid-related restrictions. Net revenue for the first quarter of 2023 came in at RMB243 billion, representing an increase of 1.4% year-over-year. Net service revenue surged by approximately 34.5% year-over-year to RMB47.4 billion, accounting for 20% of net revenue.

Quarterly income from operations arrived at RMB6.4 billion, up from RMB2.4 billion in the same quarter of 2022, indicating that income from operations increased by 167% year-on-year as consumer demand recovered amidst China reopening its doors from a prolonged lockdown. Impressively, diluted net income per American Depository Share (ADS) improved significantly to RMB3.93 in the first quarter of 2023, up from a diluted net loss per ADS figure of RMB1.92 in the same quarter of 2022, indicating that the e-commerce giant has returned to profitability. Despite total net revenue only increasing by 1.4% year-over-year for the first quarter of 2023, net income attributable to ordinary shareholders returned to positive territory, coming in at RMB6.26 billion for the first quarter of 2023, up from a loss of RMB2.99 billion in the same quarter a year ago.

During the first quarter of 2023, the e-commerce giant achieved a remarkable milestone by attracting an unprecedented influx of third-party merchants to its JD.com platform. Despite this, the company shows no signs of slowing down, having made several strides within the quarter to seize multiple growth opportunities across its segments. In February, JD.com welcomed the highly anticipated official flagship store of Tesla on its platform. The collaboration brings a wide range of automotive products to the company’s customers, including charging equipment, premium accessories, and selected apparel. JD aims to utilise its omnichannel strengths to drive the growth and visibility of Tesla’s online store within its platform. In the same month, JD announced using artificial intelligence technologies to establish an advanced medical engine for its online healthcare platform under JD Health. The primary objective of the medical engine is to enhance the effectiveness and precision of online diagnosis and treatment provided by online medical professionals. JD has made several strides across its different business segments to drive the expansion of its user base across China. Market participants will be eager to see how the company plans to grow its market share in a Chinese economy that has only just awakened from a deep and prolonged lockdown period, where economic activity slumped and consumer demand plummeted.

JD.com’s trailing twelve-month (TTM) price-to-earnings (P/E) ratio is currently sitting at a multiple of 21.2x, significantly down from its 2022 multiple of 45.2x and lower than the average peer multiple of 73.5x. JD.com has the lowest historical P/E ratio compared to Amazon, Alibaba, and eBay, indicating that the company is potentially undervalued.

Technical Analysis

Analysing the weekly price chart of JD.com (NASDAQ: JD), it becomes apparent that the company’s share price has been trending lower over the past two and half years, with lower highs and lower lows forming. The prevailing downtrend has recently dragged JD’s share price to its lowest level since March 2020, with the 50-day moving average currently positioned well above the candle sticks.

In the bull case, should China’s macroeconomic picture continue to improve amidst rising consumer demand, JD’s share price could potentially increase to the $47.50 resistance level (horizontal black dotted line), which market participants could watch closely. If the $47.50 resistance level is breached, our estimated fair value of $58.31 (green line) will be of significant interest as it could act as a prominent resistance level.

In the bear case, should China’s macroeconomic picture worsen amidst the potential of another Covid wave, negative market sentiment could drag JD’s share price back toward the primary support level at $32.80 (red line). Geopolitical headwinds and the potential for state intervention could also possibly see an influx of negative sentiment pull JD’s share price below the $32.80 support level.

Sources: Bloomberg, JD.COM, Koyfin, CNBC, Trading View

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.