Occidental Petroleum (NYSE: OXY) has been capturing investor attention recently, seemingly looking to initiate a turnaround from the sluggish earnings report in August. From the dizzying heights of 2022, this company hit some turbulence, thanks to the pesky macroeconomic hurdles that played hardball with the sensitive commodity market in which it operates. Yet, in the world of oil and gas, where fortunes rise and fall like the tides, there’s always a twist in the plot waiting to unfold. Will it seize this moment to redefine its destiny in the world of energy? The signs point toward a fundamental turnaround that could make the oil industry sit up and notice.

In the latest earnings report, Occidental Petroleum reported net sales of $6.73Bn, down significantly from the $10.74Bn it generated in the year-ago period and falling slightly below the $6.93Bn expectations of analysts. As a result, the company reported net income attributable to shareholders of only $605M, falling from the $3.56Bn in the year-ago period. This translated into $0.68 in basic earnings per share (EPS), a strong contraction from the $3.76 in the prior period, while narrowly missing the forecasts for $0.73. The sluggish performance resulted from inflated comparables and a challenging macroeconomic environment, leaving investors wondering where the company’s performance will land when the industry landscape normalizes.

Technical

On the 1D chart, a rising wedge has formed atop the recent uptrend, with the crossing of the 25-SMA (green line) and 50-SMA (blue line) supporting the upward momentum. The daily pivot point at $65.79 further supports the bullish pressure, but the share price remains vulnerable to a technical correction if the rising wedge breaks down.

The wedge breakdown could lead the share price toward support at $63.61, where a leg below the 50-SMA could bring lower support at $61.73 into play. Without retesting the breakdown point, a sustainable downtrend could then force the price toward $60.08 and $58.09 if the fundamentals favour the downside.

However, if the dynamic support prevents a breakdown, the share price could converge with the estimated fair value of $68.16. This presents a mere 2.31% potential upside potential from current levels, making the potential downside moves more attractive for possible entry points in the longer term, as the share price is currently relatively fairly valued.

Fundamental

Year to date, Occidental Petroleum’s share price has appreciated 5.29%, a result of volatile directional moves in response to a changing macroeconomic landscape. With high inflation and a strong dollar due to elevated interest rates, the commodity market has faced some pressure, preventing sustainable upside. The recent inflation report showed a 3.7% year-on-year print, exceeding the 3.6% consensus from the prior 3.2%, suggesting that higher rates for longer are not out of the equation. However, the market has priced in the probability of the Federal Reserve potentially nearing the end of its hiking cycle, a bullish development for the oil market, which has aided the recent upside in the share price. Over the same period, the company has underperformed the S&P 500 (16.35%) and the energy sector in general (5.50%). However, due to its diversified asset base, it outperformed most industry peers over the last nine months.

One of the main factors behind the company’s weak performance compared to the same quarter in 2022 is the fact that commodity prices were highly inflated when the post-Covid recovery kicked off. In 2022, the WTI futures (NYMEX: CL) touched highs of $130 per barrel (BLL), whereafter the market normalized and returned to pre-Covid levels. In the second quarter of 2022, the company generated $7.69Bn in revenue from oil and gas, a figure which has since fallen to $4.94Bn in the latest quarter. Similarly, revenue from its chemical segment decreased from $1.91Bn to $1.38Bn. This is further evident in the commodity price realizations over these periods, where the company operated under an average selling price of $100.10/barrel in 2022, compared to $73.91/barrel in the latest quarter. Its NGL price realization similarly flatlined from $39.61/barrel to $21.67/barrel. The graph below shows the fall from the 2022 highs in the WTI futures, which is currently on an upward path of recovery.

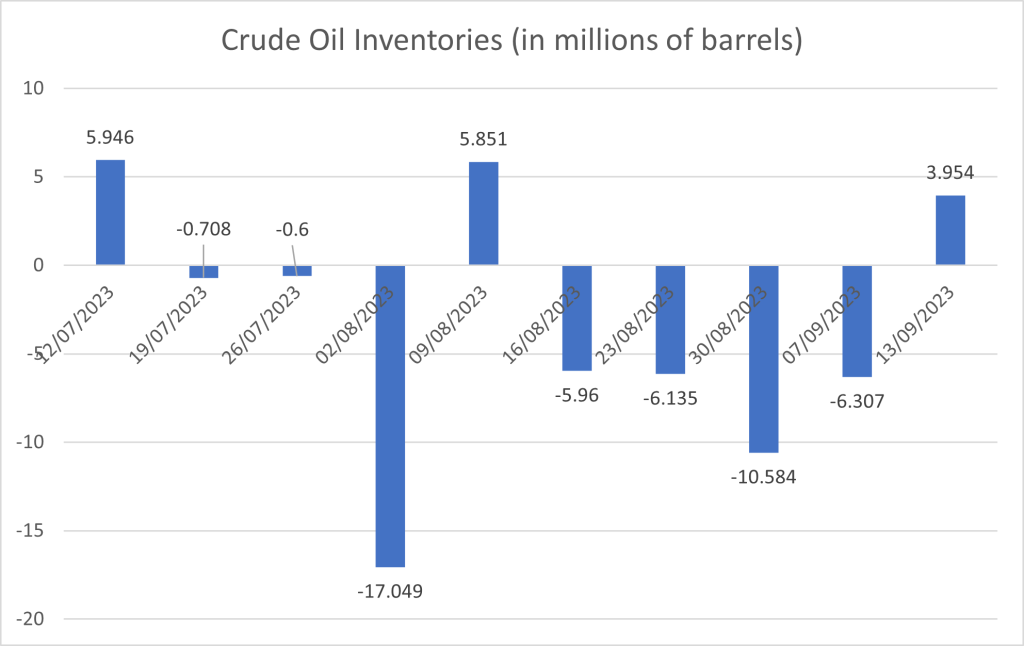

However, oil prices are showing signs of recovery, as tighter supply in the market is expected to fall short of demand for the second half of the year. The International Energy Agency (IEA) recently revealed its expectations for demand to outstrip supply after OPEC, in its latest monthly report, revealed a similar expected narrative. With Saudi Arabia and Russia extending their voluntary production cuts through to December, the cartel expects the global economy to hold firm in its demand. The graph below shows the recent reports from the Energy Information Administration (EIA) on crude oil inventories. Recent weeks have shown some significant inventory draws, exceeding expectations on the demand side and further boosting the sentiment that demand is holding firm on the diminishing supply. The WTI futures are currently at $89.68/barrel, already much higher than the price realization in the prior quarter, and with a supply deficit projected for the second half of the year, we could see the futures push even higher, which is bullish for Occidental Petroleum’s operations.

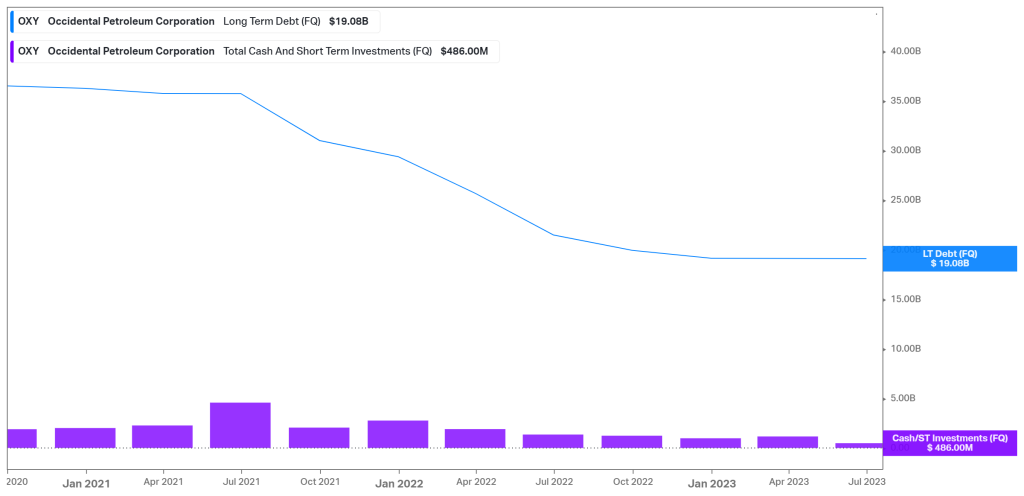

Apart from the company’s sensitivity to the commodity market, it also holds some balance sheet risk, as shown by the elevated debt levels in the graph below. While only holding $486M in cash and short-term investments, the company’s long-term debt amounts to $19.08Bn. This could become concerning when considering the company’s aggressive share repurchases. The company repurchased $425M of common stock in the recent quarter, with its year-to-date purchases amounting to almost 40% of its $3M repurchase program. To sustainably keep its aggressive buybacks going in the longer term, the company may have to de-leverage or produce more cash from its operations to reward its shareholders without taking away from its capacity to invest the necessary capital expenditure into its valuable assets.

Summary

While Occidental Petroleum delivered disappointing earnings in its latest earnings report, there is much to be optimistic about as the fundamental backdrop in the oil market is much improved. With a potential wedge breakdown holding the possibility for a pullback in the price toward $63.61, the estimated fair value of $68.16 is not far from reach.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, OPEC.org, Occidental Petroleum Corporation

Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.